Credit Report Management. Your Complete Guide to Building and Maintaining Better Credit Health.

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

- Credit Report Management. Your Complete Guide to Building and Maintaining Better Credit Health.

- Understanding Credit Management

- The Role of Credit Reports in Credit Management

- How to Obtain and Review Your Credit Report

- Credit Management Strategies for a Strong Credit Report

- Advantages of Proactive Credit Management

- Disadvantages and Challenges in Credit Management

- Credit Management Solutions and Resources

- Steps to Dispute Errors on Your Credit Report

- Legal Rights and Protections for Consumers

- Millennial Credit Advisers Key Giveaways

- Frequently Asked Questions

Your credit report really does hold the key to your financial future. It tells lenders, landlords, and sometimes even employers how you handle money and debt.

If you understand what’s in your credit report and know how to manage it, you can score better interest rates, qualify for more loans, and hit your financial goals faster.

Most people don’t check their credit reports until they’re about to borrow money. That habit can lead to surprises—errors, old debts, or even evidence of identity theft.

Taking control of credit management means you stay aware of what shows up on your report and take steps to improve it. It’s a bit like checking your car’s oil before hitting the road—better to catch issues early.

Credit management isn’t just about paying bills on time. It means monitoring your credit report, fixing mistakes, and building habits that set you up for good financial health.

The folks at Millennial Credit Advisers help people make sense of their credit reports and create plans to boost their credit scores. It’s not magic, but it can feel like it when you see your score climb.

Millennial Credit Advisers Giveaways

- Credit reports contain the info lenders use to decide on loans and interest rates.

- Regular monitoring helps you catch mistakes and fraud before they wreck your score.

- Good credit management means understanding your report, disputing errors, and building solid credit habits.

Understanding Credit Management

Credit management means keeping an eye on how you borrow money and pay it back. It covers reviewing credit reports regularly and making smart choices about loans and credit cards.

What Is Credit Management?

Credit management is all about tracking and maintaining your credit profile. You check your credit reports for errors, keep tabs on your credit scores, and make sure bills get paid on time.

Your credit report lists your payment history, current debts, and credit accounts. People who manage credit well review their reports at least once a year and hunt for mistakes that could hurt their scores.

These mistakes might be incorrect late payments or accounts that don’t even belong to you. Understanding how your actions affect your score is a big deal.

If you open too many accounts at once, your score can drop. Keeping credit card balances under 30% of the limit helps keep your score healthy.

Paying on time every month builds a positive payment history. It’s not rocket science, but it does take some attention.

Importance of Effective Credit Management

Effective credit management has a huge impact on your financial opportunities. Lenders use your credit reports and scores to decide if you’ll get approved for loans or what kind of interest rate you’ll pay.

If your credit profile is strong, you get lower rates on mortgages, car loans, and credit cards. On the flip side, poor credit management can cost you thousands more in interest over the life of a loan.

Some employers check credit reports before hiring. Landlords look at your credit before they let you rent.

Regularly checking your credit helps you catch identity theft fast. If someone steals your info and opens accounts, it shows up on your report.

Spotting these issues quickly limits the damage. Services at Millennial Credit Advisers help you understand your report and fix errors that hurt your score.

The Role of Credit Reports in Credit Management

Credit reports are the backbone of credit management, providing a record of your borrowing history and payment habits, and helping you track expenses and understanding how these reports work enables you to make better financial decisions and keep your credit profile healthy.

Definition of a Credit Report

A credit report is a detailed document that tracks your credit history and financial habits over time. Credit reporting companies gather this info and share it with lenders, employers, and other organizations.

It covers where you live, how you pay your bills, and if you’ve faced legal actions like bankruptcy. The three big players—Equifax, Experian, and TransUnion—each create their own version, and sometimes the details don’t match perfectly.

Lenders use these reports to decide if they’ll give you a loan or a credit card. They also use them to set your interest rates and credit limits.

What’s in your report can make or break your chances of borrowing money, finding a place to rent, or even landing certain jobs. It’s wild how much weight these documents carry.

Key Components of a Credit Report

A credit report has several main sections that together show your financial responsibility. The personal info section lists your name, address, Social Security number, and birthdate.

