Understanding Credit Across Generations: Challenges and Victories. Baby Boomers: Established Credit. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

- Each generation has unique financial challenges and successes.

- Relevant strategies and lessons can improve credit management.

- Insights will guide individuals in assessing and enhancing financial practices.

Financial literacy is a crucial skill that spans across generations, impacting everyone from new adults venturing into the workforce to seasoned retirees managing their savings.

Each generation faces unique challenges and victories regarding credit and financial knowledge.

By examining these differences, people can better understand how to navigate the complex world of credit management and make informed decisions about their financial futures.

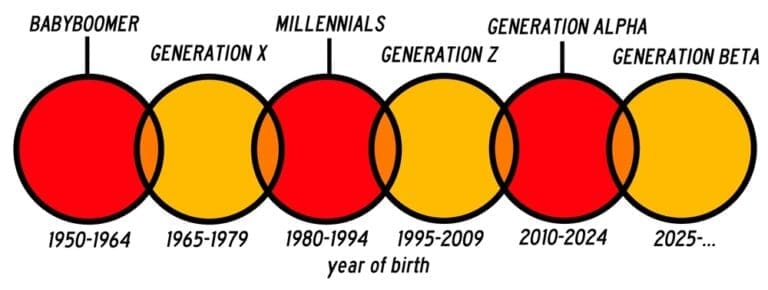

Different generations, including Gen Z, Millennials, Gen X, Baby Boomers, and the Silent Generation, have distinct credit and financial literacy approaches shaped by varying life experiences and economic environments.

Understanding these perspectives highlights the importance of tailored financial education and the steps each generation can take to improve their credit health.

Through focused articles, the blog aims to uncover which generation leads in managing credit most effectively and what strategies they employ to succeed.

Readers can expect insightful discussions on how each generation tackles credit challenges.

This article will serve as a guide to navigating the path to financial literacy. It will help individuals assess their own financial practices and encourage them to adopt successful strategies.

By celebrating financial victories and acknowledging common struggles, individuals can learn valuable lessons to apply in their own lives.

Baby Boomers: Established Credit

Baby Boomers are known for their established credit profiles.

This generation generally benefits from years of credit history, leading to higher credit scores.

Their experiences include navigating different financial climates, including economic growth and recession periods.

Common Credit Habits:

- Use of traditional banking services.

- Preferences for low-risk, steady investments.

- Timely bill payments contribute to strong credit.

These habits have contributed to credit scores often ranging between 730 and 736.

Baby Boomers tend to rely on familiar banking institutions and maintain accounts over long periods.

They value financial stability and have often invested in real estate.

Many Baby Boomers also prioritize retirement savings, using strategies like 401(k)s or pensions to secure their future.

The generation’s tendency to engage in long-term financial planning and conservative spending habits reflects their adaptability.

These practices highlight their financial victories throughout life.

Despite challenges like fluctuating interest rates or evolving financial products, Baby Boomers have maintained strong credit.

Their ability to adjust to changing economic landscapes further indicates their financial literacy.

Conclusion

When looking at credit and financial literacy through the different generations, each faces challenges and victories.

Baby Boomers, while generally experienced in financial management, face challenges like retirement planning and adapting to new technologies in the financial sector. They continue to benefit from their long history with credit systems.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content – “Please view our full AI Use Disclosure.”

“We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.”