Blog

Hey there! Forget about the boring financial jargon!

This blog section is a fan favorite. It’s like having a personal finance best friend– down-to-earth, engaging, and here to keep you informed on debt, saving, credit, money, and more. It’s a treasure trove of fantastic Millennial Credit Advisers content designed to help you achieve your financial goals!

If you’re ready to free yourself from financial stress and start making progress on your money goals, this section is your one-stop shop for financial success! We have fresh articles, inspiring stories, and practical tips to help you level your financial game like a pro. Imagine hearing real-life success stories, getting clear-cut solutions to everyday money issues, and receiving expert advice to make you feel confident about your finances.

So, don’t wait! Dive in and start your financial journey today! ✨

RECENT POSTS

How To Win The Debt, Savings, and Credit Challenge With Proven Tactics for Success.

The DEBT, SAVINGS, AND CREDIT CHALLENGE is a three-step program designed to help you pay off your debt, increase your…

181-Point Credit Score Increase: More Details Inside!

Learn which credit habits to watch out for and avoid costly mistakes that could impact your financial well-being.

How You Can You Save Up to $5,787? Discover the Best Ways to Pay Your Credit Card Bill. Uncover the Advantages Today.

Carrying a balance from month to month can be costly. Discover the advantages of this strategy and start saving today.

Millennial Credit Advisers Debt, Savings, and Credit Challenge: A Winning Three-Step Plan For Paying Off Debt, Increasing Savings, And Improving Credit.

Millions are struggling with debt, savings, and credit and want to make a change. The DEBT, SAVINGS, AND CREDIT CHALLENGE…

Debt Demolition – Unleashing the Potential of the Debt Meltdown Method.

The Debt Meltdown Method is a game-changing approach that can help you achieve financial liberation.

Organize Your Finances: Let’s Declutter Those Financial Closets!

Individuals that successfully organized their finances. Adjusting Habits for Optimal Cash Flow.

