Empower Your Financial Future: Proven Strategies for Building Wealth After Overcoming Debt. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

- Understanding Wealth Building Post-Debt

- Developing a Diversified Investment Strategy

- Maximizing Retirement Accounts

- Exploring Real Estate Opportunities

- Investing in the Stock Market

- Building an Emergency Fund

- Continuous Financial Education

- Estate Planning and Wealth Preservation

- Frequently Asked Questions

Discover dynamic strategies that help you conquer debt and set you on a path to vibrant wealth-building. Let’s transform your financial landscape together!

Ready to take your financial journey to the next level? Once you’ve tackled your debt, it’s time to shift your focus to building lasting wealth.

Dive into practical strategies that will secure your financial future and empower you to thrive.

Let’s explore how to turn your fresh start into a prosperous tomorrow!

If you recently achieved debt freedom, you may wonder what your next steps should be to secure your financial future. Building wealth can seem like a daunting task, but with the right strategies, it is achievable.

This article will provide critical strategies for building wealth after debt freedom.

The first step to building wealth after achieving debt freedom is understanding what wealth-building means.

Wealth building is the process of creating long-term financial security by accumulating assets, such as investments, real estate, retirement accounts, and other forms of savings.

Understanding wealth-building principles can help you develop a plan to achieve your financial goals.

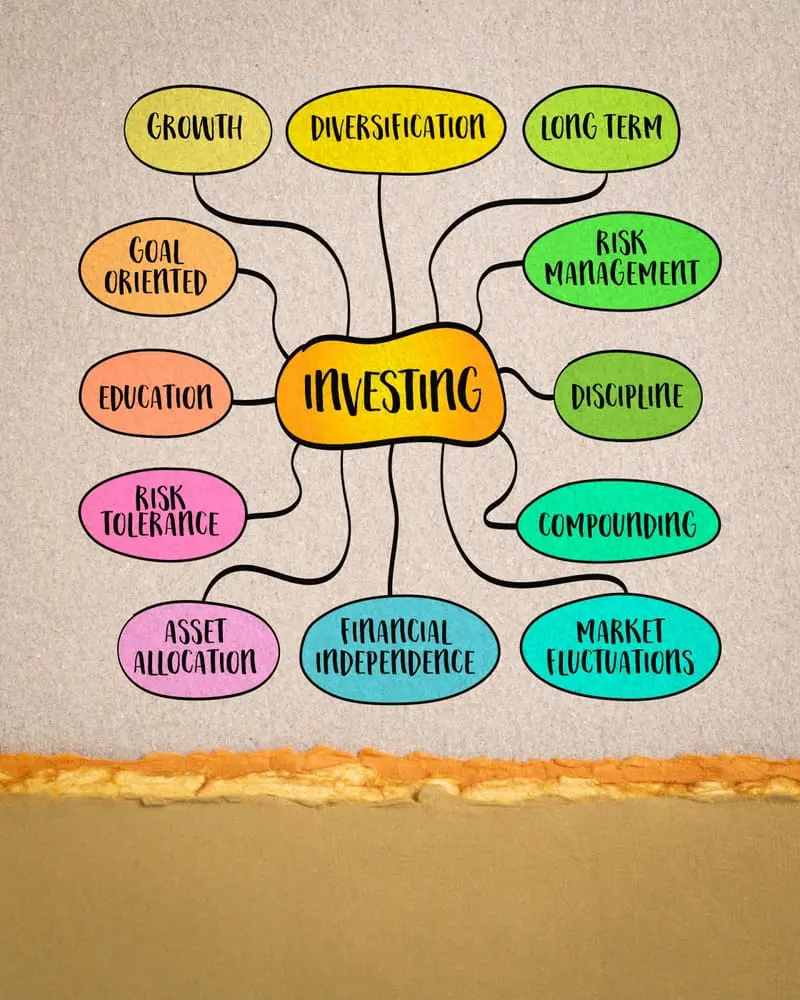

Developing a Diversified Investment Strategy

Developing a diversified investment strategy is one of the most essential strategies for building wealth. This means investing in various assets, such as stocks, bonds, real estate, and other investments.