The main components include:

- Account information – Details about credit cards, loans, and payment history

- Payment history – Records of on-time and late payments

- Credit inquiries – Companies that have checked your report

- Public records – Bankruptcies, tax liens, court judgments

- Collections – Accounts sent to collection agencies

The account section shows each credit account, the type, when it opened, your limit, and the balance. Payment history reveals if you paid bills on time or not, and this section really matters for your score.

Credit inquiries appear anytime you apply for new credit. Too many in a short time can make you look financially stressed.

Public records and collections show serious problems, and lenders don’t like seeing those.

How Credit Reports Affect Credit Management

Credit reports shape your credit management strategies and financial options. Your credit history helps you decide when to apply for credit and how to handle your accounts.

Lenders check your report before approving mortgages, car loans, and credit cards. If your report shows you pay on time, you’ll get better rates. If it shows late payments or collections, expect higher rates or even denials.

You need to monitor your credit reports regularly for mistakes or unauthorized activity. You can get free credit reportsto spot errors that could drag down your score.

Finding and fixing mistakes improves your credit profile. The report also helps you decide when to apply for new credit and which accounts need work.

If your credit cards are maxed out, your report will show it, and you can make a plan to pay them down. These reports help you track progress toward your financial goals, too.

Professional services like Millennial Credit Advisers use credit reports to build strategies for improving your credit and reaching your financial objectives.

How to Obtain and Review Your Credit Report

Knowing where to get your credit report and how to read it helps you take charge of your credit health. These steps really are the foundation of good credit management.

Where to Access Your Credit Report

You can get free credit reports from three major bureaus: Equifax, Experian, and TransUnion. The official site for free annual credit reports lets you request your reports with no fees.

Main Options for Accessing Credit Reports:

- AnnualCreditReport.com – The only federally authorized source for truly free reports

- Individual Bureau Websites – Equifax, Experian, and TransUnion offer free weekly reports

- Credit Monitoring Services – Companies like Credit Karma give you free access to reports from two bureaus

You can request reports online, by phone, or by mail. You don’t have to order all three at once.

Lots of people spread out their requests so they can check in more often. The federal government guarantees you one free report from each bureau every 12 months, and some states offer even more.

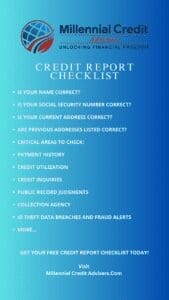

Step-by-Step Guide to Reviewing Credit Reports

Reading your credit report takes a bit of focus, but it’s worth it. Each section tells you something important about your credit history and habits.

Personal Information Section

This part lists your name, address, Social Security number, and birthdate. Double-check that every detail matches your records. Wrong info here could mean identity theft or mixed-up files.

Account History Section

Here you’ll see all your credit accounts—credit cards, loans, mortgages. Each entry shows the account type, balance, payment history, and status. Late payments show up here and stick around for seven years.

Credit Inquiries Section

Hard inquiries pop up when lenders check your credit for loan applications. Too many in a short period can lower your score. Soft inquiries from background checks don’t affect your score.

Public Records and Collections

Bankruptcies, tax liens, and accounts sent to collections appear here. These items hit your score hard and stay visible for seven to ten years.

Look for errors like accounts you don’t recognize, wrong payment statuses, or outdated negative items. Getting regular credit reports helps you catch mistakes fast.

If you spot errors, dispute them with the credit bureaus. Getting these fixed can give your score a real boost.

Credit Management Strategies for a Strong Credit Report

Building a strong credit report takes steady effort and some smart choices. It all starts with positive habits, tackling negative marks the right way, and keeping debt under control.

Establishing Good Credit Habits

Payment history is the biggest chunk of your credit score. Pay on time, every month—there’s just no substitute for that.

Automatic payments can be a lifesaver if you tend to forget due dates. They’ll help you avoid those late fees and dings on your report.

Keeping credit accounts open builds a longer history. Even if you’re not using a card, it adds to your total account age.

Closing old accounts can backfire by shrinking your available credit and shortening your credit history. Sometimes, it’s better to let those old cards quietly boost your profile.

