50/30/20 Budget Rule. A Simple Framework for Managing Your Money and Building Wealth. FIND OUT MORE IN OUR LATEST ARTICLE!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

- 50/30/20 Budget Rule. A Simple Framework for Managing Your Money and Building Wealth. FIND OUT MORE IN OUR LATEST ARTICLE!

- What Is the 50/30/20 Budget Rule?

- How the 50/30/20 Budget Rule Works

- Detailed Breakdown of Budget Categories

- Step-By-Step Guide to Implementing the 50/30/20 Budget Rule

- Advantages of the 50/30/20 Budget Rule

- Disadvantages and Limitations

- Real-Life Applications and Case Studies

- Adapting the 50/30/20 Budget Rule for Different Lifestyles

- Tools and Resources for Managing Your Budget

- How the 50/30/20 Budget Rule Compares to Other Budgeting Methods

- Common Mistakes to Avoid When Using the 50/30/20 Budget Rule

- Key Giveaways

- Frequently Asked Questions

Managing money sometimes feels like a losing battle, right? Bills show up, paychecks vanish, and suddenly you’re left wondering where it all went.

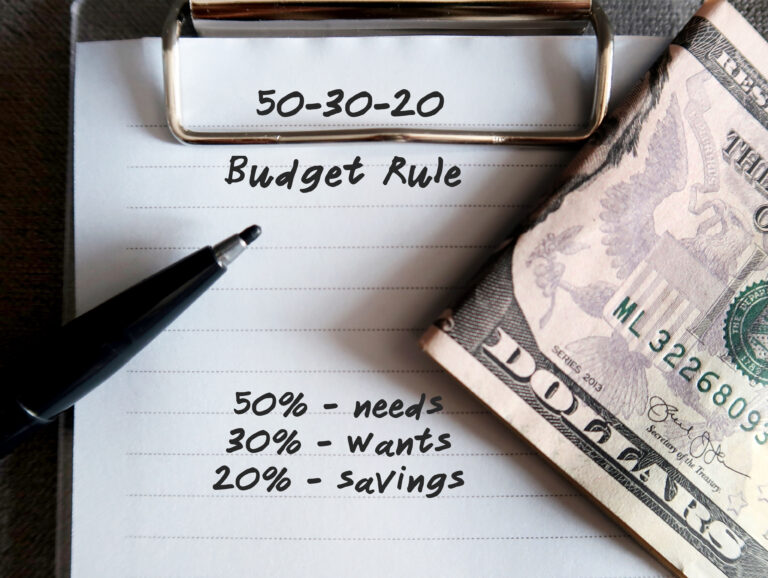

Plenty of us struggle with knowing how much to spend or save each month. The 50/30/20 budget rule gives you a straightforward way to split your after-tax income: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

This method caught on because it takes the stress out of budgeting. Instead of tracking every coffee or impulse buy, you just follow the percentages.

It works for lots of different incomes and adapts as your life changes.

The 50/30/20 budget rule helps people achieve financial freedom by balancing what they need now with their future goals. Cover your basics first, then enjoy some flexibility, but always keep savings in mind.

This system makes saving feel automatic, helping you build up an emergency fund or chip away at debt without overthinking it.

Millennial Credit Advisers Takeaways

- The 50/30/20 rule splits income into three parts: half for needs, 30% for wants, and 20% for savings

- This budgeting method simplifies money management without requiring detailed expense tracking

- The rule adapts to different income levels and life stages while building financial security

What Is the 50/30/20 Budget Rule?

The 50/30/20 budget rule splits your after-tax income into three buckets: 50% for needs, 30% for wants, and 20% for savings and debt repayment. It’s a way to organize your money without obsessively tracking every dollar.

Core Principles Explained

The 50/30/20 budgeting method divides your net income into three main purposes. Each one matters for a different reason.

The three categories include:

- 50% for needs – Rent, utilities, groceries, insurance, and minimum debt payments

- 30% for wants – Stuff you enjoy but don’t need, like dining out, hobbies, and streaming services

- 20% for savings – Emergency funds, retirement, investments, and paying extra on debts

Net income is what you actually take home after taxes and deductions. If you bring in $4,000 after taxes, aim for $2,000 for needs, $1,200 for wants, and $800 for savings.

The rule puts basic living costs first, but lets you spend enough on fun stuff to avoid feeling deprived. That last chunk goes toward financial security and future goals.

