Building Credit from Scratch. 15+ Essential Tips for Financial Beginners.

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

- Building Credit from Scratch. 15+ Essential Tips for Financial Beginners.

- Understanding the Foundations of Credit

- What Is Credit and Why Does It Matter?

- How Credit Scores Are Calculated

- Common Credit Myths Debunked

- Apply for a Secured Credit Card

- Become an Authorized User

- Open a Credit-Builder Loan

- Choose the Right Financial Institution

- Innovative Strategies for Responsible Credit Usage

- Make On-Time Payments Every Month

- Keep Your Credit Utilization Low

- Only Apply for the Credit You Need

- Monitoring Your Credit Progress

- Regularly Check Your Credit Reports

- Dispute Inaccuracies Quickly

- Building Credit Without Traditional Cards

- Use Rent and Utility Payments to Build Credit

- Explore Non-Traditional Credit Accounts

- Long-Term Habits for Healthy Credit

- Maintain Old Credit Accounts

- Diversify Your Credit Mix

- Avoid Closing Unused Accounts Abruptly

- Advantages of Building Credit from Scratch

- Disadvantages and Potential Pitfalls

- Comparing Different Methods for Credit Building

- How to Recover from Credit Mistakes

- Action Steps to Stay on Track

Building a solid credit history from zero can feel overwhelming. Still, it’s a real chance to set up good financial habits from the start.

Creating a strong credit foundation requires patience, consistency, and a solid understanding of how the credit system operates. Many people struggle with building credit because they don’t know where to start.

With the right strategies, you can start establishing your creditworthiness right away. Breaking it down into manageable steps makes the whole process less intimidating.

From secured credit cards to becoming an authorized user, you’ve got a few options, even if you don’t have any credit history yet.

Key Giveaways

- Consistent on-time payments and responsible credit management are essential for building trust with lenders.

- Diversifying your credit mix and keeping your credit utilization low can strengthen your profile faster than just relying on one method.

- Keep an eye on your credit reports so you can catch errors early and see how your efforts are paying off.

Understanding the Foundations of Credit

To build good credit, you need to know the basics of how credit works. Credit impacts a surprising number of areas in your financial life.

What Is Credit and Why Does It Matter?

Credit is basically your financial reputation—it shows how reliably you pay back borrowed money. Lenders use it to decide if they’ll loan you money and at what rate.

Good credit opens doors to better opportunities. With strong credit, you can qualify for:

- Lower interest rates on loans and credit cards

- Higher credit limits

- Better insurance rates

- Easier apartment rental approvals

- Some job opportunities (yep, certain employers check credit)

Your credit can save you thousands over your lifetime. For example, a good credit score might save you over $100,000 on a 30-year mortgage compared to someone with poor credit.