Diversification helps to spread risk and can help you achieve more consistent returns over time. By developing a diversified investment strategy, you can maximize your potential for long-term wealth building.

Understanding Wealth Building Post-Debt

Assessing Financial Health After Debt

Now that you have achieved debt freedom, it is essential to assess your financial health to determine the best strategies for building wealth.

This involves evaluating your income, expenses, assets, and liabilities. You may need to adjust your budget to accommodate new financial goals and priorities.

You can also use financial tools like net worth calculators and cash flow statements to track your progress.

Setting New Financial Goals

With debt no longer a burden, You can focus on setting new financial goals to build wealth.

These goals may include retirement savings, investing in stocks or real estate, or starting a business. Setting realistic and measurable goals and developing a plan for achieving them is essential.

This may involve seeking the advice of a financial planner or using online resources to learn more about investing and wealth-building strategies.

Understanding how to build wealth after debt requires assessing financial health and setting new financial goals.

Proactively building wealth can secure a brighter economic future for yourself and your family.

Developing a Diversified Investment Strategy

Introduction to Diversification

After achieving debt freedom, developing a diversified investment strategy is the next step toward building wealth. Diversification involves spreading investments across different asset classes to reduce risk and maximize returns. By diversifying your portfolio, you can minimize the impact of market fluctuations and protect your investments from potential losses.

Diversification involves investing in different types of assets, such as stocks, bonds, real estate, and commodities. Each asset class has unique characteristics and behaves differently under various market conditions.

By investing in a mix of assets, you can achieve a balance between risk and reward.

Asset Allocation

Asset allocation divides your investments among asset classes based on risk tolerance and investment goals.

The three main asset classes are equities (stocks), fixed-income (bonds), and cash equivalents (money market instruments).

The proportion of each asset class in your portfolio will depend on your investment objectives, time horizon, and risk tolerance.

Equities are considered high-risk investments but offer the potential for high returns over the long term.

Fixed-income investments, such as bonds, are considered low-risk investments but offer lower returns.

Cash equivalents, such as money market instruments, are low-risk investments that offer low returns but provide liquidity and stability to your portfolio.

To determine the optimal asset allocation for your portfolio, you should consider your investment goals, risk tolerance, and time horizon.

A financial advisor can help you develop a customized investment strategy that aligns with your goals and risk profile.

A diversified investment strategy is essential for building wealth after achieving debt freedom.

You can minimize risk and maximize returns by diversifying your portfolio across different asset classes.

Asset allocation is a critical component of diversification. It involves dividing investments among asset classes based on risk tolerance and investment goals.

Maximizing Retirement Accounts

As someone who has achieved debt freedom, it’s essential to start thinking about building wealth for the future. One of the best ways to do this is by maximizing your retirement accounts. In this section,

I’ll discuss two popular retirement accounts and share some investing strategies.

401(k) Optimization

A 401(k) is a retirement account offered by many employers. It allows you to contribute pre-tax dollars, which means you will only pay taxes on that money once you withdraw it in retirement.

Many employers also offer a matching contribution, which is free money.

To optimize your 401(k), contribute enough to get the full employer match. This is an easy way to maximize your retirement savings without additional effort. From there, consider increasing your contributions to the maximum the IRS allows ($19,500 in 2024).

This will help you take full advantage of the tax benefits of a 401(k) and maximize your retirement savings.

Another 401(k) optimization strategy is to choose a low-cost index or exchange-traded funds (ETFs) for your investments. These funds typically have lower fees than actively managed funds and can help you maximize your long-term returns.

IRA Investment Tactics

Another popular retirement account option is an individual retirement account (IRA). Unlike a 401(k), you open and manage an IRA independently. There are two types of IRAs: traditional and Roth.

With a traditional IRA, you contribute pre-tax dollars like a 401(k). This means you will only pay taxes on that money once you withdraw it in retirement. With a Roth IRA, you contribute after-tax dollars so that you won’t pay taxes on your retirement withdrawal.

To maximize your IRA investments, consider contributing the maximum the IRS allows ($6,000 in 2024). If you’re 50 or older, you can donate an additional $1,000 as a catch-up contribution.

Another strategy for IRA investment is to choose a target-date fund. These funds automatically adjust your asset allocation as you approach retirement, making it easier to manage your investments over time.

