Understanding Credit Across Generations: Challenges and Victories. Gen Alpha: Laying The Groundwork. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

Don’t Have Time To Read The Full Article. Here’s What You Are Missing.

- Each generation has unique financial challenges and successes.

- Relevant strategies and lessons can improve credit management.

- Insights will guide individuals in assessing and enhancing financial practices.

Financial literacy is essential for every generation. From Generation Alpha to the upcoming Generation Beta, born in 2025, each group will face its own money challenges and victories. Learning from the past can help them manage credit wisely.

Understanding past financial strategies can guide young people today. This knowledge is crucial as Generation Alpha and Generation Beta will grow up in a rapidly changing world. Technology and artificial intelligence will play big roles in their financial lives.

Societal issues like climate change and urbanization will shape the way these generations handle money. They will experience different worlds from those who came before and must learn to adapt. Credit and money management skills will be key tools for their future.

Understanding Credit Across Generations

Each generation faces distinct financial hurdles and successes. Key strategies from the past can help improve understanding and management of credit.

Generational Financial Challenges and Victories

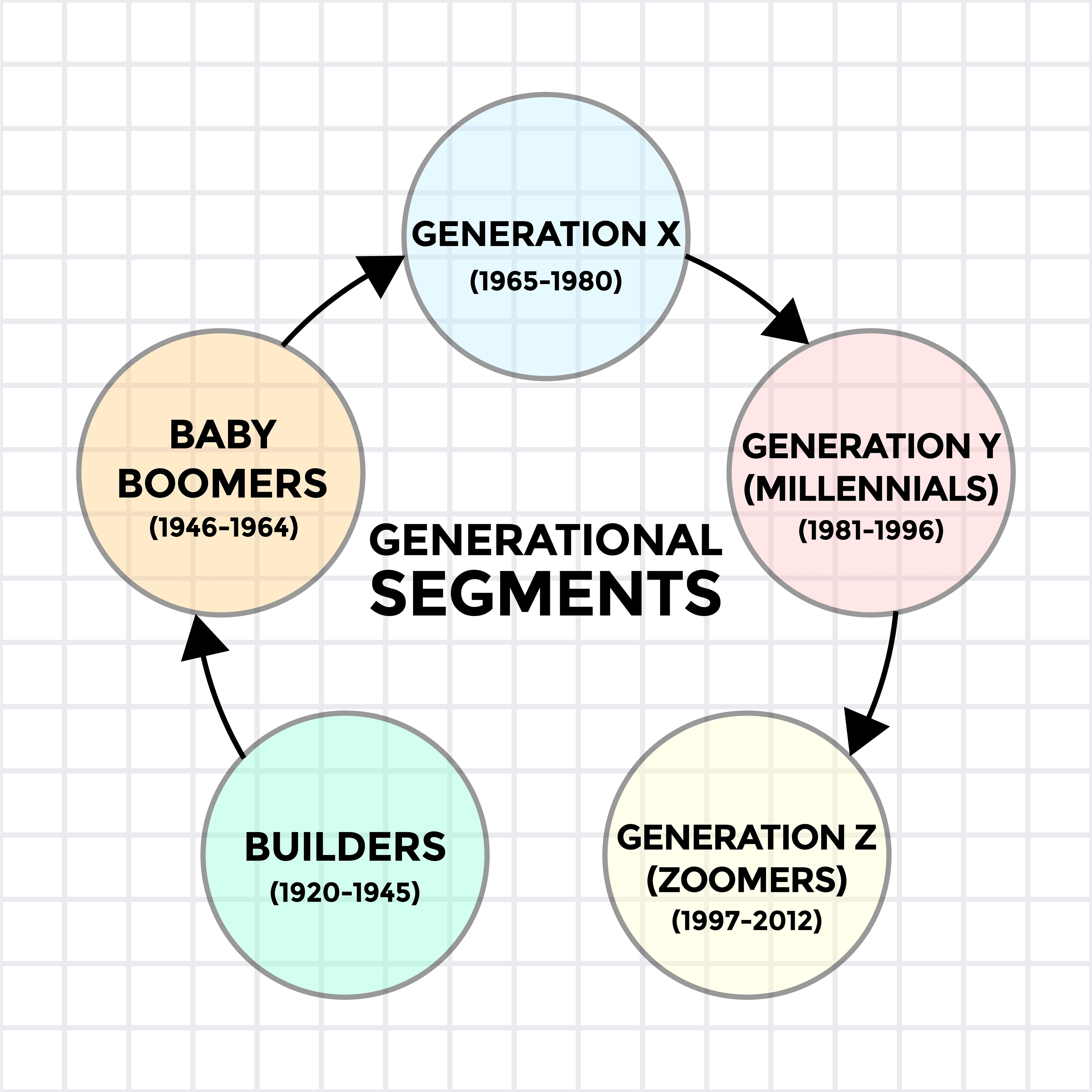

Every generation faces unique financial situations. For example, Baby Boomers dealt with high inflation in their youth, while Gen X navigated economic recessions during career peaks.

Meanwhile, Millennials often struggle with student loan debt. They also witnessed technological shifts in finance. On the other hand, Gen Z is more comfortable with digital banking and online transactions.

Generational challenges inform financial education. Previous economic events often influence how new generations handle money. Awareness of past trends can help people today avoid old pitfalls.

Importance of Financial Literacy

Financial literacy is vital. It helps individuals make informed decisions about credit management. Schools and workplaces now emphasize basic finance education.

Millennials and Gen Z frequently access online resources and apps. These tools offer quick guidance on budgeting and savings. Financial knowledge empowers all generations to manage debt.

Educators are crucial in improving financial literacy. They make complex topics like interest rates understandable. Accessible resources allow everyone to benefit from sound financial advice.

Understanding key financial concepts helps individuals guard against future challenges. Each generation learning from the last can lead to more innovative credit use.

Preparing Gen Alpha and Beta for Financial Success

