Navigating the Path to Debt Freedom – A Guide for Millennials in a Consumer-Driven Society. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

As a millennial, it’s easy to become overwhelmed with the financial challenges of navigating the path to debt freedom in a consumer-driven society.

With the rise of social media and the constant bombardment of advertisements, it’s easy to fall into the trap of overspending and accumulating debt.

However, to achieve financial stability, I learned it’s essential to take control of your finances and develop strategies for debt management.

Understanding how to manage financial challenges is crucial in developing effective strategies for debt management.

The psychology of spending plays a significant role in debt accumulation, and it’s essential to identify the triggers that lead to overspending.

Additionally, millennials’ investment mindsets differ from those of previous generations, and it’s essential to understand the factors influencing their financial decisions.

Understanding Financial Challenges

You’re not alone in understanding the financial challenges that many of us face in today’s consumer-driven society.

This section will discuss three significant financial challenges millennials often encounter: student loan debt, credit card usage, and housing market realities.

Student Loan Debt

One of the biggest financial challenges facing millennials is student loan debt. According to the Federal Reserve, the total outstanding student loan debt in the United States is over $1.6 trillion. Many millennials are burdened with high levels of student loan debt, making it difficult to save for retirement, buy a home, or start a family.

To tackle this challenge, millennials must understand their student loan repayment options. Several repayment plans, including income-driven ones, are available, which can make monthly payments more manageable.

Additionally, refinancing student loans can lower interest rates and save money over the life of the loan.

Credit Card Usage

Another financial challenge for millennials is credit card usage. Many rely on credit cards to make ends meet, which can lead to high credit card debt. According to a study by CreditCards.com, millennials have an average credit card debt of $4,712.

Millennials should establish a budget and stick to it to avoid credit card debt. They should also pay off credit card balances monthly to avoid interest charges.

Finally, millennials should be wary of credit card rewards programs, which can encourage overspending and lead to debt.

Housing Market Realities

Finally, many millennials need help entering the housing market. According to a report by the Urban Institute, homeownership rates among millennials are lower than those of previous generations of the same age.

This is due to various factors, including high levels of student loan debt, rising home prices, and stagnant wages.

To overcome this challenge, millennials should consider alternative housing options like renting or co-living arrangements. These options can also help them save for a down payment, and improving their credit scores is essential for qualifying for a mortgage.

Finally, millennials should be patient and take their time with homeownership if it is not financially feasible.

The Psychology of Spending

As a millennial, I have observed that many struggle with managing their finances and avoiding debt. One main reason for this is the psychology of spending. In a consumer-driven society, we are constantly bombarded with messages encouraging us to spend. Understanding this psychology is critical to navigating the path to debt freedom.

Social Media Influence

Social media has become ubiquitous in our lives, significantly impacting our spending habits. Many millennials use social media to keep up with trends and find inspiration for their purchases. However, social media can also create a sense of FOMO (fear of missing out) and pressure to keep up with others.

One study found that 40% of millennials have made purchases based on something they saw on social media. However, it’s essential to recognize that social media is often a highlight reel, and what we see may not reflect reality. Taking a step back and evaluating our priorities can help us avoid impulsive purchases influenced by social media.

Instant Gratification Culture

We live in an age of instant gratification, where we can have almost anything we want at the touch of a button. This culture has led to a mindset of “I want it now,” which can be dangerous regarding finances.

Many millennials have grown up with credit cards and easy access to loans, which can make overspending tempting. However, this can lead to a cycle of debt that is difficult to break. Learning to delay gratification and save for what we want can help us avoid falling into this trap.

Understanding the psychology of spending is crucial for millennials who want to achieve debt freedom. By recognizing the influence of social media and the dangers of instant gratification, we can make better financial decisions and work towards a brighter financial future.

Strategies for Debt Management

As a millennial, managing debt can be daunting. However, with the right strategies, you can achieve debt freedom and take control of your finances.