Historical Background

Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, introduced this budgeting framework in their 2005 book, “All Your Worth: The Ultimate Lifetime Money Plan.”

They wanted a simple system to help working families balance today’s needs with tomorrow’s stability.

The idea came from research into why middle-class families struggle or go bankrupt. Warren saw that most people weren’t reckless—they just didn’t have a clear plan for their money.

This rule took off because it felt like a breath of fresh air compared to complicated, nitpicky budgets. Instead of a dozen categories, you just have three.

Financial educators and advisors quickly adopted the framework. It’s now a go-to starting point for anyone new to financial planning.

Why the 50/30/20 Budget Rule Is Popular

The 50/30/20 rule provides a practical framework for balancing enjoying life now with building financial security for later. It’s easy to understand and doesn’t require a finance degree to use.

People like that it doesn’t force them to track every penny. You can spend your wants money however you want, as long as you stay within your 30% slice.

It works for just about any income. Whether you earn $3,000 or $10,000 a month, the percentages adjust to fit your situation.

Setting aside 20% for savings happens automatically. You don’t have to decide every month—it’s just part of the routine.

There’s also wiggle room. If you want to spend more on rent and less on transportation, you can, as long as your needs add up to 50% overall.

How the 50/30/20 Budget Rule Works

The 50/30/20 budget rule splits your after-tax income into three categories. Each one plays a role in keeping your finances balanced and your future secure.

Understanding the 50% Needs Category

The biggest chunk—50%—goes to needs. These are things you can’t really skip, like rent or mortgage, utilities, groceries, insurance, and minimum debt payments.

These bills usually aren’t optional. If you stop paying rent or buying food, you’ve got bigger problems.

Housing is often the largest piece here. For a lot of people, rent or mortgage alone eats up 30–40% of their income.

Healthcare, car payments (if you need a car for work), and basic clothing also count as needs. Ask yourself: If I cut this, would it mess up my health or job?

If your needs regularly take more than 50%, it might mean your housing costs are too high, or perhaps you need to look for more income. Folks in expensive cities sometimes struggle to keep needs at half their income.

Allocating 30% to Wants

Wants are the fun stuff—not essential, but they make life better. This 30% covers eating out, streaming services, hobbies, travel, gym memberships, and shopping for things you want.

Sometimes the line between needs and wants gets fuzzy. Groceries are a need, but fancy specialty foods? That’s a want.

Cable TV, concerts, and premium subscriptions go here. You could cut these and still get by just fine.

This part of your budget keeps things enjoyable. If you cut wants entirely, budgeting would feel like punishment.

If your wants keep climbing past 30%, savings might take a hit or debt could pile up. Watching this category can be eye-opening—sometimes you don’t realize how much goes to little extras.

Dedicating 20% to Savings and Debt Repayment

The last 20% is all about your future—building security and knocking out debt beyond the minimums. This includes emergency savings, retirement accounts, investments, and paying off credit cards or student loans faster.

Most experts say start with an emergency fund. Try to save enough to cover three to six months of expenses if you can swing it.

Retirement contributions, especially if your job matches part of it, are a huge win. Even small amounts add up over time thanks to compounding.

Extra payments on high-interest debt save you money and help you get out of debt sooner. Credit cards with big interest rates? Pay those down first if possible.

This category really builds your long-term financial health. Without savings and debt reduction, one surprise expense could throw your whole budget off.

Detailed Breakdown of Budget Categories

The 50/30/20 rule divides income into three parts, but it helps to know exactly what each part covers. Each category has its own reason for being there in your financial plan.

What Qualifies as Needs?

Needs are the bills you have to pay to keep life running and meet your basic responsibilities. Rent or mortgage payments are obvious needs. Utilities like electricity, water, gas, and even internet count, since modern life basically requires them.

Groceries for cooking at home are needs, but eating out is not. Transportation to work—car payments, gas, insurance, or a bus pass—all count as needs. Health insurance premiums and necessary medical care belong here too.

Minimum payments on credit cards, student loans, or other debts are needs. Basic work and everyday clothing are needs, but designer brands aren’t. Childcare that lets you keep working is also essential.

Examples of Wants in Your Budget

Wants are the things you pick because they make life nicer, not because you need them. Streaming services like Netflix, Hulu, or Spotify are wants. So are restaurant meals, coffee shop runs, and takeout.

Gym memberships, hobby gear, and entertainment all fit here. Cable TV, game subscriptions, and concert tickets are classic wants. Buying new clothes when you already have enough? That’s a want, too.

