Unlock Your Credit Power. 20 Key Areas to Review Using a Credit Report Review Checklist for Better Comprehension of Your Reports. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

Don’t Have Time To Read The Full Article. Here’s What You Are Missing.

- Unlock Your Credit Power. 20 Key Areas to Review Using a Credit Report Review Checklist for Better Comprehension of Your Reports. Find Out More In Our Latest Article!

- Verifying Personal Information

- Correctness of Name and Social Security Number

- Accuracy of Current Address and Phone Number

- Previous Addresses and Marital Status

- Employment History Verification

- Analyzing Credit Account Details

- Review of Personal Information Section

- Public Record Information Accuracy

- Status of Credit Accounts and Balances

- Authorized User and Joint Owner Accounts

- Closure and Discharge of Accounts

- Assessing Negative Information

- Correctness of Negative Credit Account Information

- Investigation of Late and Missed Payments

- Duplicate Account Listings

- Reporting of Old Negative Information

- Preventing and Addressing Identity Theft

- Identification of Potential Identity Theft

- Critical Areas Review: Payment History and Credit Utilization

- Credit Inquiries, ID Theft, and Fraud Alerts

- Improving and Protecting Your Credit Rating

- Handling Discrepancies on Your Credit Report

- Contacting Credit Reporting Companies

- Understanding Circumstances for Non-Investigation

- Enhancing Credit Scores Through Accuracy

- Guarding Against Data Breaches

- Frequently Asked Questions

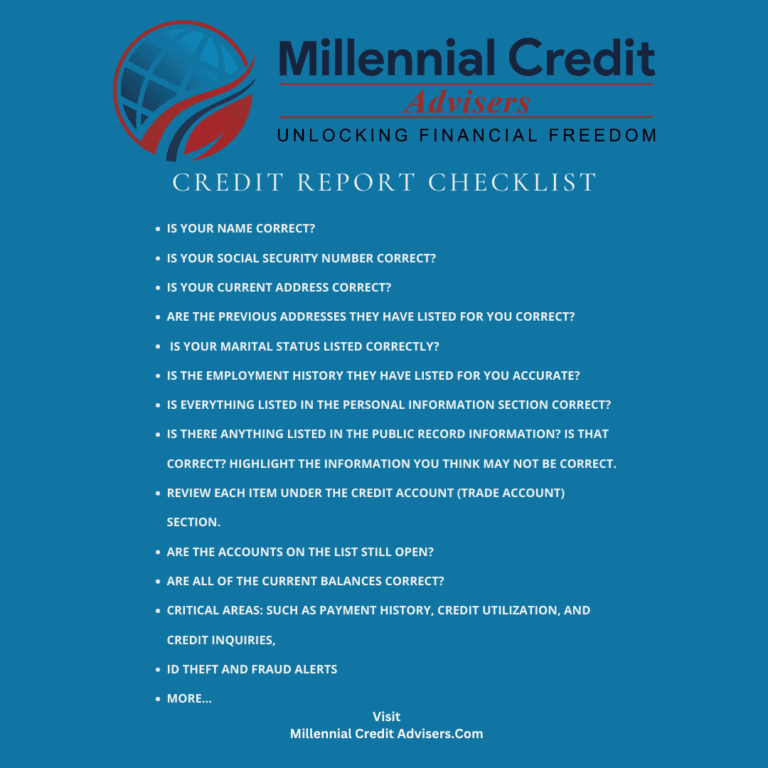

As consumers, we want to ensure our credit reports are accurate and up-to-date. However, with so much information to review, it can be overwhelming to know where to start.

That’s where a credit report review checklist comes in handy. By breaking down the review process into specific critical items, you can ensure that you’re covering all the bases and catching any errors or inaccuracies.

Verifying Personal Information: The first section of the credit report review checklist focuses on verifying your personal information.

This includes checking that your name, Social Security number, address, and phone number are correct. Additionally, you’ll want to ensure that any previous addresses listed are accurate and that your marital status is correct.

By starting with these basic details, you can establish a solid foundation for the rest of your credit report review.

Analyzing Credit Account Details: The next section of the credit report review checklist involves examining the details of your credit accounts.

This includes checking that all accounts are still open and that current balances are correct. You’ll also want to ensure that any accounts where you’re an authorized user or joint owner are listed and that any accounts you’ve closed are correctly labeled.

By reviewing each item under the credit account section, you can catch any mistakes or discrepancies that could negatively impact your credit score.

Verifying Personal Information

As you begin reviewing your credit report, the first step is to verify that your personal information is correct. This includes your name, Social Security number, address, phone number, previous addresses, marital status, and employment history.

Correctness of Name and Social Security Number

The first items to check are your name and Social Security number. Creditors use this critical information to identify you and determine your creditworthiness. Any name or Social Security number errors could negatively impact your credit score.

Accuracy of Current Address and Phone Number

Next, check to ensure that your current address and phone number are correct. These are essential pieces of information that creditors use to contact you. If your address or phone number needs to be corrected, you may not receive important notices or bills, which could lead to missed payments and negatively impact your credit score.

Previous Addresses and Marital Status

It’s also essential to verify that the previous addresses listed on your credit report are accurate. This information is used to verify your identity and determine your creditworthiness. Additionally, make sure that your marital status is listed correctly. This information can impact your credit score, as creditors may consider your spouse’s credit history when making lending decisions.

Employment History Verification

Finally, review your employment history to ensure its accuracy. This information is used to verify your income and stability, which can impact your creditworthiness. Make sure that the dates of employment and job titles are correct.