Gen Alpha and Beta are poised to face unique financial landscapes. Preparing them involves teaching practical strategies, understanding credit, and setting realistic expectations.

Imparting Relevant Strategies and Lessons

Emphasizing financial literacy from a young age is pivotal. Families can discuss budgeting, saving, and the importance of financial responsibility.

Leveraging technology, such as financial apps designed for children, can aid in these discussions. Children can learn through simulation—practicing with mock budgets or savings goals can be highly effective.

Parents and educators should focus on real-world applications. They should also teach avoiding debt early on, understanding interest rates, and the importance of a credit score. This early groundwork will empower Gen Alpha and Beta with the skills required for financial autonomy.

Insights on Credit Management for Emerging Generations

Teaching the basics of credit is crucial for future success. Understanding how credit works, its advantages, and its pitfalls is vital.

For Gen Alpha and Beta, learning about secured credit cards or student loans should be part of standard education.

Parents can share their experiences, highlighting mistakes to avoid. Providing practical insights into managing credit responsibly helps build a strong financial foundation.

Early education about interest rates and timely repayments ensures they do not fall into common traps. Well-informed choices lead to favorable outcomes in their financial journey.

Expectations and Realities for Generation Beta

As Generation Beta grows up, a strong emphasis on digital transactions will shape their experiences.

Understanding online banking, virtual currencies, and cashless payments will be essential.

These children will likely experience a fully integrated digital economy.

Forecasting their financial landscape involves acknowledging potential societal changes.

Adapting to technological advancements, inflation, and market shifts will become their reality.

Skills in digital finance, coupled with classic financial acumen, will ensure Gen Beta navigates these challenges with confidence.

Gen Alpha: Laying The Groundwork

Conclusion

The latest generation, known as Gen Alpha, is growing up in a world filled with new financial tools and technologies. As they learn more about credit, they will need guidance to navigate these changes. It’s important to think about how this groundwork can be built to set them up for success.

Generation Alpha—Today’s young generation, Gen Alpha and tomorrows generation Bravo will face a unique world filled with changing technology and economic systems. Teaching them about credit early will help them make strong financial decisions in the future.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content – “Please view our full AI Use Disclosure.

“We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.”