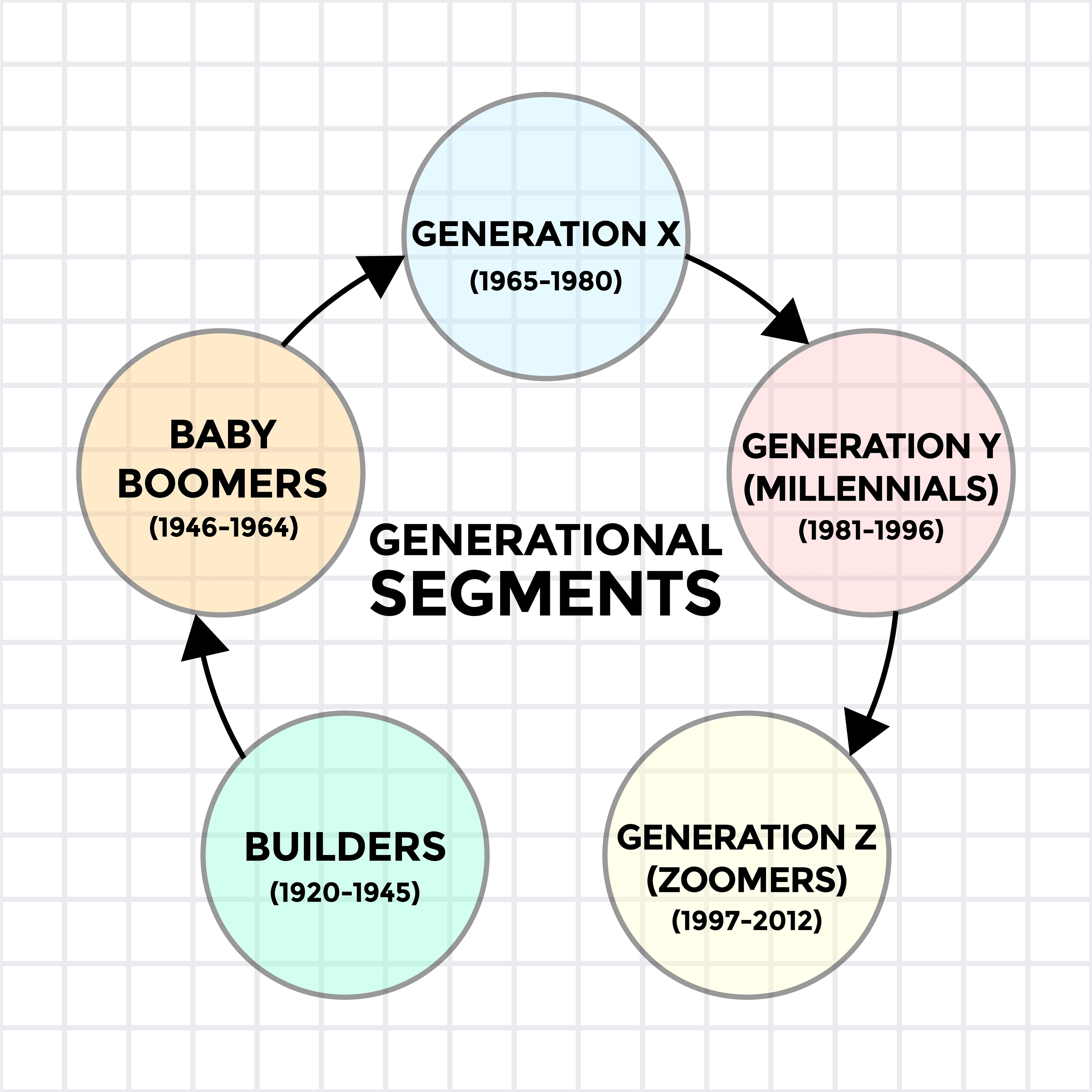

Nextgen Financial Literacy: Mastering Money Skills Without The Unnecessary Jargon.

Whether you want to save up for a house, pay off debt, or retire comfortably, having a solid understanding of…

