Crushing Holiday Credit Card Debt – Smart Strategies for Millennials. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

Credit card debt can be overwhelming, especially during the holiday season. Many individuals struggle to manage their finances and are trapped in a debt cycle. This article explores strategies to help young adults tackle their holiday credit card debt.

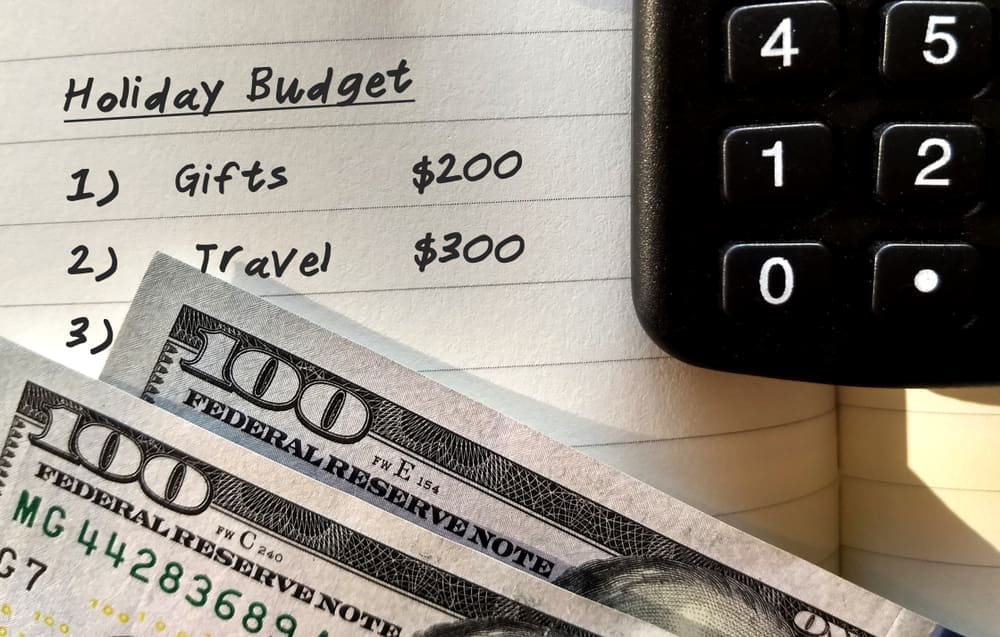

Redefining budgeting habits is crucial for crushing credit card debt. By tracking and categorizing expenses, millennials can clearly understand their spending patterns. This insight allows them to identify areas where they can cut back and allocate more funds towards debt repayment.

Prioritizing debt payments in the budget is another crucial strategy for tackling credit card balances.

Technology can be a powerful ally in managing finances and reducing debt. Various apps and tools help millennials track spending, set financial goals, and negotiate with creditors. By leveraging these resources, young adults can take control of their financial future and work towards eliminating their holiday credit card debt.

Understanding Credit Card Debt Dynamics

Credit card debt can quickly spiral out of control due to high interest rates and minimum payment traps. Many consumers get lured in by rewards programs but carry balances they struggle to pay off.

The Allure and Risks of Rewards Points

Credit card rewards programs offer enticing perks like cash back, travel miles, and sign-up bonuses. These incentives can lead people to overspend. Some consumers justify unnecessary purchases to earn more points.

Reward credit cards often carry higher interest rates. If balances aren’t paid in full monthly, interest charges can quickly outweigh any rewards earned.

Points and miles may also have blackout dates or expire. This can pressure cardholders to make unplanned purchases before rewards disappear.

Consequences of Overspending

Carrying credit card balances month-to-month leads to compounding interest charges. A small initial balance can grow rapidly. Late fees and over-limit penalties add to the debt burden.

High credit card balances negatively impact credit scores. This can make it harder to qualify for loans or get favorable interest rates in the future.

Credit card debt often causes financial stress and anxiety. It can strain relationships and limit life choices as more income goes toward debt payments.

Revamping Budgeting Habits

Changing your budgeting habits can help you tackle credit card debt faster. These strategies focus on controlling spending and tracking expenses to save more money for debt payments.