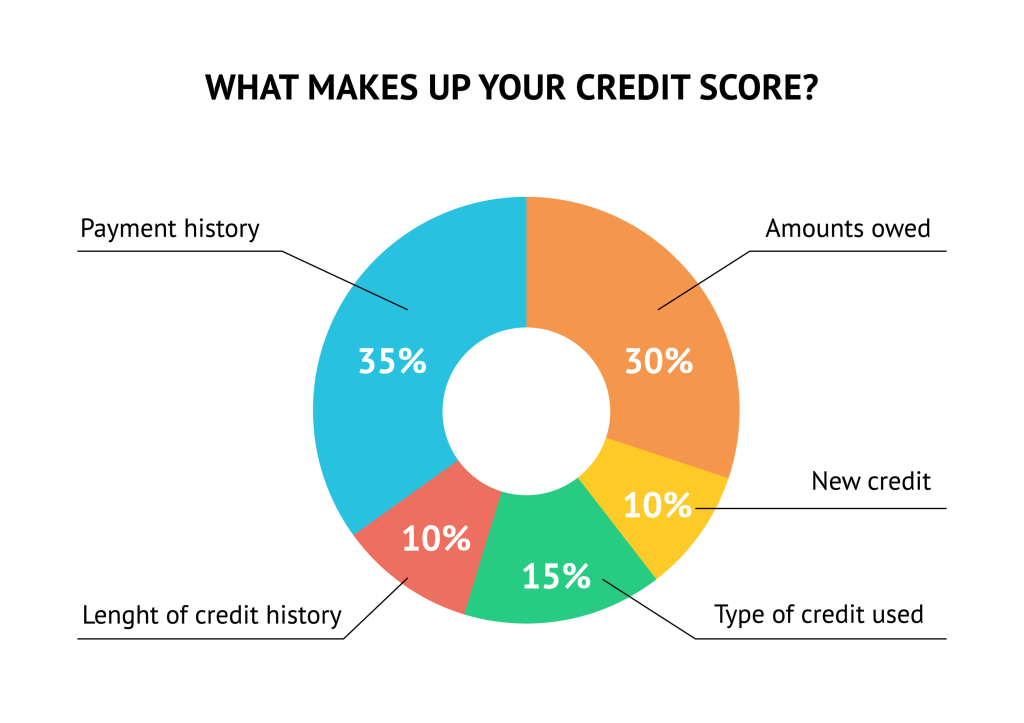

How Credit Scores Are Calculated

Credit scores usually range from 300 to 850. Higher is better, obviously. The FICO scoring model breaks down your score like this:

- Payment history (35%) – Do you pay bills on time?

- Credit utilization (30%) – How much of your available credit are you using?

- Length of credit history (15%) – How long have your accounts been open?

- New credit (10%) – Have you applied for new credit recently?

- Credit mix (10%) – Do you have a variety of credit accounts?

Most lenders consider a score above 670 to be good, and above 740 to be very good. On-time payments and keeping balances low do the most for your score.

Common Credit Myths Debunked

Myth 1: Checking your own credit hurts your score. Nope! That’s a “soft inquiry” and doesn’t affect your score. You can monitor your credit regularly without worry.

Myth 2: You need to carry a balance on credit cards to build credit. Not true. Paying off your balance in full each month demonstrates responsible use and helps you avoid accumulating interest.

Myth 3: Closing old credit cards helps your score. Closing old accounts can hurt your score by shortening your credit history and raising your utilization ratio.

Myth 4: You and your spouse share a credit score. Everyone has their own individual credit score, even if you share joint accounts.

Myth 5: Higher income means better credit. Income isn’t part of your credit score. It’s more about how you manage the money you have than how much you make.

15 Essential Tips for Building Credit from Scratch

To build credit from the ground up, you need a plan and some consistent financial habits. These practical steps can help anyone, even if you’ve never had credit before.

Apply for a Secured Credit Card

A secured credit card is a great starting point for beginners. You put down a cash deposit that usually matches your credit limit, which acts as collateral for the bank.

Most major banks and credit unions offer secured credit cards with different features. Look for cards with:

- No annual fee

- Reporting to all three major credit bureaus

- Upgrade options to unsecured cards

- Reasonable interest rates

Try to keep your utilization under 30%—so if your limit is $500, don’t carry more than $150. Pay your bill in full each month to dodge interest.

Making regular, on-time payments will build a positive payment history, which is enormous for your FICO score.

Become an Authorized User

If you become an authorized user on someone else’s card, you can piggyback off their good credit habits. When a trusted family member or friend adds you, their card’s history can show up on your report.

This works best if the primary cardholder:

- Keeps low balances

- Has a strong record of on-time payments

- Uses a card from an issuer that reports authorized users

The primary cardholder stays responsible for all charges, so set clear boundaries about how you’ll use the card. Sometimes, people become authorized users without ever touching the card itself.

This move can be beneficial for young adults or someone rebuilding credit. The good habits of the primary user can help your score climb faster.

Open a Credit-Builder Loan

Credit-builder loans let you build credit and save money at the same time. Instead of getting money up front, the lender puts the “loan” into a locked savings account.

You make fixed monthly payments (usually for 6-24 months), and after you’ve paid it off, you get the funds (minus any fees or interest). Many credit unions and community banks offer these specifically for people just starting.

Benefits include:

- Set payment schedule

- Forced savings

- Credit bureau reporting

- Lower risk than credit cards for some folks

Payments are usually small—think $25-$100 a month—so they’re doable for most budgets. This type of loan adds installment credit to your file, which is different from credit cards and helps diversify your credit mix.

Choose the Right Financial Institution

The bank or credit union you pick can really affect your credit-building journey. Credit unions often have better terms for beginners than big banks.

Some community-focused places offer:

- First-time credit products with easier approval

- Lower fees and interest

- Personalized financial advice

- Special programs for students or young adults

Make sure your financial institution reports to all three major credit bureaus—Equifax, Experian, and TransUnion. That way, your good behavior shows up everywhere it matters.

Digital banks and fintech companies have started rolling out new credit-building tools, too. You might find secured cards with no credit checks, credit-builder accounts, or apps that report rent and utilities to the bureaus.