Vacations, weekend trips, and fun outings count as wants. If you pick premium versions of something when a basic one would do, that’s a want. Home decor, fancy furniture, and upgrades you don’t really need all go here. The latest phone or tech gadgets? Usually wants, not needs.

Effective Ways to Boost Savings

The 20% savings portion builds financial security in a few key ways. Emergency funds come first—aim for three to six months of expenses set aside.

Retirement accounts like 401(k)s and IRAs help you build long-term wealth. Automated transfers from checking to savings on payday make saving easier by removing the temptation to spend.

High-yield savings accounts usually pay more interest than the regular kind. Paying more than the minimum on debts speeds up your path to financial freedom and fits right into that 20% category.

Set up separate savings accounts for each goal you care about. Investing in index funds or stocks can grow your wealth over time.

Health savings accounts (HSAs) offer tax perks while helping you build emergency medical funds. If your employer offers a 401(k) match, grab it—it’s basically free money for retirement.

Step-By-Step Guide to Implementing the 50/30/20 Budget Rule

To start with the 50/30/20 budget rule, you need to do three things. Find your real take-home pay, sort your spending into needs, wants, and savings, and make tweaks that fit your actual financial situation.

Calculating Your After-Tax Income

First, figure out your after-tax income. That’s the money you actually see after taxes and any deductions—not your pre-tax salary.

Check your pay stub or your bank account to see what lands each month. If you get paid every two weeks, multiply one paycheck by 26 and then divide by 12 for your monthly amount.

Weekly pay? Multiply by 52, then divide by 12. Add up all the money that comes in regularly—your main job, side gigs, freelance work, or anything else steady.

Skip one-time bonuses or gifts since they’re not reliable. Only count what you can count on.

What to include:

- Regular paychecks after taxes

- Side job income after taxes

- Freelance or contract work

- Regular alimony or child support

Subtract automatic deductions like health insurance, retirement contributions, or loan payments if those come out before you get paid. Whatever’s left is your starting point for the budget.

Separating Expenses into Categories

Once you know your take-home pay, split it into three groups using the 50/30/20 framework. Track your spending for at least a month to see where your cash goes.

Needs (50%) cover basics—rent or mortgage, utilities, groceries, insurance, minimum debt payments, getting to work, and required medical care. If you can’t live without it, it’s a need.

Wants (30%) are the fun stuff—eating out, streaming, hobbies, gym memberships, vacations, and shopping for extras. Sometimes the line between needs and wants gets fuzzy, so be honest with yourself.

Savings and Debt (20%) includes emergency funds, retirement accounts, extra debt payments above the minimum, and other financial goals. This is your future security.

Pull up your bank and credit card statements. Write down every expense and label each as a need, a want, or a savings. Add up each pile and see how close you are to the target percentages.

Adjusting Your Budget for Real Life

Most of us discover our spending doesn’t line up with 50/30/20 right away. That’s totally normal—small changes over time can help.

If needs eat up more than 50%, look for places to cut costs—maybe cheaper housing, a lower phone bill, smaller grocery runs, or better insurance deals. Big moves like getting a roommate or relocating can free up serious money.

When wants go over 30%, pick out what you love most and cut what you barely use. Cancel subscriptions you ignore, eat out less, or swap pricey entertainment for free options. Keep what matters and trim the rest.

If you’re not hitting 20% for savings, start with what you can. Even 5% or 10% gets the habit going. Try bumping it up by 1% each month until you hit your goal, or look for ways to earn extra—maybe a side hustle or selling stuff you don’t need.

These percentages are targets, not hard rules. If you’re stuck with high rent, maybe you go 60/20/20 for a while. If housing’s cheap, you might do 40/30/30. The 50/30/20 budget rule is a guide, not a straitjacket.

Advantages of the 50/30/20 Budget Rule

The 50/30/20 budget rule gives people a simple way to manage money. It takes the confusion out of budgeting but still keeps you on track.

Simplicity and Accessibility

This 50/30/20 budgeting method really stands out because anyone can pick it up—no advanced math or fancy spreadsheets needed. Just split your after-tax income into three buckets. That’s it.

It’s great for beginners who feel overwhelmed by complicated budgets. You can start the moment you get your first paycheck, without tracking every single expense or sorting through endless categories.

Plenty of people love that it only takes a few minutes to set up. Just figure out 50% for needs, 30% for wants, and 20% for savings. This clear split makes planning way less stressful, especially if you’re busy or just not into numbers.