Key habits to establish include:

- Paying all bills by their due dates

- Keeping credit card balances low

- Reviewing credit reports regularly for errors

- Limiting new credit applications

Diversifying your credit types gives your profile extra strength. Lenders like to see you can handle credit cards and installment loans (like a car loan) at the same time.

Understanding credit management strategies really pays off when you’re making those big financial calls.

Handling Negative Information

Negative marks on your credit report can slam the brakes on your goals. If something’s wrong, file a dispute—credit bureaus have to check it out within 30 days and remove it if they can’t prove it’s legit.

Late payments stick around for seven years, but their bite fades as you stack up more on-time payments. Lenders care more about what you’ve done lately than old slip-ups.

Fixing errors and removing negative items means learning the dispute process, which isn’t as scary as it sounds.

Some negative marks need special handling:

- Collections: Try to negotiate a pay-for-delete before you pay

- Charge-offs: After settling, ask for a goodwill deletion

- Bankruptcies: Sometimes, you just have to wait it out and rebuild

- Inquiries: These fall off after two years, so don’t sweat them too much

Writing a goodwill letter to your creditor can sometimes get a legit negative mark removed. It works best if you’ve got a solid payment history and a decent reason for missing that one time.

Optimizing Credit Utilization

Credit utilization is just how much of your available credit you’re using. Staying under 30% is good, but under 10% is even better if you can swing it.

Paying down balances fast is the quickest way to lower your utilization. Try making a couple of payments each month to keep those reported balances low.

Most credit card companies report your balance on the statement closing date, not the due date. That timing can catch you off guard if you’re not watching.

Asking for a credit limit increase can help your utilization, but only if you don’t start spending more. Higher limits don’t help if you run them up again, right?

| Utilization Rate | Impact on Score |

|---|---|

| Under 10% | Excellent |

| 10-30% | Good |

| 30-50% | Fair |

| Over 50% | Poor |

Spread your charges across more than one card to keep any single card’s utilization low. Even if your spending goes up, this trick keeps your profile looking healthy.

Implementing credit management best practices is one of those things that pays off for years, not just months.

Advantages of Proactive Credit Management

Taking charge of your credit management really does open doors. People who keep an eye on their credit reports and work to improve them get better lending terms and more financial stability. That’s just how it works.

Improved Loan and Mortgage Approvals

Lenders always check your credit before approving loans or mortgages. A steady, on-time payment history and responsible borrowing habits show you’re someone they can trust.

If you’ve got strong credit management, you’ll usually have fewer negative marks on your report. Paying bills on time and keeping balances low says a lot about your reliability.

When it’s time for a mortgage, credit management matters even more. Lenders look at every detail, and even one late payment can make or break your approval.

Folks who stay proactive with their credit portfolio show up as low-risk borrowers. That opens up financing options you might not have thought possible.

Access to Better Interest Rates

Interest rates can make or break your finances over time. Lenders reserve their best rates for people with clean credit reports and high scores.

If your score is above 740, you could get an interest rate way lower than someone with a score under 620. On a $300,000 mortgage, that could mean saving over $100,000 in interest. Wild, right?

Credit card companies look at your report, too, when they set your APR. Manage your credit well, and you’ll snag cards with lower interest rates—even if you carry a balance sometimes.

Auto loans, personal loans, business credit—it’s the same story. Better credit saves you money, and that’s money you can use for other goals instead of throwing it at interest.

Enhanced Financial Security

Good credit gives you a safety cushion when life throws a curveball. You’ll have more options for emergency loans or credit lines if something unexpected pops up.

A solid credit report gives you leverage when you negotiate. You can shop around, compare offers, and get better terms without feeling desperate.

Some employers check credit reports, especially in finance or government. A well-managed credit history could tip the scales in your favor during hiring.

Insurance companies in some states use credit-based scores to set your premiums. If you play your cards right, you could pay less for auto or homeowners insurance year after year.

Disadvantages and Challenges in Credit Management

Credit management isn’t all sunshine and roses. There are plenty of real-world obstacles that can trip up even the best-intentioned folks and businesses.

Knowing these challenges can help you dodge costly mistakes and avoid bad decisions before they snowball.