Here are two effective strategies for debt management:

Budgeting Essentials

Creating and sticking to a budget is essential for debt management. Start by listing all your sources of income and expenses. Prioritize your expenses and allocate funds accordingly. Be realistic and honest with yourself when creating your budget. Remember to include a category for unexpected expenses, such as car repairs or medical bills.

Consider using budgeting apps or spreadsheets to make budgeting easier. These tools can help you track your spending and identify areas for improvement. Remember, sticking to your budget is vital to achieving debt freedom.

Debt Snowball vs. Avalanche

Two popular strategies for paying off debt are the debt snowball and the debt avalanche. The debt snowball method involves paying off your smallest debts first and then moving on to larger debts. This approach can be motivating as you quickly see progress in paying off your debts.

On the other hand, the debt avalanche method involves paying off debts with the highest interest rates first. This approach can save you money in the long run by reducing the amount of interest you pay.

Both methods are effective, so choosing the one that works best for you is important. Consider your financial goals and priorities when deciding which method to use.

Implementing these strategies can help you control your finances and achieve debt freedom. Remember, it takes time and dedication, but anything is possible with the right mindset and tools.

Investment Mindset Among Millennials

As a millennial, I understand the importance of investing for my future financial stability. However, navigating the world of investments can be overwhelming and confusing. Here are some insights on the investment mindset among millennials.

Retirement Planning

Retirement planning is a crucial aspect of investment for millennials. According to a survey conducted by Bank of America, 67% of millennials are saving for retirement. However, many millennials are unaware of the different investment options available.

One of millennials’ most popular retirement options is the employer-sponsored 401(k) plan. It allows for automatic contributions from your paycheck, and many employers offer a matching contribution up to a certain percentage. Another option is the Roth IRA, which allows for tax-free withdrawals in retirement.

Stock Market Participation

The stock market can be intimidating for many millennials. However, investing in stocks can provide a significant return on investment in the long run. According to a survey conducted by Charles Schwab, 40% of millennials own stocks.

One way to ease into the stock market is through investing in index funds or exchange-traded funds (ETFs). These funds allow for diversification and can provide a more stable return on investment.

An investment mindset is crucial for millennials to achieve debt freedom and financial stability. By understanding and taking advantage of the different investment options available, millennials can set themselves up for a successful financial future.

Navigating Consumer Pressures

Navigating the consumer-driven society we live in today can be challenging for millennials. At every turn, we are bombarded with advertising messages encouraging us to buy more and spend beyond our means.

In this section, I will discuss millennials’ everyday consumer pressures and offer some tips on navigating them.

Advertising Tactics

Advertisers use various tactics to get us to buy their products, including emotional appeals, celebrity endorsements, and limited-time offers. It can be challenging to resist the urge to buy something when we are constantly told that we need it to be happy or successful.

One way to combat these advertising tactics is to be aware of them. Take a critical look at the ads you see and ask yourself if the product being sold is something you need or want. Consider the long-term costs of buying something on impulse and whether it aligns with your financial goals.