Supports Financial Awareness

Using this system helps you see where your money actually goes. When you sort expenses into needs, wants, and savings, you start to notice patterns you might’ve missed before.

It nudges you to check in on your priorities. Sometimes you realize you’re spending more on wants than you thought, or saving less than you hoped. Spotting these habits gives you a chance to make better decisions next time.

Financial literacy just grows as you use it. You get better at telling the difference between what you need and what you just want. That kind of thinking sticks with you, even outside of budgeting.

Promotes Healthy Savings Habits

Automatically putting 20% toward savings sets you up for a solid financial future. A lot of people struggle to save because they wait until the month ends, but this flips the script and makes saving a top priority.

Set aside one-fifth of your income and your emergency fund grows without you stressing about it. For example, if you earn $3,000 a month, you’d save $600 automatically. In six months, that’s $3,600—no extra willpower needed.

This structure takes the worry out of saving. You know you’re making progress, even if it’s not perfect. Little by little, that consistency builds real momentum.

Disadvantages and Limitations

The 50/30/20 budget rule works for many folks, but it has some real drawbacks. The fixed percentages don’t always fit every income level, unexpected costs, or unique financial situations.

Challenges for Low-Income Earners

If you’re earning less, the 50/30/20 budget rule can feel impossible. When you’re living on minimum wage or working part-time, keeping needs to 50% doesn’t happen.

Rent, utilities, food, and transportation can eat up 70% or more of a low-income budget. In some cities, housing alone takes half your income or more. That barely leaves room for wants or the 20% savings goal.

People in this situation might need to adjust the percentages—a 70/20/10 split, or focusing just on needs. The standard rule assumes you have enough to divide, but that’s not true for everyone.

Inflexibility for Irregular Expenses

This system doesn’t handle expenses that pop up once in a while. Car repairs, medical bills, home fixes, and yearly insurance premiums don’t fit neatly into a monthly plan.

Say you get hit with a $1,200 car repair. If you’ve only saved $200 that month, you’re still short a grand. The rule doesn’t really tell you what to do here.

Seasonal costs throw things off, too. Back-to-school shopping or holiday spending can wreck a typical month. Real life just isn’t that predictable.

Not Suitable for Every Situation

Different life stages call for different budgets. If you’re paying off high-interest debt, you might need to throw more than 20% at your financial goals. Saving for a house? Maybe you need 30-40% going to savings.

Living somewhere expensive makes the 50% needs cap unrealistic. In places like San Francisco or New York, rent alone can blow past half your take-home pay. Add in healthcare, student loans, or childcare, and needs can spike even more.

If your income jumps around—like with freelancing or commission work—fixed percentages are tough to follow. Some months you might not have enough, other months you have extra. Flexible budgeting might work better when your earnings don’t stay the same.

Real-Life Applications and Case Studies

People from all walks of life have tried the 50/30/20 budget rule to get a handle on their money. Their stories reveal both what works and what doesn’t with this method.

Success Stories

A young teacher making $45,000 a year used the 50/30/20 approach to wipe out $15,000 in student loans in just three years. She put $1,875 a month toward needs, $1,125 toward wants, and $750 into savings and debt payments.

Key actions that led to success:

- Tracked every expense for a month to see where her money went

- Moved into a cheaper apartment, dropping needs from 60% to 50%

- Used the extra cash from lower rent to pay down debt faster

- Stuck with the plan for a full 36 months

A couple earning $85,000 together followed the rule to save for their first house. By sticking to the 20% savings guideline, they hit their $25,000 down payment goal in 30 months. The clear percentages made it easier to know what they could safely spend on fun without derailing their savings.

Lessons Learned from Failures

A freelance graphic designer struggled with the 50/30/20 split because her income bounced between $2,000 and $7,000 every month. The fixed percentages just didn’t fit when paychecks were all over the place.

Common challenges people face:

- Living in pricey cities where rent alone eats up more than 50% of income

- Unpredictable income that makes percentage planning tricky

- Big debts that need more than 20% of income to tackle

- Unexpected medical bills or emergencies that blow up the budget

One person earning $38,000 a year in San Francisco found rent alone took 45% of his take-home pay. Add in groceries, utilities, and getting around, and needs shot up to 75%. He had to tweak the rule to 75/15/10 until he could earn more or move somewhere cheaper.