Alternatively, you can choose a mix of low-cost index funds or ETFs to build a diversified portfolio.

By maximizing your retirement accounts, you can build wealth for the future and set yourself up for a comfortable retirement. Keep these strategies in mind as you work to achieve your financial goals.

Exploring Real Estate Opportunities

Real estate is a popular investment option for those looking to build wealth. Two primary ways to invest in real estate are direct property investment and real estate investment trusts (REITs).

Direct Property Investment

Direct property investment involves purchasing a property and renting it out to tenants. This can be a lucrative investment strategy, as rental income can provide a steady cash flow stream.

Additionally, the property’s value may appreciate over time, providing a potential source of capital gains.

However, direct property investment requires a significant amount of capital upfront, and managing a rental property can be time-consuming and stressful. It is essential to carefully consider the costs and potential risks before investing in a rental property.

Real Estate Investment Trusts (REITs)

REITs are investment funds that own and manage a portfolio of income-generating real estate properties. Investors can purchase shares in a REIT, which gives them a portion of the income generated by the properties in the fund.

REITs can be a more accessible way to invest in real estate, as they require less capital upfront and do not require investors to manage rental properties themselves.

However, it is essential to carefully research and choose a reputable REIT, as not all REITs are created equal.

Real estate can be a valuable addition to a well-diversified investment portfolio. However, considering the costs and potential risks before investing in real estate, whether through direct property investment or REITs, is important.

Investing in the Stock Market

Investing in the stock market is an excellent way to build wealth over time. However, to maximize returns and minimize risks, it is essential to approach it with a well-thought-out strategy. Here are some stock market investment strategies to consider.

Stock Selection Strategies

When selecting stocks to invest in, conducting thorough research and analysis is crucial to identify companies with solid fundamentals and growth potential. Some popular stock selection strategies include:

- Value Investing: This strategy identifies undervalued companies with solid fundamentals, such as low price-to-earnings ratios and high dividend yields.

- Growth Investing: This strategy involves investing in companies with high growth potential, such as those in emerging markets or with innovative products or services.

- Index Investing: This strategy involves investing in a broad market index like the S&P 500 to achieve broad market exposure and diversification.

Understanding Risk vs. Reward

While investing in the stock market can be lucrative, it also comes with risks. Understanding the relationship between risk and reward and developing a risk management strategy to protect your investments is essential. Some key considerations include:

- Diversification: Investing in various stocks and other assets can help spread risk and minimize losses.

- Asset Allocation: Allocating your investments across different asset classes, such as stocks, bonds, and real estate, can help balance risk and reward.

- Risk Tolerance: Understanding your risk tolerance and investing accordingly can help you avoid making emotional investment decisions that can lead to losses.

By following these stock market investment strategies and understanding the risks involved, you can build wealth and achieve your financial goals over time.

Building an Emergency Fund

As you build your wealth after achieving debt freedom, emergencies can sometimes arise. That’s why it’s essential to have a solid emergency fund.

In this section, I’ll discuss calculating the ideal emergency fund and where to place it for accessibility.

Calculating the Ideal Emergency Fund.

Everyone’s ideal emergency fund is different, but a good rule of thumb is to have three to six months’ worth of living expenses saved up.

To calculate your ideal emergency fund, determine your monthly expenses, including rent/mortgage, utilities, food, transportation, and other necessary expenses.

Depending on your risk tolerance, multiply that number by three to six.

It’s important to note that your emergency fund should be separate from your other savings goals, such as retirement or a down payment on a house.

This ensures that you won’t have to dip into your long-term savings and potentially derail your financial plans if an emergency arises.

Fund Placement and Accessibility

Once you’ve calculated your ideal emergency fund, you must decide where to place it for accessibility. You want to access it quickly and easily in an emergency.

One option is to keep the emergency fund in a high-yield savings account. These accounts offer higher interest rates than traditional savings accounts but allow easy access to funds.

Another option is to keep the emergency fund in a money market account, which offers higher interest rates and easy accessibility.

It’s essential to remember that while investing in your emergency fund may yield higher returns, it also carries more risk. You want to ensure that your emergency fund is easily accessible and not subject to market fluctuations.