Potential Risks and Pitfalls

Credit management comes with serious risks. Bad debt is a big one—it’s what happens when customers just don’t pay, and that hits profits and cash flow hard.

Data quality is another headache. If your credit report has mistakes or old info, you might make the wrong call on lending or borrowing. Traditional credit scores can’t always tell the whole story.

When the economy tanks, credit risk jumps across the board. Suddenly, lots of customers default at once, and even strong credit teams can get overwhelmed.

Tech isn’t foolproof, either. System crashes or cyberattacks can put your financial data at risk. Keeping your tools updated and secure is a never-ending job.

Regulations keep changing, too. New rules mean more compliance work, and falling behind can bring fines or damage your reputation.

Common Credit Management Mistakes

Businesses make a lot of avoidable mistakes with credit risk management. Weak or vague credit policies are at the top of the list.

Departments that don’t talk to each other make things worse. Sales might want easy credit terms, while finance worries about risk. That tug-of-war causes messy decisions.

Some companies forget to check in on existing accounts. They focus on new customers but miss warning signs from the ones they already have. Payment habits change, and you’ve got to stay alert.

Relying only on automated systems is risky. Data is great, but sometimes you need a human touch and some gut instinct to make the right call.

Putting too much credit into one customer or industry is dangerous. If they go under, you could take a huge hit. For stronger credit management, check out https://millennialcreditadvisers.com/ for real-world advice.

Credit Management Solutions and Resources

If you want to manage credit well, you’ll need the right tools and some solid advice. Professional services, online platforms, and educational resources can help you get a grip on your financial health—no matter where you’re starting from.

Professional Credit Counseling

Credit counseling agencies offer personalized guidance to folks dealing with debt or credit headaches. These organizations have certified counselors who dig into your finances and come up with a custom action plan.

Counselors help you break down your credit report, build a realistic budget, and even talk to your creditors for you. They’ll walk you through what’s really going on with your money—sometimes it’s not as bad as it looks, other times, well, it might be worse.

Many nonprofit credit counseling services charge little or nothing for a basic consultation. They can set up debt management plans that roll all your payments into one monthly chunk.

Your counselor works with your creditors to try and get those interest rates down or maybe even have a few fees dropped. It’s not magic, but it can really help take the pressure off.

Benefits of credit counseling include:

- Objective analysis of financial situations

- Education on credit management best practices

- Support during challenging financial times

- Access to debt management programs

Before signing up, check that your counselor’s legit and certified by a recognized group. The National Foundation for Credit Counseling and the Financial Counseling Association of America both accredit trustworthy agencies.

Online Tools and Calculators

Digital resources have made credit management way more accessible. Credit management software lets you track spending, monitor your credit score, and set goals.

These platforms usually sync with your bank accounts, so you get real-time updates on your financial activity. It’s kind of addicting to watch those numbers change.

Popular online tools include:

- Credit score simulators that show how different actions might impact your score

- Debt payoff calculators that map out how long it’ll take to get debt-free

- Budget trackers that sort your expenses automatically

- Payment reminder systems so you don’t miss due dates

Most banks and credit card companies now offer free credit monitoring for their customers. These tools send alerts if something changes on your credit report or if there’s suspicious activity.

Mobile apps make it super easy to check your credit info wherever you are. You don’t have to wait for a paper statement anymore.

Relevant Articles on Credit Management credit report, https://millennialcreditadvisers.com/

Millennial Credit Advisers shares educational content about credit management and credit reports. The site covers everything from understanding your score to fixing errors on your report.

You’ll find step-by-step guides for improving your credit health. There’s a focus on making things clear, especially for younger adults who might be building credit for the first time.

Articles break down how your financial decisions can impact your score over time. They keep the language simple; nobody needs a finance degree to understand what’s going on here.

Key giveaways from credit management resources:

- Understanding Your Credit Report Components

- Strategies for Raising Credit Scores Quickly

- How to Dispute Credit Report Errors

Visitors to Millennial Credit Advisers can dig into info about credit laws and consumer rights. The site updates content regularly, so you’re not getting advice that’s out of date.

Steps to Dispute Errors on Your Credit Report

Mistakes on your credit report can drag down your score and even lead to loan denials or higher rates. Knowing how to spot errors and file disputes helps you protect your financial health.