Adapting the 50/30/20 Budget Rule for Different Lifestyles

The 50/30/20 budget rule hits differently depending on your living situation and how you get paid. Families wrestle with childcare, singles feel the pain of solo rent, and freelancers have to plan for paychecks that never look the same twice.

For Families

Families often find the standard 50/30/20 split tough because their needs go way beyond just bills. Childcare alone can chew up 15-25% of what you bring home. Add in school supplies, kids’ clothes, and doctor visits, and suddenly needs are way over 50%.

Lots of families bump needs up to 60% and cut wants down to 20%. That way, they still save 20% but don’t pretend groceries and daycare cost less than they do.

Tracking which kid expenses are true needs versus wants really helps. Sports gear? Probably a want. School uniforms? Definitely needs. Birthday parties and family outings feel important but usually land in the wants pile.

Family Budget Adjustments:

- Let needs rise to 55-60% when kids are little

- Use wants for just one special family thing each month

- Split savings between emergencies and college

- Revisit the budget every six months as kids grow and needs change

Dual-income families usually find it easier to stick to 50/30/20 than single parents. Single parents might need to go 65/15/20 for a while as they build financial stability.

For Singles

Singles face their own headaches with this rule since there’s no one to split the rent. Housing often eats up a bigger chunk of their income compared to couples.

In expensive cities, singles might spend 40-45% of what they make just on rent. Hitting the 50% needs target without roommates? It’s pretty impossible. A simple budgeting method like 50/30/20 needs some tweaking in those places.

If you’re just starting out, aim to keep needs under 60%. As you earn more, try to edge back toward that 50% goal. Moving to a cheaper area or finding a roommate can help a lot.

Singles have more leeway with wants since it’s just their own priorities. They can cut wants down to 20% for a while if they want to save faster or pay off debt.

Single Person Strategies:

- Find roommates to lower rent

- Spend wants money on social stuff and hobbies

- Build a six-month emergency fund before anything else

- Automate savings so 20% actually gets stashed away

Singles without dependents sometimes manage to save more than 20% if they keep their lifestyle simple. That extra cushion builds wealth and peace of mind.

For Freelancers and Gig Workers

Freelancers have the toughest time with 50/30/20 since their income jumps around. They need to base percentages on average income from a few months, not a steady paycheck. That means tracking income for three to six months to find a baseline.

Self-employed folks have to pay both sides of payroll taxes, adding about 15% to their tax load. They should figure budget percentages based on what’s left after setting aside taxes. Many freelancers stash 25-30% of their gross for taxes before dividing up the rest.

With income that’s never guaranteed, freelancers should build up a bigger emergency fund—think six to twelve months, not just three. During good months, saving 25-30% helps cover the slow ones.

Freelancer Budget Tips:

- Base your budget on the lowest monthly income you made in the past year

- Save extra when you have a good month

- Keep needs as lean as possible for income flexibility

- Use separate accounts for taxes, needs, wants, and savings

Freelancers working toward financial balance should treat business expenses as a separate animal. Deduct those before applying the 50/30/20 rule to what’s left for personal spending.

Tools and Resources for Managing Your Budget

The 50/30/20 budget rule really shines when you use the right tools to track your money. Apps and printable worksheets make it way easier to stay organized and spot where the cash actually goes.

Recommended Budgeting Apps

Modern budgeting tools let you track spending without messing with spreadsheets. A lot of banks now have built-in budgeting features in their apps, automatically sorting your purchases and pinging you if you overspend.

Apps like Intuit Mint and YNAB (You Need A Budget) sync up with your bank and credit cards to track your money in real time. They categorize your spending into groceries, fun, utilities, and more. Some even give you charts showing how close you are to the 50/30/20 split.

If you want to keep it simple, there are free apps with the basics—expense tracking and budget alerts, no monthly fees. The trick is picking one that fits your style and makes checking your finances a habit, not a chore.

Printable Worksheets

Some folks just like paper. Free budget templates let you jot down income and expenses by hand. These usually have sections for needs, wants, and savings right on the page.

Printable planners give you a month-at-a-glance look at everything. A budget planner template will include space for all your income at the top, with separate sections for needs, wants, and savings below. You can total up each section and see how you stack up to the 50/30/20 rule.

Writing down every expense can be eye-opening. You’ll spot patterns and quickly see where to cut back. Toss completed worksheets in a binder to track your progress and watch your habits shift over time.