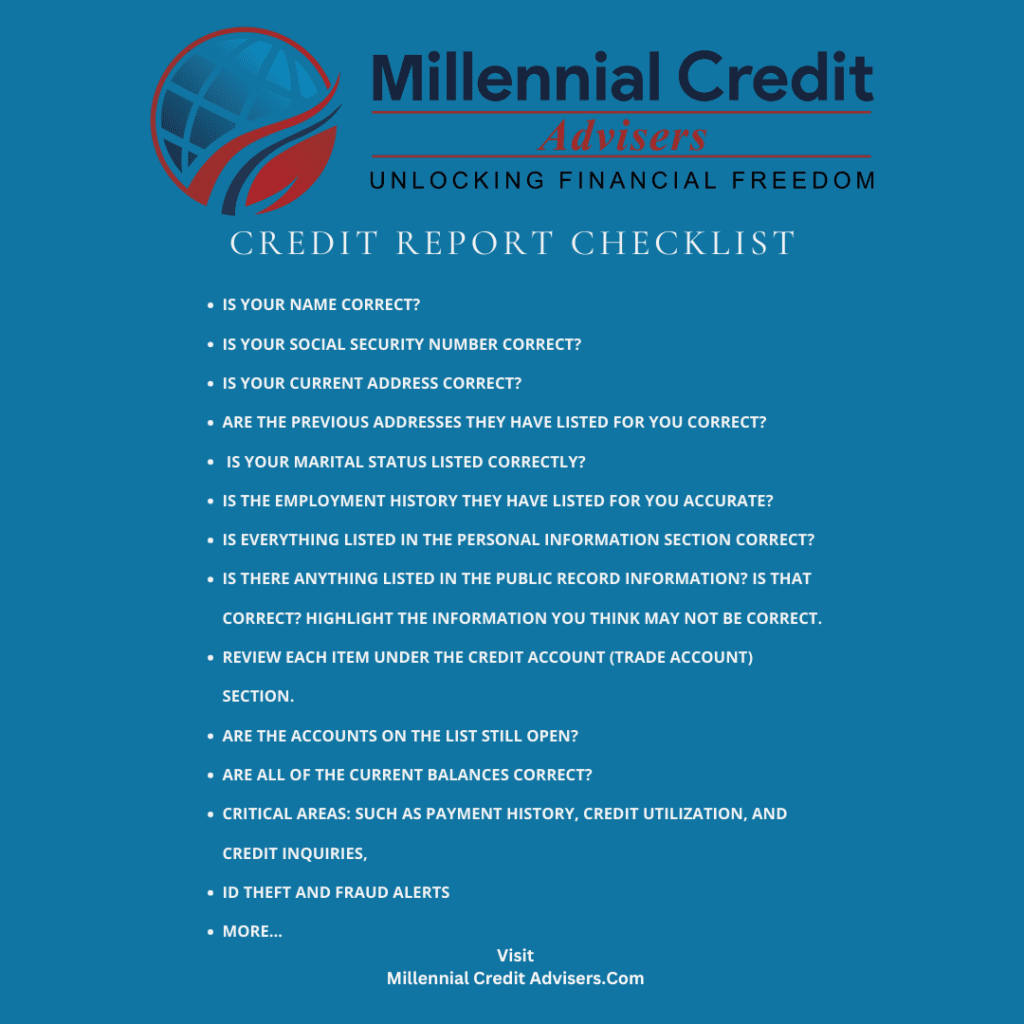

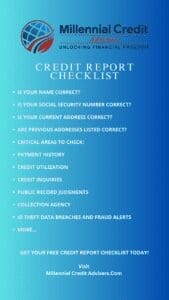

Unlock Your Credit Power: 20 Key Areas to Review Using a Credit Report Review Checklist for Better Comprehension of Your Reports.

As consumers, we want to ensure our credit reports are accurate and up-to-date. That's where a credit report review checklist…

Break Free from Debt: Effective Ways to Achieve Financial Independence.

Debt can feel like an overwhelming mountain to climb, but there are proven strategies to help you break free and…

The Top 12 Credit Report Errors You Should Look For.

Do Credit Reports Have Errors? You may never know if you’re not evaluating, auditing, and reviewing your credit reports!

Achieve Financial Wellness At Work & Home – Millennial Credit Advisers Debt Saving & Credit Challenge.

Many people make resolutions each year to improve their financial wellness, but knowing where to start can be difficult.

How To Earn Extra Money: Top 10 On and Offline Opportunities for Enhanced Income.

Whether you're looking to pay off debts, save for a special purchase, or boost your income, multiple options are available.

Related posts

Related posts

Free Email Course

Gain invaluable insights on launching your blog, from niche selection to audience expansion and monetization strategies. Access your FREE course today and embark on your journey to blogging success!

We respect your privacy. We will not send you spam emails.

RECENT POSTS

How To Win The Debt, Savings, and Credit Challenge With Proven Tactics for Success.

The DEBT, SAVINGS, AND CREDIT CHALLENGE is a three-step program designed to help you pay off your debt, increase your…

181-Point Credit Score Increase: More Details Inside!

Learn which credit habits to watch out for and avoid costly mistakes that could impact your financial well-being.

How You Can You Save Up to $5,787? Discover the Best Ways to Pay Your Credit Card Bill. Uncover the Advantages Today.

Carrying a balance from month to month can be costly. Discover the advantages of this strategy and start saving today.

Millennial Credit Advisers Debt, Savings, and Credit Challenge: A Winning Three-Step Plan For Paying Off Debt, Increasing Savings, And Improving Credit.

Millions are struggling with debt, savings, and credit and want to make a change. The DEBT, SAVINGS, AND CREDIT CHALLENGE…

Debt Demolition – Unleashing the Potential of the Debt Meltdown Method.