Identifying Incorrect Information

Start by grabbing your credit reports from all three big bureaus: Equifax, Experian, and TransUnion. You can get one free report per year from each, so don’t let that go to waste.

Go through each report and look for common errors. Watch for things like:

- Wrong personal info—misspelled names, old addresses, or the wrong Social Security number

- Accounts that aren’t yours—could be identity theft, could be a typo

- Duplicate accounts—same debt showing up twice

- Incorrect account status—closed accounts listed as open, or vice versa

- Wrong payment history—late payments you know you made on time

- Incorrect credit limits or balances—showing you owe more than you really do

Check payment dates, balances, and credit limits against your own records. Bank statements and receipts can back you up if you spot something off.

Circle or highlight each error and jot down exactly what’s wrong. The Fair Credit Reporting Act says you have the right to dispute anything inaccurate. The more documentation you have—receipts, cancelled checks, account statements—the stronger your case.

How to File a Dispute

Contact both the credit bureau that’s reporting the error and the company that gave them the info. It’s best to send your dispute in writing, not by phone, so you have a paper trail.

Your dispute letter should spell out what’s wrong and why. Ask them to fix or remove the bad info.

Include these in your dispute letter:

- Your full name and current address

- Each disputed item with a short explanation

- Copies of documents that support your claim

- A copy of your credit report with the errors circled

Send the letter by certified mail with return receipt requested, so you know they got it. Keep copies of everything you send.

Credit bureaus usually have 30 days to look into your dispute. They’ll check with the company that reported the info. If the company can’t verify it, or if it’s wrong, the bureau has to fix or delete it.

Send a separate dispute letter to the creditor, too. That way both sides know you’re on top of it.

Monitoring Dispute Outcomes

After you file a dispute, the credit bureau will send you a written response within the investigation period. They’ll tell you if they changed, deleted, or kept the info as is.

If your dispute leads to changes, the bureau should give you a free updated copy of your credit report. You can ask them to let the other two bureaus know about the fix, too.

Check all three reports to make sure the changes show up everywhere. Sometimes an error pops up on one report but not the others.

If your dispute gets denied, here’s what you can do:

- Ask for the investigation results and their reasoning

- Get the name and contact info of the company that reported the info

- Send in more documentation if you have it

- Add a statement of dispute to your report

- Reach out to Millennial Credit Advisers if you want professional help

If the bureau insists the info is correct but you still disagree, you can add a short statement to your file. That way, anyone who pulls your report sees your side of the story.

Keep checking your credit reports after a dispute, just in case the wrong info shows up again. If it does, file another dispute and mention that you’ve already had it corrected once.

Legal Rights and Protections for Consumers

Consumers have some real legal muscle when it comes to their credit reports and personal financial information. Federal laws spell out how credit information can be collected, shared, and used by businesses and credit bureaus.

Fair Credit Reporting Act Overview

The Fair Credit Reporting Act protects your credit information. You’ve got the right to see your credit reports and dispute anything that looks off.

Credit bureaus have to investigate disputes within 30 days and remove anything they can’t verify. The law also limits who can peek at your credit—only businesses with a legit reason, like lenders, landlords, employers, and insurance companies.

You can get one free credit report each year from the big three bureaus. Bad stuff like late payments can only stick around for seven years, while bankruptcies can last up to 10.

If a company denies you credit or charges you more based on your report, they have to let you know. That’s fair, right?

How to Use .gov and .edu Resources

Government and educational sites are goldmines for info on credit management and consumer rights. The Consumer Financial Protection Bureau has free guides and tools for understanding your credit report.

Their site walks you through how to dispute errors and file complaints against credit bureaus. The Federal Trade Commission also offers resources on identity theft and credit protection, plus steps for freezing your credit or recovering from fraud.

Universities sometimes publish research about copyright and consumer financial literacy on their .edu sites. These resources are usually unbiased and aren’t trying to sell you anything.

Official sources like these help you double-check info you find elsewhere. They also give you contact details if you ever need to file a complaint or report a company that’s breaking the rules.

