Strategies for Building an Emergency Fund: A Clear and Confident Guide. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

Don’t Have Time To Read The Full Article. Here’s What You Are Missing.

- Strategies for Building an Emergency Fund: A Clear and Confident Guide. Find Out More In Our Latest Article!

- Understanding the Importance of an Emergency Fund

- Establishing Your Financial Goals

- Determining Your Emergency Fund Target

- Setting a Timeframe

- Creating a Savings Plan

- Budgeting for Savings

- Automating Your Savings

- Maintaining Your Emergency Fund

- Periodic Reviews

- Adjusting for Life Changes

- Frequently Asked Questions

Building an emergency fund is a crucial step in achieving financial stability and is considered a cornerstone for your financial foundation. It provides a safety net for unexpected expenses like car repairs, medical bills, or job loss but that’s not all the benefits.

With an emergency fund, people don’t have to rely on credit cards or loans, leading to debt and financial stress.

Understanding the Importance of an Emergency Fund

As we go through life, we will inevitably face unexpected expenses or financial emergencies. These can range from car repairs, home repairs, medical bills, or even a loss of income. These events can quickly derail our financial stability without proper preparation and leave us in a difficult situation.

That’s where an emergency fund comes in. It provides a safety net to help us weather unexpected economic storms without using high-interest loans or credit cards.

Understanding the Importance of an Emergency Fund is the first step in building one. An emergency fund is a separate account or cash reserve for unplanned expenses. It is essential to have this fund because it provides a buffer against financial emergencies.

Establishing Your Financial Goals is the next step. You need to set a goal for how much money you want to save in your emergency fund. Doing so can help you stay motivated and focused on building your fund.

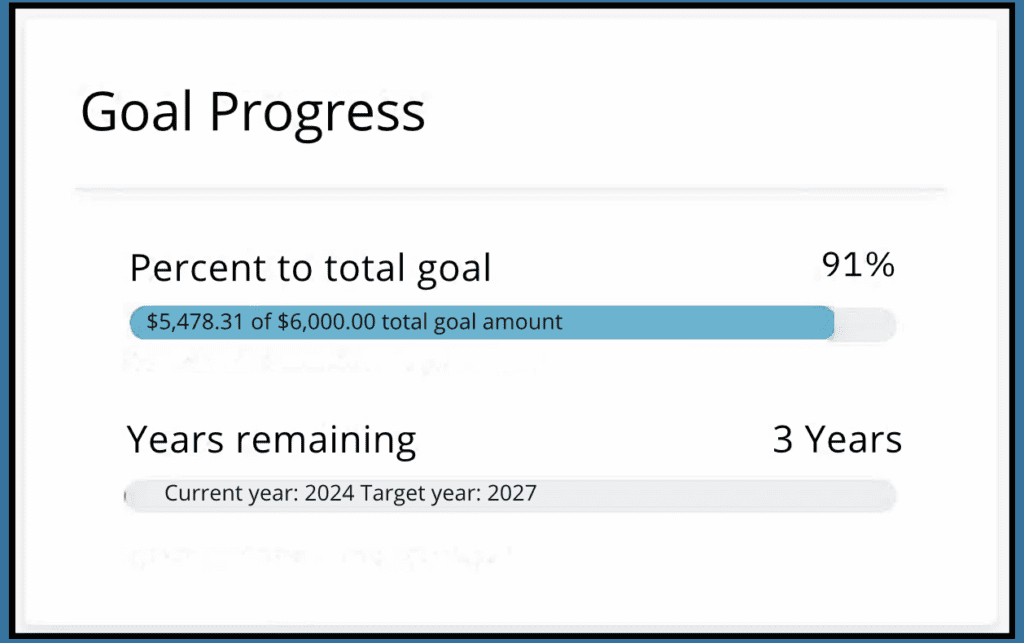

Years ago, I explained to a group how easy it is to set up an emergency fund. Here’s an example of one you can create for car maintenance, insurance, and transportation-related expenses.

An emergency fund is essential because it prepares you for the unexpected. We can’t predict the future, but we can take steps to protect ourselves from financial hardship.

With an emergency fund, we can have peace of mind knowing that we have a cushion to fall back on in an emergency.

It’s important to note that an emergency fund differs from a savings account. While a savings account is essential for long-term financial goals like retirement or a down payment on a house, an emergency fund allows you to set money aside for unexpected expenses that may arise in the short term.

An emergency fund is an essential part of any financial plan. It provides a safety net to help you weather economic storms without using high-interest loans or credit cards.

By setting aside money in an emergency fund, we can have peace of mind knowing that we have a cushion to fall back on in an emergency.

Establishing Your Financial Goals

As we begin to build our emergency fund, it’s important to establish our financial goals. Financial goals help us determine how much money we need to save and how long it will take us to reach our target.

Determining Your Emergency Fund Target

Determining our emergency fund target is the first step in establishing our financial goals. This is how much we need to cover expenses in an emergency, such as a job loss or medical emergency.

Financial experts recommend having at least three to six months’ worth of expenses saved in an emergency fund. However, your target may vary depending on our circumstances, such as your income, expenses, and job security.

We need to calculate our monthly expenses to determine our emergency fund target. This includes _rent/mortgage, utilities, food, transportation, and insurance. Once we have our monthly expenses, we can multiply this by the number of months we want to save for.

For example, if our monthly expenses are $3,000 and we want to save for six months, our emergency fund target would be $18,000.