Setting Spending Limits

Setting clear spending limits is vital to managing credit card debt. Start by reviewing your income and essential expenses. Then, set strict limits for discretionary spending categories like entertainment and dining out.

Use the envelope method to stick to your limits. Put cash for each category in separate envelopes. When the money is gone, stop spending in that area.

Consider using a prepaid debit card with a set balance for non-essential purchases. This prevents overspending and helps build better habits.

Expense Tracking and Categorization

Tracking expenses is crucial for identifying areas to cut back. Use a budgeting app or spreadsheet to record all spending. Categorize each expense to see where the money goes.

Common categories include:

- Housing

- Transportation

- Food

- Utilities

- Entertainment

- Personal care

Review spending weekly. Look for trends and areas to reduce. Small changes add up – cutting $5 daily on coffee saves $150 monthly for debt payments.

Set alerts on your credit cards to notify you when you are nearing category limits. This helps prevent overspending before it happens.

Technology as a Financial Ally

Technology offers powerful tools to help millennials tackle holiday credit card debt. These digital solutions make budgeting easier and assist in negotiations with creditors.

Budgeting Apps and Tools

Learn more about budgeting-friendly apps that can help millennials transform and manage their finances. These apps track spending automatically, categorize expenses, and provide real-time insights.

Popular options include:

- Mint: Syncs with bank accounts and creates custom budgets

- YNAB (You Need A Budget): Uses zero-based budgeting to allocate every dollar

- PocketGuard: Finds ways to lower bills and suggests savings opportunities

Many apps offer features like bill reminders and savings goals. Some even use machine learning to predict future expenses and suggest intelligent financial moves.

Negotiating with Creditors using Tech

Technology can also aid in negotiations with credit card companies. AI-powered tools can analyze credit reports and suggest strategies for lowering interest rates or settling debts.

Key tech-enabled strategies include:

- Debt payoff calculators: Show the impact of different payment plans

- Credit score simulators: Predict how actions will affect credit scores

- AI chatbots: Offer 24/7 support for basic credit inquiries

Some services, like Rocket Money Premium, can help users manage their finances by tracking expenses and optimizing subscriptions with features like their cancellation concierge. These tools empower millennials to take control of their finances and tackle holiday debt more effectively.

Prioritization of Debt Payments

Putting debt payments first can help you get out of credit card debt faster. This strategy focuses on paying more than the minimum and targeting high-interest debts.

Allocating Funds for Debt Reduction

To start, look at your budget and find areas to cut back. Put any extra money toward debt payments. Aim to pay more than the minimum on your credit cards each month.

Consider the snowball method for motivation. Pay off your smallest debt first, then move to the next smallest. This can give you quick wins and keep you going.

Another option is to use any windfalls or extra income for debt payoff. This might include tax refunds, work bonuses, or money from selling items you don’t need.

The Debt Avalanche Method

The debt avalanche method targets high-interest debts first. List your debts from highest to lowest interest rate. Pay the minimum on all debts, but put extra money toward the highest-interest debt.

This method can save you money on interest over time. It may feel slower initially, but it can be very effective for paying off debt.

Use a debt payoff calculator to see how much you could save with this method. Many free tools online can help you plan your debt payoff strategy.

Actionable Steps to Reduce Debt

To crush credit card debt, you need a solid plan. These steps will help you cut expenses and manage your budget more effectively.

Identify Areas for Expense Reduction

Start by reviewing your monthly statements. Look for recurring charges you can eliminate, like unused subscriptions or memberships. Cut back on non-essential spending such as dining out or entertainment.

Consider negotiating bills for services like cable, internet, and phone. Many providers offer discounts if you ask. Shop around for better deals on insurance policies.

Look for ways to reduce grocery costs. Use coupons, buy generic brands, and plan meals around sales. Cook at home more often to save on food expenses.

Explore cheaper transportation options. Carpooling, public transit, or biking can reduce gas and parking costs. Consider selling an extra vehicle.