How the 50/30/20 Budget Rule Compares to Other Budgeting Methods

The 50/30/20 budget rule is a simple way to manage your money, but it’s not the only game in town. Other approaches get more detailed and might fit some situations better.

Zero-Based Budgeting

Zero-based budgeting means you give every dollar a job until there’s nothing left unassigned. You plan out where every cent will go before the month even starts.

The gap between zero-based budgeting and the 50/30/20 approach is pretty wide. Zero-based budgeting takes more time since you track every single expense. You have to plan for groceries, gas, fun, and even the odd coffee run.

For people who want total control, zero-based budgeting is ideal. It shines a light on spending habits and helps cut waste. But let’s be honest—it’s more work than the broad-strokes 50/30/20 system.

Many financial experts point folks who tend to overspend toward zero-based budgeting. That level of detail makes it tough for money to slip through the cracks. The 50/30/20 rule is more forgiving and works with bigger buckets.

Envelope System

The envelope system means splitting your cash into labeled envelopes for each spending category. When an envelope is empty, you’re done spending in that area until next month.

This old-school method makes your limits super clear. You might have one envelope for groceries, one for entertainment, another for gas. Handling actual cash makes you feel every dollar.

The 50/30/20 rule doesn’t care how you track spending—it works with cards, apps, or cash. The envelope system is all about using physical money and stopping when it’s gone.

Some folks mix these methods, using envelopes just for the 30% wants category. That way, they keep things simple but add a little discipline for fun spending.

Honestly, the envelope system gets tricky these days. Most bills are paid online, and carrying around a ton of cash isn’t exactly safe or convenient.

Pay Yourself First Approach

The pay yourself first method puts savings at the top of your priorities. You move money into savings accounts before paying bills or spending on anything else.

This strategy treats savings like a bill you pay right after getting paid. It’s non-negotiable—almost like rent, but for your future self.

You’ll notice it’s similar to the 20% savings portion of the 50/30/20 rule. Both focus on making saving a priority, not an afterthought.

But pay yourself first is less structured. After you set aside your savings, you spend what’s left on everything else, without sticking to set percentages for needs and wants.

The 50/30/20 rule, on the other hand, tells you exactly how to split the rest of your income. That makes it a bit more prescriptive.

If you find it hard to save, this method can really help. Automatic transfers mean you don’t have to think about it—your savings get funded before you get tempted to spend.

Some folks end up saving more than 20% this way. If your needs cost less than half your paycheck, you might bump your savings up to 30% or even 40%.

The reverse budgeting approach expects you to fit your spending into whatever’s left after saving. It’s a bit of a mindset shift, but it works for many people.

Common Mistakes to Avoid When Using the 50/30/20 Budget Rule

People often run into trouble with the 50/30/20 budget rule because they mislabel expenses or forget their income isn’t always the same each month. These slip-ups can make it tough to hit your financial goals.

Misclassifying Expenses

One huge stumbling block? Putting expenses in the wrong bucket. It’s easy to call gym memberships, streaming services, or dinners out “needs,” but they’re really “wants.”

This mistake messes up your 50% allocation for needs. Suddenly, your budget doesn’t work the way it should.

Needs are things like housing, utilities, groceries, insurance, minimum debt payments, and your ride to work. Everything else? That’s wants.

Some stuff sits in a gray area, though. A basic cell plan for work is a need. Unlimited data for TikTok and YouTube? That’s a want, let’s be real.

Groceries can be tricky, too. The food itself is a need, but fancy brands, pre-made meals, and those little splurges? Those slide into wants territory.

If you track your spending for a month, you’ll spot which purchases are truly necessary and which ones just feel necessary in the moment.

Ignoring Variable Income

Freelancers, gig workers, and folks who work on commission face special challenges here. A common mistake is budgeting based on your best month ever instead of your average or worst-case month.

That habit leads to overspending when business is slow. It’s a recipe for stress, honestly.

Try using your average monthly income from the last 6-12 months as your baseline. That number gives you a more realistic budget.

If you earn more in a good month, toss the extra into savings or pay down debt. Don’t just inflate your “wants” category.

Some people budget using their lowest expected monthly income. Anything extra goes to savings or gets split up according to the 50/30/20 rule. This way, you build a cushion for leaner months.

Neglecting Irregular Costs

Car repairs, annual insurance premiums, holiday gifts, and medical copays pop up throughout the year. Most people forget to plan for these until they hit, and then they scramble to cover the cost.

One fix is to list all the irregular expenses you expect over the next year. Add them up, divide by 12, and set that amount aside each month.