Setting a Timeframe

Once we have our emergency fund target, we must set a timeframe for reaching our goal. Having an established timeframe will help us stay motivated and on track.

When setting a timeframe, we need to consider our income and expenses. We should aim to save a realistic amount each month without compromising our other financial goals, such as paying off debt or saving for retirement.

One strategy is to automate your savings by setting up a direct deposit or automatic transfer into your emergency fund each month. Using this strategy will help you save consistently and make it easier to reach your target.

Establishing financial goals is essential in building our emergency fund. We must determine our emergency fund target and set a timeframe for reaching our goal. By doing so, we can stay motivated and on track toward achieving financial security.

Creating a Savings Plan

Building an emergency fund requires a consistent saving habit. We must create a savings plan that works for our lifestyle and income. In this section, we will discuss two strategies for creating a savings plan: budgeting for savings and automating your savings.

Budgeting for Savings

The first step in creating a savings plan is to budget for savings. We must identify how much we can save each month and where to cut expenses to increase our savings. One way to do this is by creating a budget with a savings category.

To create a budget, we need to track our income and expenses. We can use a spreadsheet or budgeting app to help us keep track of our finances. Once we understand our income and expenses clearly, we can identify areas to cut costs and allocate more money toward savings.

It’s essential to be realistic when creating a budget. You don’t want to create a budget that isn’t flexible or easy to stick with. Instead, aim to create a sustainable budget that allows you to save consistently over time.

Automating Your Savings

Automating our savings is another effective strategy for building an emergency fund. By automating our savings, we can ensure that a portion of our income goes towards monthly savings without manually transferring money.

We can set up automatic monthly transfers from our checking account to our savings account. This way, we don’t have to remember to transfer money, and we can ensure that we are consistently saving.

Another way to automate our savings is using a savings app that rounds up our purchases and transfers the spare change to our savings account—a simple and effective way to save money without even thinking about it.

Creating a savings plan is essential for building an emergency fund. By budgeting for and automating our savings, we can ensure that we consistently save money each month.

Maintaining Your Emergency Fund

Once you have built up your emergency fund, it is essential to maintain it to ensure it is always available when needed. Here are some strategies to help you maintain your emergency fund:

Periodic Reviews

It is essential to periodically review your emergency fund to ensure it meets your needs. We recommend examining your emergency fund at least once a year. During your review, consider the following:

- Is your emergency fund sufficient to cover your expenses for at least three to six months?

- Have your expenses increased or decreased?

- Have there been any changes in your income or job security?

- Have there been any changes in your family situation, such as a new baby or a divorce?

If your emergency fund is insufficient, you may need to adjust your savings plan to increase your contributions.

Adjusting for Life Changes

Life is unpredictable, and your emergency fund needs may change over time. You may need to dip into your emergency fund if you experience a significant life change, such as a job loss, an unexpected medical expense, or a natural disaster. If this happens, it is essential to replenish your emergency fund as soon as possible.

If your emergency fund is depleted, you may need to adjust your savings plan to rebuild it. To help reduce discretionary spending or find ways to increase your income.

It is essential to prioritize rebuilding your emergency fund to provide you with a safety net in future emergencies.

You can ensure it is always available when needed by periodically reviewing your emergency fund and adjusting for life changes.

Frequently Asked Questions

How much money should I aim to save for my emergency fund?

The amount of money you should aim to save for your emergency fund depends on your situation. A common rule of thumb is to save at least three to six months of living expenses.

If you were to lose your job or face an unexpected expense, you would have enough money saved to cover your bills and other necessary costs for three to six months.

However, depending on your circumstances, such as your job security, health, and family situation, you may need to save more or less.

What are some effective strategies for building an emergency fund?

There are several effective strategies for building an emergency fund. One of the most important is prioritizing saving in your budget. One method involves automatic transfers from your checking account to a dedicated emergency savings account or setting aside a portion of your monthly income.

Another strategy is to reduce your expenses wherever possible. This method could involve cutting back on discretionary spending, such as eating out or buying new clothes, or finding ways to save on your regular bills, such as by negotiating lower rates on your utilities or insurance.

What is the difference between an emergency fund and regular savings?

An emergency fund is a savings account covering unexpected or financial emergencies. It is typically kept separate from your regular savings. It will be used only in emergencies like job loss, medical emergencies, or major home repairs.

On the other hand, regular savings are money you set aside for longer-term goals, such as a down payment on a house, a vacation, or retirement.

While emergency funds and regular savings are essential, keeping them separate so that you don’t dip into your emergency fund for non-emergency expenses is vital.

Should I invest my emergency fund or keep it in a savings account?

Keep your emergency fund in a savings account or other low-risk, liquid investment because you want to access your emergency fund quickly and easily in an emergency.

If you were to invest your emergency fund in a higher-risk investment, such as stocks or mutual funds, you could lose money if you needed to withdraw it during a market downturn.

Are there any government programs that can help me build my emergency fund?

Some government programs can help you build your emergency fund, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). These programs provide tax credits to low- and moderate-income households, which can help them save money and build their emergency funds.

What are the most important factors to consider when structuring an emergency fund?

When structuring your emergency fund, it is essential to consider several factors, including how much money you need to save, how quickly you can access your funds, and where to keep your emergency savings.

You should also consider your situation, such as your job security, health, family situation, and other financial goals. Considering these factors, you can create an emergency fund tailored to your needs and circumstances.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content – “Please view our full AI Use Disclosure.”

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.