Innovative Strategies for Responsible Credit Usage

Responsible credit use is the backbone of a strong financial future. The proper habits help you build good credit and avoid mistakes that can stick with you for years.

Make On-Time Payments Every Month

Late payments can significantly harm your credit score and remain on your record for up to seven years. Set up automatic payments or use calendar reminders so you never forget a due date.

Just one payment that’s 30 days late can drop your score by 50-100 points. If you’re having trouble paying, reach out to your creditor right away—many have hardship programs.

Payment history makes up about 35% of your credit score, so it’s crucial. Responsible credit card use starts with paying on time, every time.

Most credit card companies offer free text or email alerts to help you remember. Use them! They’re there for a reason.

Keep Your Credit Utilization Low

Credit utilization refers to the percentage of your available credit you’re using. Experts suggest keeping it under 30% for the best scores.

If your limit is $1,000, try to keep your balance below $300. Even lower (under 10%) can give your score an extra boost.

Check your balances often with your card’s mobile app. It’s the easiest way to stay on top of your spending and avoid getting too close to your limit.

If you use your cards frequently, consider making multiple payments throughout the month. That way, your reported balances stay low, even if you charge quite a bit.

Only Apply for the Credit You Need

Every time you apply for new credit, lenders run a “hard inquiry” on your report. Too many in a short time can hurt your score and make you look desperate for credit.

Before you apply, ask yourself if you really need that new account. Innovative credit strategies mean being picky about what you open.

Try to space out applications by six months or more. If you’re rate shopping for something big (like a mortgage), do all your applications in a 14-45 day window so they count as one inquiry.

Every new account lowers your average account age, which can temporarily lower your score. It’s better to build a long history with a few solid accounts than to open a bunch at once.

Monitoring Your Credit Progress

Tracking your credit journey is key if you want to make smart financial moves and see real progress. Staying on top of things helps you catch issues early and keeps your efforts moving in the right direction.

Regularly Check Your Credit Reports

You’re entitled to free credit reports from each of the three major bureaus—Equifax, Experian, and TransUnion—once per year through AnnualCreditReport.com.

Many people recommend reviewing one report every four months to stay on top of things all year round. It’s easy to forget, so set calendar reminders to review your reports regularly.

When you look, check for:

- New accounts you didn’t open

- Hard inquiries you didn’t authorize

- Payment status on all accounts

- Credit utilization percentages

- Overall credit score trends

Many credit card companies now toss in free credit score monitoring. These tools offer monthly updates and can ping you if your score suddenly changes.

Dispute Inaccuracies Quickly

Credit report errors pop up more often than you’d think, and they can really tank your score if you ignore them. If you spot something off, jump on it right away and file a dispute with the right credit bureau.

Here’s how the dispute process usually goes:

- Pinpoint the error in your report

- Gather any paperwork or evidence

- Send in a formal dispute—online, by phone, or by mail

- Check back within 30 days if you don’t hear back

Credit bureaus have 30 days to investigate disputes and remove any information they cannot verify. Keep a folder or email trail of all communications you send and receive.

If you suspect identity theft, consider placing a fraud alert or credit freeze on your reports. It’s just an extra layer of protection while you sort things out.

Building Credit Without Traditional Cards

You don’t actually need a regular credit card to build up a solid credit history. There are other ways to prove your creditworthiness and skip the headache of credit card debt.

Use Rent and Utility Payments to Build Credit

Now you can get credit for bills you already pay. Experian Boost lets you add utility payments, streaming services, and phone bills to your credit report for free, which could bump up your score right away.

Rent reporting services like RentTrack and PayYourRent send your monthly rent payments to credit bureaus. These usually cost a bit, but if you consistently pay on time, it might be worth it.

Some landlords or property managers already report rent. Ask yours, and if they don’t, suggest it or try a third-party rent reporting company.

Explore Non-Traditional Credit Accounts

Credit-builder loans exist to help you start building credit. With these, you make payments first and get the money after the term ends. These payments show up on your credit report, helping you build history.

Store credit cards from retailers are often easier to get than regular cards. If you go this route, pick “closed loop” cards—usable only at certain stores—instead of “open loop” cards that act like regular credit cards.

Student loan repayment counts too. If you make your payments on time, it shows lenders you can handle ongoing credit obligations.

