Top Strategies for Examining Credit Reports to Save Money. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

Managing your money wisely often starts with understanding your credit. Your credit report holds crucial information about your borrowing habits and financial health.

Regularly checking your credit reports can save you hundreds or even thousands of dollars by helping you catch errors, spot fraud, and improve your overall financial standing.

Many folks don’t realize that errors on credit reports are surprisingly common. According to the Federal Trade Commission, one in five consumers has an error on their credit report.

These mistakes can result in higher interest rates or even loan denials, directly affecting your financial situation. Spotting these errors early allows you to dispute them before they cause any real damage.

Reviewing your credit reports can also reveal chances to negotiate better interest rates on your existing debts. You might even spot unauthorized accounts—an early warning sign of identity theft.

When you keep tabs on your credit, you empower yourself to make more brilliant money moves and, honestly, keep more cash in your pocket.

Key Giveaways.

- Regular credit report reviews help you catch errors and fraud that could cost you serious money if you ignore them.

- Knowing your credit standing lets you negotiate better rates and qualify for more favorable financial products.

- Grab your free annual credit reports from all three major bureaus for a complete picture and smarter, money-saving decisions.

Understanding Credit Reports

Credit reports play a significant role in your financial health by documenting your credit history. They affect how easily you can borrow money and touch a surprising number of areas in your financial life.

What Is a Credit Report?

A credit report is a summary of your credit history, put together by credit bureaus. The three major nationwide bureaus are TransUnion, Equifax, and Experian.

These reports track how you use credit and whether you pay bills on time. Your credit report lists both open and closed credit accounts, as well as information about loans, credit cards, and your payment history going back several years.

Lenders, landlords, employers, and insurance companies use credit reports to judge your financial responsibility. They use this info to decide whether to approve your applications and what terms to offer you.

Credit reports typically cover seven years for most items, although certain items, such as bankruptcies, can remain on record for longer periods.

Key Components of a Credit Report

Credit reports include a few key sections that reveal your financial habits:

- Personal Information: Name, address history, Social Security number, date of birth, and job info.

- Credit Accounts: Details about your current and past credit accounts, like:

- Type of account (credit card, mortgage, auto loan)

- When the account was opened

- Credit limit or loan amount

- Current balance

- Payment history

- Public Records: Financial legal matters such as bankruptcies.

- Inquiries: Companies that have requested your credit report.

Credit reports show what types of credit you use, when you opened accounts, and if you pay bills on time. Lenders use this snapshot to judge risk when you apply for credit.

Importance of Credit Reports in Personal Finance

Credit reports have a significant impact on your financial opportunities. Good credit can save you thousands in lower interest rates on loans and credit cards.

Landlords often check credit reports before approving rental applications. A solid credit history makes finding a place to live easier and helps you skip extra deposits.

Insurance companies use credit-based insurance scores, pulled from your credit report, to set premiums. Better credit can mean cheaper insurance.

Some employers check credit reports during the hiring process, especially for financial positions. Understanding your credit lets you prepare for these situations.

Reviewing your credit reports regularly helps you catch errors and spot fraud early on. That proactive move protects your reputation and can save you from headaches later.

How Reviewing Credit Reports Saves Money

Regularly reviewing your credit reports brings significant financial benefits. Taking the time to review these documents can stop costly errors, flag fraud, and help you avoid extra expenses.

Identifying and Correcting Errors

Credit reports often have mistakes that can hurt your finances. The Federal Trade Commission found that one in five people has an error on their credit report.

These errors may be due to incorrect account information, outdated personal details, or late payments made in error. If you don’t fix them, your credit score can drop for no good reason, which means higher interest rates and more money out of your pocket over time.

You have the right to dispute mistakes. Credit bureaus must investigate within 30 days and remove anything they can’t verify.

- Accounts belonging to someone with a similar name

- Closed accounts showing as open

- Wrong payment statuses

- Old negative info that should’ve dropped off

- Duplicate accounts or debts

Detecting and Responding to Fraudulent Activity

Credit reports act as early warning systems for identity theft and fraud. If you see unfamiliar accounts, odd credit inquiries, or sudden balance changes, someone might have gotten hold of your info.

Catching fraud early by reviewing your reports allows you to act quickly. The sooner you spot it, the less damage it usually causes—and the easier it is to fix.

If you see suspicious activity, you should:

- Contact the credit bureau to place a fraud alert

- Notify any affected banks or lenders

- File a police report if needed

- Consider freezing your credit for extra safety

Lenders examine credit reports to judge risk, so keeping your reports clean helps you score better lending terms.