The Debt Meltdown Method is a game-changing approach that can help you achieve financial liberation.

Organize Your Finances: Let’s Declutter Those Financial Closets!

Individuals that successfully organized their finances. Adjusting Habits for Optimal Cash Flow.

Nextgen Financial Literacy: Mastering Money Skills Without The Unnecessary Jargon.

Whether you want to save up for a house, pay off debt, or retire comfortably, having a solid understanding of…

Unlock Your Credit Power: 20 Key Areas to Review Using a Credit Report Review Checklist for Better Comprehension of Your Reports.

As consumers, we want to ensure our credit reports are accurate and up-to-date. That's where a credit report review checklist…

Break Free from Debt: Effective Ways to Achieve Financial Independence.

Debt can feel like an overwhelming mountain to climb, but there are proven strategies to help you break free and…

The Top 12 Credit Report Errors You Should Look For.

Do Credit Reports Have Errors? You may never know if you’re not evaluating, auditing, and reviewing your credit reports!

Achieve Financial Wellness At Work & Home – Millennial Credit Advisers Debt Saving & Credit Challenge.

Many people make resolutions each year to improve their financial wellness, but knowing where to start can be difficult.

How To Earn Extra Money: Top 10 On and Offline Opportunities for Enhanced Income.

Whether you're looking to pay off debts, save for a special purchase, or boost your income, multiple options are available.

Related posts

RECENT POSTS

How To Win The Debt, Savings, and Credit Challenge With Proven Tactics for Success.

The DEBT, SAVINGS, AND CREDIT CHALLENGE is a three-step program designed to help you pay off your debt, increase your…

181-Point Credit Score Increase: More Details Inside!

Learn which credit habits to watch out for and avoid costly mistakes that could impact your financial well-being.

How You Can You Save Up to $5,787? Discover the Best Ways to Pay Your Credit Card Bill. Uncover the Advantages Today.

Carrying a balance from month to month can be costly. Discover the advantages of this strategy and start saving today.

Millennial Credit Advisers Debt, Savings, and Credit Challenge: A Winning Three-Step Plan For Paying Off Debt, Increasing Savings, And Improving Credit.

Millions are struggling with debt, savings, and credit and want to make a change. The DEBT, SAVINGS, AND CREDIT CHALLENGE…

Debt Demolition – Unleashing the Potential of the Debt Meltdown Method.

The Debt Meltdown Method is a game-changing approach that can help you achieve financial liberation.

Organize Your Finances: Let’s Declutter Those Financial Closets!

Individuals that successfully organized their finances. Adjusting Habits for Optimal Cash Flow.

Nextgen Financial Literacy: Mastering Money Skills Without The Unnecessary Jargon.

Whether you want to save up for a house, pay off debt, or retire comfortably, having a solid understanding of…

Unlock Your Credit Power: 20 Key Areas to Review Using a Credit Report Review Checklist for Better Comprehension of Your Reports.

As consumers, we want to ensure our credit reports are accurate and up-to-date. That's where a credit report review checklist…

Break Free from Debt: Effective Ways to Achieve Financial Independence.

Debt can feel like an overwhelming mountain to climb, but there are proven strategies to help you break free and…

The Top 12 Credit Report Errors You Should Look For.

Do Credit Reports Have Errors? You may never know if you’re not evaluating, auditing, and reviewing your credit reports!

Achieve Financial Wellness At Work & Home – Millennial Credit Advisers Debt Saving & Credit Challenge.

Many people make resolutions each year to improve their financial wellness, but knowing where to start can be difficult.

How To Earn Extra Money: Top 10 On and Offline Opportunities for Enhanced Income.

Whether you're looking to pay off debts, save for a special purchase, or boost your income, multiple options are available.

Related posts

Blog

✨ Hey there! This blog section is a fan favorite. Let’s say goodbye to dull financial jargon and explore the exciting and fun world of finance!