Effective Budget Management

Create a detailed budget listing all income and expenses.

Use apps or spreadsheets to track spending accurately.

Categorize expenses to see where your money goes each month.

Set up automatic savings to pay yourself first.

Even small amounts add up over time.

Allocate a portion of your income to debt repayment before other expenses.

Use the debt meltdown method to tackle high-interest debt first.

This saves money on interest charges in the long run.

Consider a balance transfer to a card with a lower interest rate.

This can help you pay off debt faster if you stick to a repayment plan.

Review your budget regularly.

Adjust as needed to stay on track with your debt reduction goals.

Closing

Successfully crushing holiday credit card debt begins with a few innovative strategies. We’re sharing a few to help you get started.

- Plan your strategies for tackling credit card balances before you shop.

- Make tracking of expenses and crushing credit card debt payments fun!

- Leverage technology to manage finances and negotiate with creditors

- Implement strategies early to take control of holiday spending and achieve financial freedom.

Credit card debt management involves various strategies and tools.

Young adults can leverage technology, seek professional advice, negotiate with creditors, and adjust their lifestyles to tackle debt effectively.

Side hustles can also provide extra income to accelerate debt repayment.

Frequently Asked Questions

How can young adults use smartphone applications to manage their credit card debts effectively?

Smartphone apps offer powerful tools for tracking expenses and managing credit card debt.

Many apps provide real-time updates on spending habits and alert users when they approach preset limits.

Some apps even offer personalized advice on debt repayment strategies based on the user’s financial situation.

These tools can help young adults stay accountable and make informed decisions about their spending.

By using financial apps, millennials can gain better insights into their financial health and take proactive steps to reduce their credit card debt.

What are the benefits of seeking credit counseling for individuals with high credit card debt?

Credit counseling provides professional guidance tailored to an individual’s financial situation.

Counselors can help create a realistic budget, negotiate with creditors, and develop a personalized debt repayment plan.

They also offer education on financial management skills.

This expert advice can lead to lower interest rates, reduced fees, and a more straightforward path to becoming debt-free.

Credit counseling agencies often have established relationships with creditors, which can be beneficial in negotiating more favorable terms.

What strategies can be employed to negotiate more favorable credit card interest terms?

Negotiating with credit card companies can lead to better interest rates and terms.

Cardholders can start by researching competitive offers from other companies.

They can contact their current card issuer and request a lower rate with this information.

Highlighting a good payment history and long-standing relationships can strengthen the negotiation position.

If the initial request is denied, asking to speak with a supervisor or mentioning balance transfer offers from competitors may help.

Persistence and politeness are essentialin these negotiations.

In what ways can adopting a different lifestyle aid in accelerating the repayment of credit card balances?

Lifestyle changes can free up more money for debt repayment.

This might involve downsizing living arrangements, using public transportation instead of owning a car, or cutting back on non-essential expenses like dining out and entertainment.

Adopting a minimalist lifestyle can help reduce impulse purchases and focus on necessities.

Cooking at home, canceling unused subscriptions, and finding free or low-cost entertainment options can contribute to faster debt repayment.

What role do debt repayment methods like the Avalanche and Snowball techniques play in eliminating credit card debt?

The Avalanche and Snowball methods are popular strategies for tackling multiple credit card debts.

The Avalanche method focuses on paying off the highest-interest debt first, which can save money over time.

The Snowball method targets the smallest balance first, providing psychological wins that can boost motivation.

Both methods require making minimum payments on all debts while putting extra funds toward the targeted debt.

The choice between them often depends on personal preference and financial situation.

How can generating additional income through side gigs contribute to overcoming credit card debt?

Side gigs can provide extra income specifically for debt repayment. The gig economy offers numerous opportunities, from freelance work to rideshare driving.

This additional income can significantly accelerate debt payoff without affecting the primary household budget.

Dedicating all earnings from side gigs to debt repayment creates a clear purpose and can lead to faster results.

Make sure to consider the time investment and potential expenses associated with side gigs to ensure they’re truly beneficial for debt reduction.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content: Please view our full AI Use Disclosure.

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.