Avoiding Costly Mistakes and Overpayments

Checking your credit reports helps you avoid unnecessary penalties. Knowing what creditors see gives you leverage to negotiate better terms and dodge extra fees.

When you know your credit score, you can shop for loans or credit cards that fit your situation. That way, you’re not wasting time (and points) on applications you probably won’t get.

Too many rejected applications can ding your credit even more, thanks to repeated hard inquiries. Each one knocks your score down slightly, which can add up quickly.

Bank management uses credit reports to make lending calls. When you check your reports regularly, you gain insight into how lenders perceive you, enabling you to make more informed choices and save money over time.

Maximizing Savings through Credit Report Management

Understanding and staying on top of your credit report can lead to real financial savings in different parts of your life. A strong credit profile opens doors and reduces unnecessary costs.

Negotiating Better Loan and Credit Terms

Your credit report is a powerful tool when you’re looking for loans or credit cards. Individuals with higher scores typically receive better rates and more favorable terms.

When you apply for a mortgage, auto loan, or credit card, bring a copy of your good credit report to the table. Lenders often have wiggle room in what they offer.

For example, someone with a 760 score might get an interest rate that’s 0.5% lower than a person with a 680 on the same mortgage. On a $300,000 30-year mortgage, this difference could save you over $30,000 in the long run.

Before making major purchases, check your credit report three to six months in advance. That gives you time to fix any issues and boost your score.

Qualifying for Improved Insurance Rates

Many insurance companies use credit-based scores to determine premiums. These scores help them figure out the odds you’ll file a claim.

If you have a higher credit score, you’ll often get lower insurance premiums. The gap can be pretty big—studies show people with poor credit might pay 40-100% more for auto insurance than those with excellent credit. Home insurance rates can show the same pattern.

Want to save on insurance?

- Check your credit report before your policy renews

- Dispute any mistakes that could drag down your score

- Keep making on-time payments to improve your score slowly

Some states have cracked down on this practice, so check your local rules to see how credit affects your insurance rates.

Reducing Interest Costs

Managing your credit report effectively can significantly reduce your interest expenses on all types of borrowing. If you keep an eye on your credit report regularly, you’ll spot chances to lower what you pay on existing debt.

For example, good credit lets you:

- Refinance high-interest loans at lower rates

- Transfer credit card balances to 0% introductory APR offers

- Consolidate multiple debts into a single lower-interest loan

Even a small bump in your credit score—from 650 to 700—might drop credit card interest rates by 4-5 percentage points. On a $10,000 balance, that’s about $400-500 saved each year.

Credit card companies often offer more favorable terms to retain customers with strong credit. Sometimes, simply calling and asking for a rate reduction, leveraging your positive payment history, can be effective, especially if you consistently pay on time. Many people have had success with this simple move.

Steps to Access and Review Your Credit Report

Keeping tabs on your credit report is essential for your financial health. Regular reviews help you catch mistakes, spot identity theft, and see how lenders view your credit.

Requesting Free Credit Reports

You can grab free copies of your credit report once a year from each of the big three bureaus: Equifax, Experian, and TransUnion. The official spot for these reports is AnnualCreditReport.com.

You have three ways to get your free reports:

- Visit AnnualCreditReport.com online

- Call 1-877-322-8228

- Mail in a completed request form

Many people suggest spacing out your requests over the year. Maybe pull one bureau’s report every four months to keep a steady watch on things.

Some banks and credit card companies also offer free credit reports or scores. These extras help you monitor things in between your annual freebies.

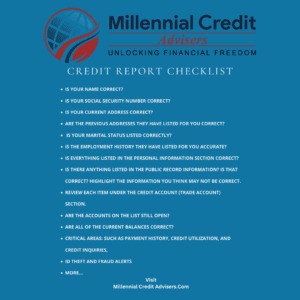

Understanding What to Look for

When you review your credit report, pay attention to key sections like personal info, accounts, collections, inquiries, and public records. Double-check your name, address, Social Security number, and birth date.

Check these areas closely:

- Account details: Make sure all accounts listed are yours

- Payment history: Check that payment records match what happened

- Credit limits: Look for accurate credit limits and loan amounts

- Account status: Be sure open accounts aren’t marked closed, or vice versa

- Hard inquiries: Confirm you authorized every credit check

Watch for accounts you don’t recognize—they could mean identity theft. Also, keep an eye out for outdated negative information that should have been removed, as most negative marks typically disappear after 7-10 years.