Millennial Credit Advisers Key Giveaways

Credit management is about knowing how to watch your financial standing and improve it—by reviewing your credit report and planning smartly. These habits help you keep a strong credit profile and make better choices for your financial future.

Building and Maintaining a Healthy Credit Score

Keeping a healthy credit score really comes down to your everyday habits. Making payments on time matters most—payment history actually makes up about 35% of your score.

Try to keep your credit utilization below 30% of your available limit. Lenders want to see you can handle your credit without maxing out cards.

Lower utilization usually means better scores. It’s not always easy, but it’s worth it.

Key actions for score improvement:

- Pay all bills by their due dates

- Keep credit card balances low

- Avoid closing old credit accounts

- Limit new credit applications

The age of your credit accounts matters, too. If you can, hang onto your first credit card—older accounts show a longer history of how you handle money.

Mixing up your credit types helps as well. Having both credit cards and installment loans shows you can juggle different kinds of financial responsibilities.

Benefits of Regular Credit Report Reviews

Checking your credit report regularly helps you spot mistakes and catch fraud before it gets out of hand. The three main bureaus—Experian, Equifax, and TransUnion—collect and share your financial data with lenders.

Checking reports regularly provides these advantages:

- Early detection of identity theft

- Identification of reporting errors

- Tracking of credit score progress

- Understanding of factors affecting credit

Errors on credit reports happen more than most folks realize. Wrong account info, incorrect payment statuses, or old negatives can unfairly drag down your score.

If you spot a mistake, dispute it with the bureaus—they’ll remove what doesn’t belong. You’ve got to be proactive, but it pays off.

Monitoring your report also helps you catch identity theft fast. If you see accounts or inquiries you don’t recognize, someone might be using your info. The sooner you act, the less damage they can do.

Your credit report makes it clear what’s helping or hurting your score. That info guides where you need to focus next.

Effective Use of Credit Management Tools

Credit management tools give you a way to track your credit and make improvements. You’ll find monitoring, score simulators, and lots of educational resources on these platforms.

Many of these tools send alerts when something changes on your report. Maybe a new account shows up or a balance shifts—getting notified quickly means you can react right away.

Some services monitor all three bureaus, others just one. Going for the full package gives you the clearest picture of your credit status.

Score simulators let you play around with “what if” scenarios. Want to see what happens if you pay off a card or open a new account? It’s a handy way to plan your next move.

Budget tracking features can help you keep spending in check and make sure bills get paid. Linking your bank accounts and cards gives you a better sense of your money flow. Honestly, better budgeting usually leads to stronger credit over time.

Frequently Asked Questions

Credit reports are packed with info that can shape your financial future. If you know how to read them, verify details, and dispute what’s wrong, you’re way ahead in managing your credit.

What are the key components of a credit report for effective credit management?

Credit reports have four main sections lenders look at. First, you’ll see personal info—names, addresses, Social Security numbers, and job history. This just helps confirm your identity; it won’t change your score.

Credit accounts take up the most space. These include credit cards, mortgages, car loans, and student loans. Each account lists when it opened, the credit limit or loan amount, current balance, and payment history.

Next up: credit inquiries. Hard inquiries pop up when you apply for credit. Soft inquiries happen when you check your own report or get a pre-approved offer.

Public records and collections come last. Think bankruptcies, tax liens, civil judgments, and accounts sent to collections. These can stick around for seven to ten years, depending on what they are.

How can individuals ensure their credit reports are accurate and up-to-date?

Request your free credit reports from all three bureaus every year at AnnualCreditReport.com. Federal law gives you one free report per bureau, per year.

If you stagger your requests every four months, you’ll be able to keep a closer eye on things. Check your reports carefully for mistakes—like accounts you don’t recognize or wrong payment statuses. It’s surprising how many people find errors.

Setting up fraud alerts or credit freezes adds another layer of safety. Fraud alerts make lenders double-check your identity before opening new accounts. Credit freezes block anyone from accessing your report unless you say so.

Monitoring services from Millennial Credit Advisers can send you updates and alerts about changes to your report. You’ll know right away if something new pops up.

What steps should one take if they find inaccuracies in their credit report?

If you spot an error, start by gathering evidence—account statements, payment receipts, court docs, even screenshots. The more proof, the better.