Long-Term Habits for Healthy Credit

Building good credit takes time, but maintaining it requires steady habits and wise choices. It’s less about tricks and more about consistency.

Maintain Old Credit Accounts

Try to keep your oldest credit accounts open and active. The age of your credit history is about 15% of your FICO score.

Lenders like seeing that you can manage credit over the long haul. Use your oldest accounts every few months, even for small stuff like gas or groceries.

Set up autopay to never forget a payment. Credit history length matters a lot, especially when you’re starting.

If you’re thinking about closing an old account, pause and consider how it could affect your average account age. The longer your accounts have been open, the better you look to lenders.

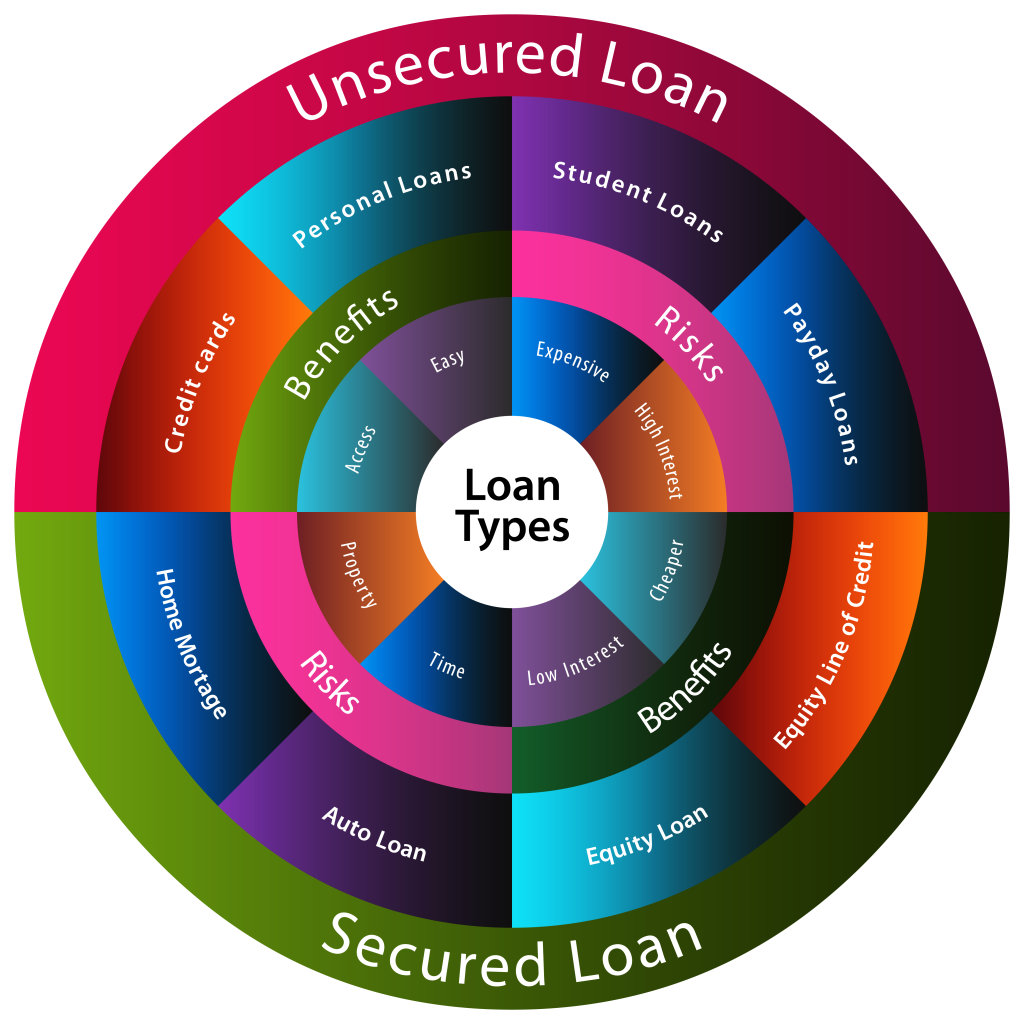

Diversify Your Credit Mix

Having different types of credit helps your score. A good mix might include:

- Revolving accounts (credit cards)

- Installment loans (auto loans, mortgages)

- Personal loans

- Student loans

Lenders want to see that you can handle different credit types. Credit mix makes up about 10% of your FICO score.

Don’t open accounts just for variety, though. Only take on credit you actually need and can manage. Building credit is about being strategic, not just collecting accounts.