This blog provides personalized strategies for managing debt, saving, improving your credit, and exploring income options, suitable for individuals of all ages.

Your support team is always available, engaging, and dedicated to keeping you informed about debt, savings, credit, income, and more.

It’s a treasure chest of helpful Millennial Credit Adviser content aimed at helping you reach your financial goals!

If you’re ready to eliminate financial stress and begin making progress on your money goals, this section is your one-stop shop for financial success!

We have new articles, inspiring stories, and practical tips to help you improve your financial skills like a pro.

Imagine reading real-life success stories, getting straightforward solutions to everyday money problems, and receiving expert advice to help you feel comfortable and confident about your finances.

So, don’t wait! Jump in and begin your financial journey today! ✨

RECENT POSTS

☀️ Summer Side Hustle Challenge (June–August)

Hot Profit Ideas for Summer: 10 Quick & Easy Side Hustles That Could Bring in $1,000+ This Season.

☀️Hot Summer Debt Repayment Strategies (Jun-Aug).☀️ From Debt Snowball to Debt Meltdown. Quick, Proven Strategies to Slash Debt and Save Big.

Paying off debt quickly remains a challenge for many individuals, but having strategic approaches available can make a significant difference.

Achieve Your Financial Freedom! Take Control of Your Debt and Build a Brighter Future Today.

Are you ready to take charge of your financial destiny? It's time to break free from the chains of debt…

Top Strategies for Examining Credit Reports to Save Money.

Managing your money wisely often starts with understanding your credit. Your credit report holds crucial information about your borrowing habits…

Navigating Financial Hurdles – Strategies from Smart Savers.

As we navigate the complex world of personal finance, we are bound to encounter obstacles that can make it difficult…

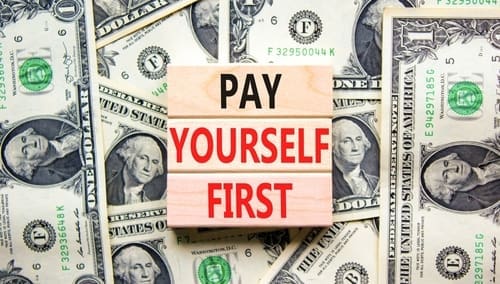

6 Essential Habits of Successful Savers You Should Know!

I am constantly seeking ways to improve my saving habits. I was excited to participate in the Savings Challenge and…

Kickstart Your Millennial Credit Advisers Savings Challenge for Unmatched Long-Term Success!

Starting a savings challenge can be daunting, but with the right mindset and strategies, it can be a rewarding experience…

Debunking the Myths – The Truth About Long-Term Debt Reduction, Increased Savings, and Credit Improvement Strategies That Work!

Managing personal finances is crucial today, yet many myths and misconceptions can prevent informed decision-making.

Four Effective Strategies to Maintain Your Savings Momentum – Tips for Long-Term Success!

Maintaining your savings can sometimes feel like a marathon, but with the right strategies, you can keep up the pace…

Monetize Your Future! The Beginner Blog Management Agency and Content Writer Course for Virtual Businesses & Virtual Assistants!

Discover the Key Skills Needed for Effective Blog Management and Optimization in Today’s Virtual Assistant Landscape.

How to Increase Your Income: A Quick Start Guide Starting A Virtual Business Agency.

Are you ready to turn your virtual assistant business into a profitable blogging career?

Unlock Financial Success – Proven Steps to Control Debt, Boost Savings, Improve Annual Credit Maintenance, and Maximize Income. Transform Your Future!

Money worries can keep people up at night, but taking control of finances isn't as hard as many think.

Related posts

RECENT POSTS

How To Win The Debt, Savings, and Credit Challenge With Proven Tactics for Success.

The DEBT, SAVINGS, AND CREDIT CHALLENGE is a three-step program designed to help you pay off your debt, increase your…

181-Point Credit Score Increase: More Details Inside!