How to Dispute Inaccuracies

If you spot errors, you can provide information. Begin by gathering documents such as payment records or account statements.

The dispute process usually goes like this:

- File a dispute online, by phone, or by mail with the credit bureau

- Clearly explain what’s wrong and why

- Attach copies (not originals) of supporting documents

- Hang on to records of all your communications

Credit bureaus have to investigate within 30 days. They’ll send your info to the company that reported the item.

If they confirm an error, they’ll fix your report. You can even ask the bureau to send correction notices to anyone who got your report in the last six months.

Protecting Your Financial Health

Protecting your financial well-being means staying alert to threats that can wreck your credit or drain your savings. A little extra caution now can save you a lot of trouble later.

Preventing Identity Theft

Identity theft happens when someone uses your personal information without your permission. This can damage your credit score and cause significant stress.

To protect yourself, check your credit reports often to catch accounts you didn’t open.

Setting up fraud alerts with the bureaus adds another layer of security.

Use strong, unique passwords for your accounts and enable two-factor authentication if possible.

Don’t overshare personal details online or on the phone—don’t.

Shred financial documents before tossing them out.

If you’re not planning to apply for new credit, freezing your credit is an option to block new accounts from being opened in your name.

Avoiding Scams and Predatory Lending

Scammers and predatory lenders go after people with tricks meant to steal money or trap them in endless debt.

Be skeptical of offers that seem too good to be true or pressure you to act fast. Always research lenders before providing personal information or signing any documents.

High-interest payday loans and auto title loans can drag you into debt spirals. Consider alternatives, such as credit union loans or payment plans with your current creditors.

Watch out for signs like upfront fees, “guaranteed” approvals, or confusing terms. Real financial institutions are transparent about their fees and the way things work.

If you suspect a scam, report it to the Federal Trade Commission and your state’s attorney general. It helps protect others, too.

Planning for Major Purchases with Credit Insights

Understanding your credit report comes in handy when you’re planning big purchases—think homes, cars, or even major appliances. Knowing your credit helps you get better financing terms and could save you a ton over time.

Timing Your Applications for Credit

If you’re planning a significant purchase, timing matters for your credit applications. Too many credit inquiries at once can ding your credit score, at least temporarily.

Experts recommend spacing out applications by at least six months. For major purchases, such as homes or cars, review your credit report 6-12 months in advance to allow time to address any issues.

If you need to save up for something big, set a timeline. For a $25,000 purchase in two years, that’s about $1,000 a month—no small feat, but doable with a plan.

Most advisors recommend holding off on new credit applications for at least three months after applying for a large loan. It’s just safer that way.

Building a Stronger Financial Profile

A solid financial profile boosts your odds of approval and gets you better interest rates. Start by checking your credit utilization ratio—most experts say keep it below 30% of your available credit.

Paying down debt demonstrates to lenders that you’re responsible. Try making a debt reduction plan that targets high-interest accounts first.

Your FICO® credit score makes a difference in loan rates. Even a 50-point jump could save you thousands on a mortgage or car loan.

If you need to make a purchase in 12-18 months, focus on saving, not investing. That way, market swings won’t mess up your timeline.

Pay bills on time, keep older accounts open, and mix up your credit types. All these habits contribute to a financial profile that lenders prefer to see.

Conclusion and Next Steps

Checking your credit reports often is one of those underrated financial habits that pays off.

You can spot mistakes early, which gives you a chance to fix them before your credit score takes a hit.

Go ahead and grab your free annual credit reports from all three main credit bureaus at AnnualCreditReport.com.

If you set reminders to space out your checks every four months, you’ll keep an eye on things all year without much hassle.

If you think your identity’s at risk, it’s smart to set up fraud alerts. These measures enable companies to double-check your identity before approving any new credit in your name, which adds a solid layer of protection.

Use the information in your credit reports to create a debt repayment plan. Try to tackle high-interest debt first, since that’s usually where most of your money disappears on interest.

Boosting your credit score can lead to more favorable rates on loans and credit cards. Even a small rate drop can mean saving a surprising amount over the years.

Be cautious of companies that promise “credit repair” for high fees. Most of the time, you can handle these fixes yourself for free if you follow the credit bureaus’ dispute steps.

Millennial Credit Advisers is your go-to resource for mastering the intricate world of personal finance with topical and timely information.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content: Please view our full AI Use Disclosure.

We improve our products and advertising by using Microsoft Clarity to see how you use our website. Using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.