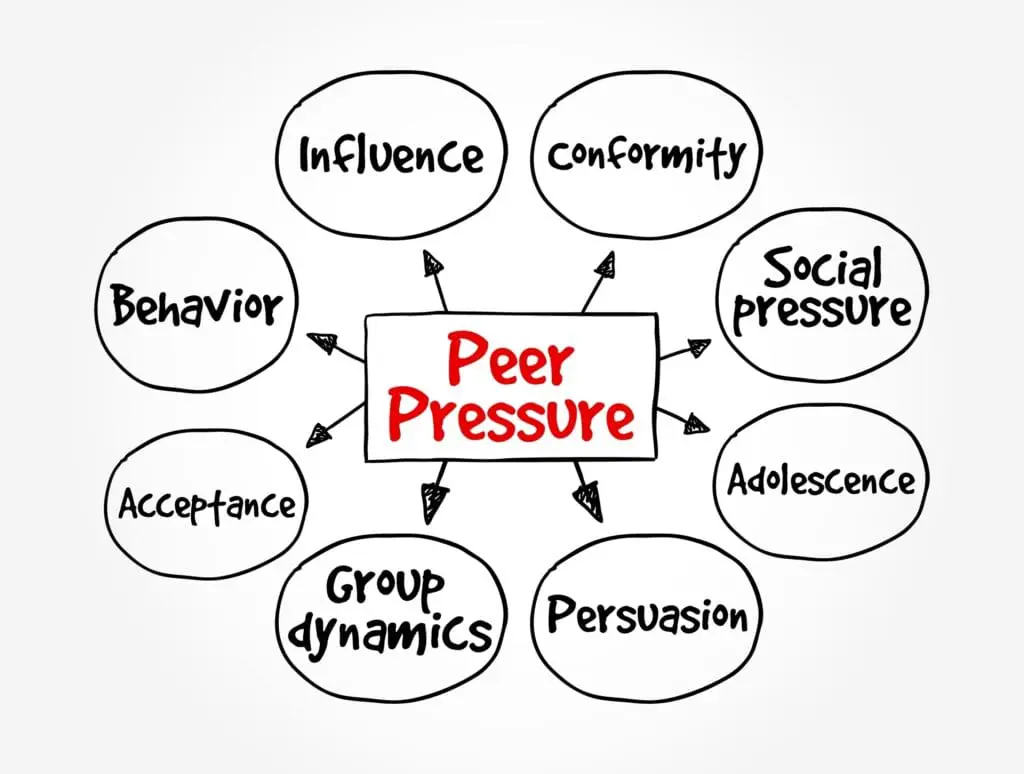

Peer Pressure and Lifestyle Creep

Other pressures that millennials face are peer pressure and lifestyle creep. We may feel pressure to keep up with our friends, coworkers, or social media influencers and spend money on things we don’t need or can’t afford.

To navigate this pressure, being honest about what you can afford and your financial priorities is essential. Don’t be afraid to say no to social events or purchases that don’t align with your goals. You can still have fun and enjoy life without breaking the bank.

Navigating consumer pressures as a millennial can be challenging, but it’s not impossible. By being aware of advertising tactics and staying true to our financial priorities, we can make smart choices and work towards debt freedom.

Building a Sustainable Financial Future

As a millennial, I understand the importance of building a sustainable financial future. In a consumer-driven society, avoiding debt and achieving financial freedom can be challenging. However, you can reach your financial goals with the right strategies and mindset.

Emergency Savings

Establishing an emergency savings fund is essential to building a sustainable financial future. This fund should be easily accessible and cover at least three to six months of living expenses. By having this safety net, you can avoid accumulating debt in case of unexpected expenses or emergencies.

Set up automatic transfers from your checking account to your emergency savings account to achieve this financial goal. This way, you can consistently contribute to your emergency fund without thinking about it.

Diversifying Income Streams

Diversifying your income streams is another way to build a sustainable financial future. Relying solely on one source of income can be risky, especially in uncertain economic times. By diversifying your income, you can increase your earning potential and reduce your financial vulnerability.

Some ways to diversify your income streams include:

- Starting a side hustle or freelance gig

- Investing in stocks or real estate

- Selling items online or at local markets

By exploring these options, you can find additional sources of income that fit your skills and interests.

Building a sustainable financial future requires discipline, patience, and a willingness to learn. In a consumer-driven society, you can achieve financial freedom and avoid debt by establishing an emergency savings fund and diversifying your income streams.

Financial Literacy and Education

As a millennial, I understand the importance of financial literacy and education in achieving debt freedom. With so many consumer-driven temptations around us, it’s easy to fall into the trap of overspending and accumulating debt. However, by educating ourselves on personal finance and money management, we can make informed decisions and take control of our financial future.

Personal Finance Resources

There are many resources available to improve our financial literacy. One of the most accessible is the Internet. Numerous websites and blogs on personal finance offer tips and advice on budgeting, saving, and investing. Some popular ones include NerdWallet, The Simple Dollar, and Empower.

Another great resource is books. There are countless books on personal finance and money management, ranging from beginner’s guides to more advanced topics. Some popular titles include “The Total Money Makeover” by Dave Ramsey, “Rich Dad Poor Dad” by Robert Kiyosaki, and “The Intelligent Investor” by Benjamin Graham. “The Millionaire Next Door by Thomas J. Stanley and William Danko.”