By building a solid emergency fund, you can rest easy knowing that you’re prepared for any unexpected expenses that may arise.

Continuous Financial Education

As someone who has achieved debt freedom, it’s essential to continue learning about personal finance and investing to build wealth for the future. Here are a few strategies for continuous financial education:

Keeping Up With Economic Trends

Staying current with economic trends is crucial for making informed investment decisions. Read financial news regularly and monitor market trends. This helps you understand how the economy is performing and which areas may offer investment opportunities.

Leveraging Financial Advisors

Financial advisors can be valuable resources for learning about investing and building wealth. You can find it helpful to work with one who can provide guidance on investment strategies and help you navigate complex financial decisions.

Finding a reputable advisor with a successful track record who shares your investment goals is essential.

By continuously educating yourself about personal finance and leveraging the expertise of financial advisors, you can be confident in your ability to build wealth and secure your financial future.

Estate Planning and Wealth Preservation

As you work towards building wealth after achieving debt freedom, you must consider estate planning and wealth preservation strategies. This will ensure that your assets are protected and your loved ones are taken care of in the event of your passing.

Creating a Will

One of the most critical steps in estate planning is creating a will. A will is a legal document that outlines how assets will be distributed after death. It is essential to update your will regularly and ensure it accurately reflects your current wishes.

When creating a will, it is vital to consider the following:

- Who will be the executor of your estate?

- Who will inherit your assets?

- How will your debts and taxes be paid?

Trust Funds and Inheritance Planning

Another strategy for wealth preservation is setting up a trust fund. A trust fund is a legal arrangement that allows you to transfer assets to a trustee, who will manage the assets on behalf of your beneficiaries.

Trust funds can be used for a variety of purposes, including:

- Providing for minor children or grandchildren

- Protecting assets from creditors

- Minimizing estate taxes

Inheritance planning is also an essential aspect of wealth preservation. This involves creating a plan for how your assets will be distributed to your heirs.

Working with a financial advisor or estate planning attorney can ensure that your assets are distributed tax-efficiently and that your loved ones are cared for after your death.

Estate planning and preservation are essential to building wealth and achieving financial security.

By creating a will, setting up a trust fund, and planning for inheritance, you can protect your assets and provide for your loved ones for years.

Frequently Asked Questions

What are the most effective investment strategies after becoming debt-free?

After achieving debt freedom, focusing on building wealth through smart investments is crucial. The most effective investment strategies include diversifying your portfolio, investing in low-cost index funds, and investing in real estate. Diversifying your portfolio reduces risk and increases returns. Low-cost index funds are a great way to get exposure to the stock market without having to pick individual stocks. Real estate can provide both passive income and long-term appreciation.

How can I maximize wealth growth post-debt freedom?

To maximize wealth growth, it’s important to continue living below your means and saving aggressively. You should also consider increasing your income through side hustles or career advancement. Investing in tax-advantaged accounts, such as a 401(k) or IRA, can also help.

What are the key financial moves to make after paying off all debts?

After paying off all debts, it’s important to establish an emergency fund for 3-6 months of living expenses. You should also focus on building wealth through investments and saving for long-term goals such as retirement. Additionally, you may want to consider consulting with a financial advisor to ensure you are on track to meet your financial goals.

What types of investments should I consider after achieving debt freedom?

After achieving debt freedom, it’s essential to consider a mix of investments that align with your risk tolerance and financial goals. This may include stocks, bonds, real estate, and alternative investments such as private equity or hedge funds.

How do I balance risk and return when building wealth after debt?

Balancing risk and return is crucial when building wealth after debt. When selecting investments, consider your risk tolerance and time horizon. Diversifying your portfolio can also help reduce risk while still providing potential returns.

What are the long-term wealth-building tactics for individuals who are debt-free?

Long-term wealth-building tactics for debt-free individuals include investing in tax-advantaged accounts, such as a 401(k) or IRA, regularly contributing to a diversified investment portfolio, and living below one’s means. It’s also important to periodically review and adjust one’s financial plan to ensure one is on track to meet one’s long-term financial goals.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content: Please view our full AI Use Disclosure.

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.