This money should come from the 50% needs category, since most irregular costs are essentials. Don’t ignore them—they’ll find you eventually.

A sinking fund is a great solution. Set up a separate savings account just for these known, upcoming costs.

Automatic transfers make it painless. When the bill arrives, the money’s ready and waiting. You don’t have to raid your emergency fund or mess up your regular budget.

Key Giveaways

The 50/30/20 budget rule provides a simple framework for managing your money. No need for complex spreadsheets or tracking every penny.

This method splits your income into three clear buckets: needs, wants, and savings. It covers what you need now, what you enjoy, and what you’ll need in the future.

Why Everyone Should Master the 50/30/20 Rule

Honestly, this rule works for just about anyone. If you’re just starting your career, it helps you build strong money habits from day one.

Families juggling multiple incomes can use it to coordinate spending and avoid confusion. It even works for people who’ve been budgeting for years.

One of the best parts? Decision-making gets easier. If you know 30% is for wants, you can spend on fun stuff guilt-free, as long as you stay within your limit.

No more second-guessing whether you can afford that dinner out. The system already made the decision for you.

People who use this framework tend to save more, too. That automatic 20% for savings and debt payoff means you’re always moving toward your goals, even if you’re not thinking about it every day.

It’s also a great way to spot trouble. If you keep blowing past your 50% needs limit, it’s a sign you need to cut back or find ways to earn more. That kind of clarity makes it easier to take action—no more wondering where your money disappeared to.

Adapting the Rule for Long-Term Success

The standard percentages are just a starting point. Life isn’t one-size-fits-all, right?

If you live in an expensive city, your needs might eat up 60% of your income. Maybe you cut wants to 20% or less to compensate.

If you’re gunning for early retirement, you might flip things and save 30% or 40%. The rule is flexible—that’s the beauty of it.

Big life changes? You’ll probably need to adjust your numbers. Marriage, kids, new jobs—they all shift your spending patterns.

But the framework sticks around, even if the percentages change. That’s what makes it so helpful over the long haul.

- Boosting savings above 20% when your income jumps

- Cutting wants temporarily to crush debt

- Adjusting needs for high cost-of-living areas

- Splitting savings between multiple goals

Young adults with student loans might put 25-30% toward debt and savings. Empty nesters with no mortgage can often shrink their needs category and bump up savings or wants.

Top Tools for Effective Budget Tracking

Let’s be honest—budgeting is way easier with digital tools. Modern budgeting apps connect to your bank and sort transactions into needs, wants, and savings automatically.

Popular budget tracking options include:

| Tool Type | Best For | Key Features |

|---|---|---|

| Mobile apps | Daily tracking | Automatic categorization, spending alerts |

| Spreadsheets | Custom control | Full customization, detailed analysis |

| Bank tools | Simple setup | Built-in integration, no extra accounts |

If you love spreadsheets, you can build your own 50/30/20 tracker or use a template. You get full control over categories and calculations.

Some people prefer seeing all their numbers in one place and don’t want to link their bank to a third-party app. That’s fine too.

Automated tools save time and cut down on mistakes. They track your spending throughout the month and show if you’re staying on target.

Push notifications warn you when you’re close to a category limit. That heads-up can save you from overspending before it happens.

Honestly, the best tracking method is the one you’ll actually use. Some people want deep analysis, others just want to see if they’re on track. Starting anywhere is better than not tracking at all.

Frequently Asked Questions

The 50/30/20 budget rule sparks a lot of questions, especially about how flexible it is and what tools actually help. People want to know if it works for their unique situation, and that’s a fair concern.

How does the 50/30/20 budget rule assist with financial planning for different life stages?

This rule adapts to almost any life stage because it uses percentages instead of fixed amounts. A new grad making $35,000 a year puts $1,458 toward needs, $875 toward wants, and $583 into savings each month.

Someone further along in their career earning $75,000 just scales those numbers up, but the split stays the same. Young adults often like this rule because it’s straightforward and helps build good habits early on.

Families with kids sometimes need to tweak the formula. Childcare, healthcare, or housing can push needs above 50%. Parents might temporarily shift to 60/20/20 or 65/15/20 until costs drop.

Retirees often benefit from a modified split, too. With mortgages paid off and less debt, they might go for a 40/40/20 setup—more for hobbies and travel, but still keeping emergency savings in the mix.

Are there any updated strategies for implementing the 50/30/20 rule effectively in the current economic climate?