Learn which credit habits to watch out for and avoid costly mistakes that could impact your financial well-being.

How You Can You Save Up to $5,787? Discover the Best Ways to Pay Your Credit Card Bill. Uncover the Advantages Today.

Carrying a balance from month to month can be costly. Discover the advantages of this strategy and start saving today.

Millennial Credit Advisers Debt, Savings, and Credit Challenge: A Winning Three-Step Plan For Paying Off Debt, Increasing Savings, And Improving Credit.

Millions are struggling with debt, savings, and credit and want to make a change. The DEBT, SAVINGS, AND CREDIT CHALLENGE…

Debt Demolition – Unleashing the Potential of the Debt Meltdown Method.

The Debt Meltdown Method is a game-changing approach that can help you achieve financial liberation.

Organize Your Finances: Let’s Declutter Those Financial Closets!

Individuals that successfully organized their finances. Adjusting Habits for Optimal Cash Flow.

Nextgen Financial Literacy: Mastering Money Skills Without The Unnecessary Jargon.

Whether you want to save up for a house, pay off debt, or retire comfortably, having a solid understanding of…

Unlock Your Credit Power: 20 Key Areas to Review Using a Credit Report Review Checklist for Better Comprehension of Your Reports.

As consumers, we want to ensure our credit reports are accurate and up-to-date. That's where a credit report review checklist…

Break Free from Debt: Effective Ways to Achieve Financial Independence.

Debt can feel like an overwhelming mountain to climb, but there are proven strategies to help you break free and…

The Top 12 Credit Report Errors You Should Look For.

Do Credit Reports Have Errors? You may never know if you’re not evaluating, auditing, and reviewing your credit reports!

Achieve Financial Wellness At Work & Home – Millennial Credit Advisers Debt Saving & Credit Challenge.

Many people make resolutions each year to improve their financial wellness, but knowing where to start can be difficult.

How To Earn Extra Money: Top 10 On and Offline Opportunities for Enhanced Income.

Whether you're looking to pay off debts, save for a special purchase, or boost your income, multiple options are available.

RECENT POSTS

How To Win The Debt, Savings, and Credit Challenge With Proven Tactics for Success.

The DEBT, SAVINGS, AND CREDIT CHALLENGE is a three-step program designed to help you pay off your debt, increase your…

181-Point Credit Score Increase: More Details Inside!

Learn which credit habits to watch out for and avoid costly mistakes that could impact your financial well-being.

How You Can You Save Up to $5,787? Discover the Best Ways to Pay Your Credit Card Bill. Uncover the Advantages Today.

Carrying a balance from month to month can be costly. Discover the advantages of this strategy and start saving today.

Millennial Credit Advisers Debt, Savings, and Credit Challenge: A Winning Three-Step Plan For Paying Off Debt, Increasing Savings, And Improving Credit.

Millions are struggling with debt, savings, and credit and want to make a change. The DEBT, SAVINGS, AND CREDIT CHALLENGE…

Debt Demolition – Unleashing the Potential of the Debt Meltdown Method.

The Debt Meltdown Method is a game-changing approach that can help you achieve financial liberation.

Organize Your Finances: Let’s Declutter Those Financial Closets!

Individuals that successfully organized their finances. Adjusting Habits for Optimal Cash Flow.

Nextgen Financial Literacy: Mastering Money Skills Without The Unnecessary Jargon.

Whether you want to save up for a house, pay off debt, or retire comfortably, having a solid understanding of…

Unlock Your Credit Power: 20 Key Areas to Review Using a Credit Report Review Checklist for Better Comprehension of Your Reports.

As consumers, we want to ensure our credit reports are accurate and up-to-date. That's where a credit report review checklist…

Break Free from Debt: Effective Ways to Achieve Financial Independence.

Debt can feel like an overwhelming mountain to climb, but there are proven strategies to help you break free and…

The Top 12 Credit Report Errors You Should Look For.