Money Management Courses

Money management courses are also available for those who prefer a more structured approach. Many community colleges and universities offer personal finance and money management courses, and online courses are available through platforms like Coursera and Udemy.

In addition, some employers offer financial education programs as part of their benefits package. These programs can include workshops, seminars, and one-on-one counseling sessions with financial advisors.

Improving our financial literacy and education is critical to achieving debt freedom in a consumer-driven society. By utilizing the resources and courses available, we can make informed decisions and take control of our financial future.

Policy and Economic Factors

Government Legislation

As a millennial, I understand government legislation’s impact on our financial lives. One example is the Credit CARD Act of 2009 (The Credit Card Accountability Responsibility and Disclosure Act), which established new rules for credit card companies. This legislation prohibited companies from raising interest rates on existing balances unless the cardholder was more than 60 days late on a payment. It also required credit card companies to provide clearer information about fees and interest rates.

Another example is the Affordable Care Act, which allows young adults to stay on their parent’s health insurance until age 26. This provision has helped many millennials save money on healthcare costs.

Economic Trends Affecting Millennials

Millennials have faced economic challenges that previous generations did not. For example, higher education costs have skyrocketed, leaving many millennials with significant student loan debt. The job market has also been challenging for millennials, with many needing help finding full-time, well-paying jobs.

Another trend affecting millennials is the rise of the gig economy. Many millennials are turning to freelance work, such as driving for Uber or delivering food for Grubhub, to supplement their income. While this can provide flexibility, it can also lead to financial instability.

Government legislation and economic trends significantly impact millennials’ financial lives. We must stay informed about these factors and advocate for policies that support our financial well-being.

Frequently Asked Questions

What strategies can millennials employ to reduce their debt effectively?

Millennials can employ several strategies to reduce their debt effectively. One of the most effective strategies is to create a budget and stick to it. This involves tracking all expenses and cutting back on unnecessary spending. Another strategy is consolidating debt into a single payment with a lower interest rate. Additionally, millennials can negotiate with creditors to reduce interest rates or payment amounts.

How does the financial behavior of millennials differ from previous generations?

Millennials tend to have higher debt levels than previous generations due to student loans and credit card debt. They also tend to prioritize experiences over material possessions, which can lead to overspending on travel and entertainment. However, millennials are also more likely to seek financial advice and use technology to manage their finances.

What are millennials’ primary sources of debt, and how do they rank in prevalence?

Millennials’ primary sources of debt are student loans, credit card debt, and personal loans. Student loans are the most prevalent, with over 44 million Americans owing $1.6 trillion in student loan debt. Credit card debt is the second most prevalent, with the average millennial carrying a balance of $4,712.

How can millennials balance saving for the future while managing existing debt?

Millennials can balance saving for the future while managing existing debt by creating a budget that includes debt repayment and savings goals. They can also consider refinancing high-interest debt to lower their monthly payments and free up more money for savings. Additionally, millennials can prioritize retirement savings by contributing to a 401(k) or IRA, which can provide tax benefits and compound interest over time.

How have economic factors shaped the financial outlook of millennials compared to older cohorts?

Millennials have faced several economic challenges, including rising education costs, stagnant wages, and the 2008 financial crisis. These factors have led to higher levels of debt and lower levels of wealth accumulation compared to older cohorts. However, millennials have also adapted to these challenges by seeking alternative income streams and using technology to manage their finances.

What advice is available for millennials seeking financial stability in a consumer-driven economy?

Several pieces of advice are available for millennials seeking financial stability in a consumer-driven economy. First, it is essential to create a budget and stick to it. Second, millennials should prioritize debt repayment and consider consolidating or negotiating with creditors to reduce interest rates. Third, they should prioritize retirement savings and consider alternative income streams. Finally, seeking financial advice and using technology to manage finances can also be helpful.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content: Please view our full AI Use Disclosure.

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.