With inflation on the rise, sticking to the 50/30/20 budget rule takes a bit more creativity these days. The cost of basic necessities keeps climbing, so that 50% allocation for needs isn’t always enough.

If you live in a pricey city, you might want to think about geographic arbitrage. Exploring remote work or moving somewhere more affordable can really shrink your housing costs, which tend to eat up the largest chunk of your needs budget.

Building a few extra income streams can give your budget some breathing room. Side gigs, freelancing, or even passive income help cover those rising expenses without tossing the whole rule out the window.

Try automating your savings right after payday. That way, the 20% savings goal gets handled first, and you’re less tempted to dip into it for random spending later in the month.

Set a reminder to review your budget every month. Little things—like subscriptions and convenience splurges—can sneak in and push your wants category over that 30% line before you know it.

What are the advantages and limitations of adhering to the 50/30/20 budgeting framework?

The 50/30/20 budget rule stands out for its simplicity. You don’t need fancy spreadsheets or endless tracking to get started.

It flexes with your income, too. As your earnings change, you just adjust the dollar amounts but keep the same percentage splits.

The framework also helps you balance enjoying life now with planning for the future. Giving yourself 30% for wants makes the process feel less restrictive, which is honestly a relief.

But there are some clear drawbacks. If you live somewhere expensive, keeping housing and transportation under 50% of your income can feel impossible, no matter how hard you try.

If you’re managing hefty debt, you should tweak the rule. For example, someone with $30,000 in credit card debt at 22% interest should probably focus more on debt elimination for a while instead of saving 20%.

The rule doesn’t really tell you how to spend within each category, either. You could technically follow it but still blow your wants budget on impulse buys instead of things that actually make you happy.

If your income bounces around—like for freelancers or gig workers—it gets tricky. You’ll need to use an average income over a few months to figure out your percentages, which takes some extra effort.

How can one customize the 50/30/20 budget rule to accommodate fluctuating income levels?

If you’re a freelancer or gig worker, try using a rolling three-month average income to set your percentages. This method helps smooth out those unpredictable ups and downs.

Build your base budget around your lowest expected monthly income. Anything extra you make can go toward your top priorities, like boosting savings or making bigger debt payments.

It’s smart to keep a bigger emergency fund if your income isn’t steady. Instead of three to six months of expenses, aim for six to twelve months just in case things slow down.

Some folks flip the script and pay themselves first—setting aside 20% for savings and 30% for wants as soon as money comes in, then using the rest for needs. It’s not for everyone, but it works for some.

If your work is seasonal, plan your budget for the whole year instead of month by month. Figure out your total yearly income, split it into categories, and adjust your monthly spending based on where you are in your earning cycle.

Consider opening a buffer account just for income swings. When you have a high-earning month, stash some extra cash there. During leaner months, you can draw from that buffer to keep things steady.

What are some tools or apps that can help track expenses according to the 50/30/20 rule?

Plenty of digital tools make tracking expenses in the 50/30/20 framework almost painless. Apps like Mint pull in transactions from your bank accounts and cards, then sort everything into categories—so you can see at a glance how your spending stacks up against your targets.

YNAB (You Need A Budget) is a bit more hands-on. It asks you to give every dollar a job before you spend it. If you like more control, this zero-based budgeting app lets you set up custom categories that align perfectly with the 50/30/20 budget rule.

PocketGuard keeps things even simpler. It shows you exactly how much money you have left for “wants” after it factors in bills and savings. For folks who don’t want to fuss with too many details, the clean interface is a breath of fresh air.

Some people just love spreadsheets—I get it. Google Sheets and Excel both have free templates that crunch the numbers for you, calculating percentages and tracking your spending over time. If you’re comfortable with basic formulas, you can make these as detailed or as simple as you want.

There are also banking apps with built-in budgeting features. You can set up spending buckets for needs, wants, and savings, and the app pings you when you’re close to hitting your limit in any category. Not everyone likes those notifications, but for some, they’re a lifesaver.

Cash envelope systems are old-school but still work. You pull out your monthly income in cash, split it into three envelopes, and only spend what’s inside each one. It’s tactile, it’s visual, and honestly, it can be a bit of a reality check.

Some people swear by manual tracking with a journal. Jotting down every purchase by hand really makes you pause and think about where your money is going. It’s not for everyone, but it’s about as mindful as money management gets.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content: Please view our full AI Use Disclosure.

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.