Do Credit Reports Have Errors? You may never know if you’re not evaluating, auditing, and reviewing your credit reports!

Achieve Financial Wellness At Work & Home – Millennial Credit Advisers Debt Saving & Credit Challenge.

Many people make resolutions each year to improve their financial wellness, but knowing where to start can be difficult.

How To Earn Extra Money: Top 10 On and Offline Opportunities for Enhanced Income.

Whether you're looking to pay off debts, save for a special purchase, or boost your income, multiple options are available.

RECENT POSTS

How To Win The Debt, Savings, and Credit Challenge With Proven Tactics for Success.

The DEBT, SAVINGS, AND CREDIT CHALLENGE is a three-step program designed to help you pay off your debt, increase your…

181-Point Credit Score Increase: More Details Inside!

Learn which credit habits to watch out for and avoid costly mistakes that could impact your financial well-being.

How You Can You Save Up to $5,787? Discover the Best Ways to Pay Your Credit Card Bill. Uncover the Advantages Today.

Carrying a balance from month to month can be costly. Discover the advantages of this strategy and start saving today.

Millennial Credit Advisers Debt, Savings, and Credit Challenge: A Winning Three-Step Plan For Paying Off Debt, Increasing Savings, And Improving Credit.

Millions are struggling with debt, savings, and credit and want to make a change. The DEBT, SAVINGS, AND CREDIT CHALLENGE…

Debt Demolition – Unleashing the Potential of the Debt Meltdown Method.

The Debt Meltdown Method is a game-changing approach that can help you achieve financial liberation.

Organize Your Finances: Let’s Declutter Those Financial Closets!

Individuals that successfully organized their finances. Adjusting Habits for Optimal Cash Flow.

Nextgen Financial Literacy: Mastering Money Skills Without The Unnecessary Jargon.

Whether you want to save up for a house, pay off debt, or retire comfortably, having a solid understanding of…

Unlock Your Credit Power: 20 Key Areas to Review Using a Credit Report Review Checklist for Better Comprehension of Your Reports.

As consumers, we want to ensure our credit reports are accurate and up-to-date. That's where a credit report review checklist…

Break Free from Debt: Effective Ways to Achieve Financial Independence.

Debt can feel like an overwhelming mountain to climb, but there are proven strategies to help you break free and…

The Top 12 Credit Report Errors You Should Look For.

Do Credit Reports Have Errors? You may never know if you’re not evaluating, auditing, and reviewing your credit reports!

Achieve Financial Wellness At Work & Home – Millennial Credit Advisers Debt Saving & Credit Challenge.

Many people make resolutions each year to improve their financial wellness, but knowing where to start can be difficult.

How To Earn Extra Money: Top 10 On and Offline Opportunities for Enhanced Income.

Whether you're looking to pay off debts, save for a special purchase, or boost your income, multiple options are available.

Related posts

The Zero Debt Plan: An Easy Strategy To Save Money And Get Out Of Debt.

Discover the Zero Debt Plan - an easy way to become debt-free and increase your savings.

Debt-Free: Tips for Achieving Financial Freedom.

Dealing with debt is a common issue that can cause anxiety and stress. However, with proper planning and discipline, it…

Cracking the Code: What Your Credit Approval Officer Knows About Your Credit.

Wouldn’t you like to have a clear understanding of what lenders, banks, and non-lenders know about your credit?

Unlock Financial Freedom: Empowering Young Adults to Take Charge.

Take control of your finances easily, uncover practical methods to save, and swiftly grasp an understanding of credit.

Create A Simple Budget. Ultimate Quick Start Guide to Budgeting In Five Easy Steps.

Creating a solid financial foundation is essential for your future. Our simple guide will help you set up your first…

A Cause For Celebration: Millions Of Consumers In The U.S. Are Debt Free – Find Out How?

"Discover the ways millions of Americans have achieved financial freedom by becoming debt-free. Learn how to do it too!"