Think about how each new account fits into your bigger financial picture. Gradual, intentional diversification works better than just grabbing every offer.

Avoid Closing Unused Accounts Abruptly

If you close credit accounts, your score drops. That’s because your available credit shrinks and your credit utilization ratio goes up.

Before you shut any account, ask yourself:

- How long have I had this account?

- Does it have an annual fee?

- How does it affect my total available credit?

If there’s no annual fee, it’s usually better to keep it open. For accounts with fees, weigh the cost against what it could do to your score.

To keep unused cards active, make a small purchase every few months and pay it off right away. That keeps your account open and protects your credit health without racking up interest.

Advantages of Building Credit from Scratch

Starting with a blank credit slate actually has some perks. No negative marks mean you’ve got a clean foundation to build on.

When you start from scratch, you can learn good credit habits right away. You don’t have to unlearn bad habits first, which is honestly a relief.

Financial opportunities open up when you have good credit. You’ll qualify for lower interest rates on loans and cards, which can save you a lot over time.

Good credit makes renting apartments easier, too. Landlords often check scores, and a solid one helps you stand out.

In many states, you’ll get better insurance rates since insurers use credit-based scores to set premiums for auto and homeowners policies.

| Credit Benefits | How They Help |

| Lower interest rates | Save money on loans |

| Easier apartment approvals | Secure housing more easily |

| Better insurance rates | Reduce monthly expenses |

| Employment opportunities | Some employers check credit |

Some employers check credit reports when hiring, especially for specific roles. A well-managed credit profile might give you an edge.

When you build credit from scratch, you can skip the common traps that trip up a lot of people: no old debt, no late payments—just a chance to write your own positive story.

There’s something satisfying about watching your score climb thanks to your own good habits. It gives you absolute confidence and peace of mind.

Disadvantages and Potential Pitfalls

Building credit isn’t all sunshine—there are challenges, especially when you’re new. Knowing what to watch out for makes the road a bit smoother.

High Interest Rates hit hard with secured and starter cards. Some of these products charge APRs of 20-25% or more, which can get expensive fast if you carry a balance.

Fees pile up with some credit-building tools. You might see:

- Annual fees

- Monthly maintenance fees

- Application fees

- Late payment penalties

Limited credit limits can box you in and bump up your credit utilization ratio if you’re not careful.

Credit score dips often happen when you apply for new credit, thanks to hard inquiries showing up on your report.

The risk of debt increases as you gain more access to credit. If you don’t budget, repayments can start to pile up.

Secured deposits mean your money’s tied up—money you could maybe use elsewhere if funds are tight.

Credit report errors are more common than people think. If you don’t check and dispute problems quickly, your progress can stall.

Approval can still be tough even with credit-building products, especially if you’ve got a rough financial past or serious delinquencies.

Identity theft risks go up as you open more accounts, so you have to keep a sharp eye on your reports and account activity.

Time commitment is real—building credit from scratch usually takes 6-12 months before you see significant changes.

Comparing Different Methods for Credit Building

Starting your credit journey can feel overwhelming. There are several ways to build a solid foundation, and each has its own quirks, for better or worse.

Secured Credit Cards vs. Credit Builder Loans

| Method | Initial Cost | Credit Impact | Time to Build |

| Secured Credit Card | $200-$500 deposit | Moderate-High | 6-12 months |

| Credit Builder Loan | Monthly payments | Moderate | 12-24 months |

Secured credit cards ask for a deposit up front. In return, you get flexibility for everyday spending and a chance to prove you can pay on time.

If you like a little tech support, credit-building apps can help you track spending and remind you to pay.

Credit builder loans take a different route. The lender locks the loan funds away while you make payments, and you get the cash after you finish paying it off.

This method kind of forces you to save, which isn’t the worst thing if you struggle with discipline.

Becoming an Authorized User lets you piggyback on someone else’s established credit account. No application, no deposit, but you’re counting on the other person’s good habits.

Retail and Store Cards are easier to get. The catch? High interest, and you can usually only use them at one store.

Credit-building accounts are a newer option. They report your positive payment history but don’t require a traditional credit check.

Diversity really matters here. Having a good credit mix shows lenders you can juggle different types of credit, which helps your score in the long run.

How to Recover from Credit Mistakes

Everybody slips up with credit at some point. The upside? You can recover, though it takes time and some strategy.