File a dispute with the bureau as soon as possible. They’ve got 30 days to look into it. The bureau will contact the creditor and ask them to verify the info.

You can also go straight to the creditor that reported the mistake. Send a letter with your evidence to the address on your report. They need to investigate and respond within 30 days, too.

If nobody fixes the problem, you can add a statement to your credit report explaining your side. Lenders will see it when they check your report.

If the bureaus or creditors ignore valid disputes, it might be time to get legal help. The Fair Credit Reporting Act is on your side. Attorneys who know credit law can push for corrections and, if needed, go after damages.

How do credit reports influence credit management strategies?

Your credit report lays out your spending patterns and debt levels. If you’re carrying high balances, especially across several cards, it’s time to pay down debt. Keeping utilization under 30% almost always gives your score a lift.

Payment history on the report shows you which accounts need your attention first. Late payments? Make those a priority. Setting up autopay can help you avoid missing more in the future.

The types of credit you have matter, too. Lenders like to see a mix—credit cards and installment loans. If you only have one type, maybe consider diversifying just a bit.

Account age is another factor. Older accounts boost your credit history length. Closing old cards can actually hurt your score, even if you rarely use them.

Finally, look at your inquiry data. Too many hard inquiries in a short time can ding your score. If you’re planning big purchases, try to space out your applications.

What are the best practices for monitoring and improving one’s credit score?

Pay your bills on time—every time. Payment history is the single biggest factor in your score. Even one late payment can drop your score by 100 points or more, which is rough.

Work on lowering your credit card balances. Focus on paying off the cards with the highest utilization first for the fastest score bump. Some folks pay multiple times a month to keep their reported balances low.

Try not to apply for new credit unless you really need it. Each hard inquiry can knock your score down a few points. If you can, wait at least six months between applications to let your score recover.

Becoming an authorized user on someone else’s well-managed account can give your score a boost. The primary account holder’s good payment history will show up on your report. It only works if they’re keeping things in good shape, though.

If you find negative items that are outdated, dispute them. Sometimes creditors don’t respond to verification requests, and if they don’t act within 30 days, the bureaus have to remove the item.

Working with pros at Millennial Credit Advisers can make a big difference. They’ll look at your unique situation and come up with a plan that fits your needs.

Can a credit report affect financial opportunities, and how can one mitigate negative impacts?

Credit reports play a huge role in whether you get approved for mortgages, car loans, and credit cards. Lenders look at your score and use it to set your interest rates.

Honestly, just a 100-point difference in your score can cost you thousands in extra interest over time. It’s wild how much that adds up.

Some employers—especially in finance or jobs handling money—check credit reports during hiring. Not every state allows this, but many do, though a few limit how companies can use that information.

Landlords almost always review credit reports before renting to someone. If you’ve got several late payments or collections, you might get rejected or asked for a bigger deposit.

Insurance companies often use credit-based scores when setting your auto or home premiums. In some cases, poor credit can hike your premiums by 50% or more.

Keeping your credit in good shape can save you a surprising amount on insurance. It’s not just about loans.

Utility companies—think phone, electric, gas—usually check your credit before turning anything on. If your credit’s not great, they might require a hefty deposit upfront.

But with good credit, you can usually skip those extra costs. It’s one of those perks people don’t talk about enough.

If you’ve got negative marks, writing a letter of explanation sometimes helps. Say you had medical debt, a divorce, or lost your job—lenders might actually consider that if you include documentation with your application.

Secured credit cards and credit-builder loans can help you rebuild after tough times. These tools report to the credit bureaus and show you’re handling things better now.

Usually, a year of on-time payments makes a real difference. After that, you might qualify for better products.

If you’re feeling overwhelmed, getting professional help from services like Millennial Credit Advisers could speed up the process. They’ve seen it all and know which strategies work fastest for real people.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We do not offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized guidance. Track your progress for an improved credit journey.

Written content – “Please view our complete AI Use Disclosure.”

We enhance our products and advertising by using Microsoft Clarity to understand how you interact with our website. Using our site, you agree that we and Microsoft can collect and utilize this data. Our privacy policy provides further details.