First steps to take:

- Figure out what went sideways in your credit history

- Pull your credit reports from all three bureaus

- Scan for errors that could be dragging your score down

Paying bills on time is huge for rebuilding your credit. Even one late payment can sting for a while.

Set up automatic payments or use calendar reminders so you don’t miss a due date.

High credit card balances? They’re bad news for your score. Try to keep your credit utilization under 30%—that’s the golden rule.

Paying down debt shows lenders you’re getting your act together financially.

Effective recovery strategies:

- If you can’t get a regular card, try a secured credit card

- Ask to become an authorized user on a responsible person’s card

- Look into credit-builder loans from credit unions

- Use tools like Experian Boost to get credit for utility payments

Time helps old derogatory marks fade. Late payments and collections matter less as they age, and most negatives drop off after seven years.

Action Steps to Stay on Track

Building credit isn’t a one-and-done thing. It takes steady effort and a bit of vigilance.

Create a payment calendar and jot down every due date for your bills and cards.

Set reminders three to five days ahead so you don’t get caught off guard by a deadline.

Check your credit card statements weekly instead of waiting for the monthly bill. This way, you’ll catch odd charges and keep tabs on your spending before things spiral.

Track your credit utilization with this simple formula:

| Credit Used | ÷ | Total Credit Available | = | Utilization Rate |

| $500 | ÷ | $2,000 | = | 25% |

Automate minimum payments on all your accounts. You can always pay extra manually if you want to knock down balances faster.

Check your credit reports regularly from all three bureaus. Mark these review dates on your calendar:

- Experian: January

- Equifax: May

- TransUnion: September

Reassess your credit-building strategy every quarter. As your score climbs, you might snag better cards or loans with lower rates or perks.

Create a progress tracker—maybe a chart on your fridge or a spreadsheet you actually look at. Watching your score tick up is surprisingly motivating.

Limit new credit applications to one every six months. Too many apps at once can ding your score and make lenders nervous.

Frequently Asked Questions

Credit building isn’t exactly intuitive. These common questions dig into the nuts and bolts of getting your credit on track.

How does one establish a credit history with a secured credit card?

Use a secured credit card for small purchases each month. Pay off the balance in full before the due date to avoid interest charges.

Your payment activity goes to the credit bureaus, and that builds your payment history—which is a big chunk of your credit score.

Stick with it for 6-12 months and keep your utilization under 30%. You’ll probably see your credit profile improve.

What are the benefits and responsibilities of becoming an authorized user on a credit card?

As an authorized user, you get the primary cardholder’s credit history added to your report. If they’ve got good payment habits, that’s a big win for you.

But you’ve got to be careful. Your spending affects them, and any slip-ups could mess with both your relationship and their score.

You’re not legally on the hook for the debt, but you should still pay for what you buy. It’s just good manners.

Why is it crucial to make bill payments promptly when building credit?

On-time payments are the backbone of a strong credit score. Payment history makes up 35% of your FICO score, so you can’t really ignore it.

Just one late payment can stick around for up to seven years and significantly hinder your financial progress.

Set up autopay or reminders to keep yourself on track. Lenders notice when you pay on time, and that’s what you want.

Can a credit builder loan positively affect my credit, and how does it function?

Credit builder loans can help your credit by adding positive payment history. You don’t get the money up front—the lender holds it in a savings account while you make payments.

They report your payments to the credit bureaus. When you’re done, you get the loan amount, sometimes with a bit of interest tossed in.

This is especially handy if you’re starting from scratch. It gives you a record of steady payments, no previous credit required.

What role does a co-signer play in securing credit, and what are the implications?

A co-signer with good credit can open doors to loans or cards you wouldn’t get on your own. Basically, they’re vouching for you.

Both of you are on the hook for the debt, though. If you miss payments, you both take a hit, and it can strain your relationship.

Still, it’s a way to access better rates and start building your own credit history through regular, on-time payments.

How does managing credit utilization influence your credit score?

Credit utilization—basically, the percentage of available credit you’re using—makes up 30% of your FICO score.

Most experts recommend keeping this ratio under 30% to improve your score.

Let’s say you have a $1,000 credit limit. Try not to let your balance go over $300.

If you keep your utilization low, lenders see that you’re not desperate for credit and you’re handling your money well.

Paying down your balances before the statement closing date can also make a difference.

That’s usually when credit bureaus get your balance info, so timing your payments can help keep things looking good.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content: Please view our full AI Use Disclosure.

We improve our products and advertising by using Microsoft Clarity to see how you use our website. Using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.