By verifying your personal information, you can ensure that your credit report is accurate and up-to-date. This can help you maintain a good credit score and avoid negative impacts on your creditworthiness.

Analyzing Credit Account Details

When reviewing your credit report, it’s crucial to carefully analyze the details of each credit account listed. This section will cover the most critical areas to review.

Review of Personal Information Section

The personal information section of your credit report includes details such as your name, Social Security number, current and previous addresses, and employment history. It’s essential to ensure all this information is accurate and up-to-date. Any errors in this section could lead to issues with your credit report, so reviewing this section carefully is necessary.

Public Record Information Accuracy

Your credit report’s public record information section includes details about bankruptcies, tax liens, and other public records. Make sure that any information listed in this section is accurate and up-to-date. If you find any errors, you should contact the credit reporting company and the creditor or institution providing the information to correct it.

Status of Credit Accounts and Balances

Review each item under the credit account (trade account) section and ensure all listed accounts remain open. Check to see if the current balances are correct and if any accounts where you are an authorized user or joint owner are listed. If you find any discrepancies, you should contact the creditor or institution to have the information corrected.

Authorized User and Joint Owner Accounts

Ensure that any accounts where you are an authorized user or joint owner are listed correctly. If you find any errors, contact the creditor or institution to have the information corrected.

Closure and Discharge of Accounts

Check if your accounts are listed as “closed by the consumer.” Also, ensure zero balances are recorded for debts discharged in bankruptcy or debts paid in full. If you find any errors, you should contact the creditor or institution to have the information corrected.

By analyzing your credit report’s credit account details section, you can ensure that all the information listed is accurate and up-to-date. This can help you improve your credit rating, prevent identity theft, and be prepared for any data breach alerts.

Assessing Negative Information

When reviewing your credit report, it’s vital to assess negative information. Negative information can include late payments, missed payments, collections, and bankruptcy filings. Incorrect negative details can significantly impact your credit score and borrowing ability, so reviewing this information carefully is crucial.

Correctness of Negative Credit Account Information

When reviewing negative credit account information, it’s essential to ensure it is correct. Review the dates of any late payments or missed payments to make sure they are accurate. If you believe that negative information is incorrect, you can dispute it with the credit bureau and the creditor or institution providing the information.

Investigation of Late and Missed Payments

If you find late or missed payments on your credit report, it’s important to investigate them. Contact the creditor or institution to determine why the payment was late or missed. If there was an error, ask them to correct it. If the late or missed payment is accurate, consider setting up automatic payments to ensure you don’t miss any future payments.

Duplicate Account Listings

Duplicate account listings can occur if a creditor or institution reports the same account more than once. This can negatively impact your credit score, so reviewing your credit report for duplicate account listings is essential. If you find duplicate account listings, dispute them with the credit bureau and the creditor or institution providing the information.

Reporting of Old Negative Information

Negative information can only be reported on your credit report for a certain period. In most cases, negative information can only be reported for seven years. If you find old negative information on your credit report, highlight it and dispute it with the credit bureau and the creditor or institution providing it.

By assessing negative information on your credit report, you can ensure that your credit report is accurate and take steps to improve your credit score. If you suspect you have been the victim of identity theft, review your credit report carefully and consider placing a fraud alert on your credit report.

Preventing and Addressing Identity Theft

Identity theft is a growing concern in today’s digital age. It is essential to protect yourself by reviewing your credit report regularly. By doing so, you can identify potential identity theft and take the necessary steps to prevent it.

Identification of Potential Identity Theft

When reviewing your credit report, look for accounts you did not open, credit inquiries you did not initiate, and personal information that is not yours. If you find any of these, it may indicate that someone has stolen your identity.

Critical Areas Review: Payment History and Credit Utilization

Two critical areas to review when checking for identity theft are payment history and credit utilization. Look for late or missed payments that you should have made, as well as higher-than-expected balances. These could be signs that someone has used your identity to purchase or open accounts.

Credit Inquiries, ID Theft, and Fraud Alerts

You should also review the credit inquiries section of your report. Look for inquiries that you did not initiate. These could be signs that someone has applied for credit using your identity.

If you suspect that you have been the victim of identity theft, you should place a fraud alert on your credit report. This will alert potential creditors that they need to take extra steps to verify your identity before approving any credit applications.

If you find any errors or discrepancies on your credit report, you should dispute them with the credit reporting company and the creditor or institution providing the information. You can do this online, by phone, or by mail.

Reviewing your credit report regularly is an essential step in preventing identity theft. You can protect your credit rating and financial future by identifying potential identity theft and taking the necessary steps to address it.

Improving and Protecting Your Credit Rating

Handling Discrepancies on Your Credit Report

Checking your credit report regularly is essential in protecting your credit rating. If you notice any discrepancies, such as an incorrect name, address, or social security number, you must dispute them immediately. Disputing errors on your credit report can help improve your credit rating.

Contacting Credit Reporting Companies

If you find errors on your credit report, you should contact the credit reporting company that provided the report. You can request a free copy of your credit report from each of the three major credit reporting companies once a year. You can also contact the creditor or institution that provided the information to the credit reporting company.

Understanding Circumstances for Non-Investigation

In certain circumstances, creditors and furnishing institutions are not required to investigate disputes. For example, the creditor or institution may not investigate if the dispute is frivolous or irrelevant. Understanding these circumstances and providing accurate information when disputing errors on your credit report is essential.

Enhancing Credit Scores Through Accuracy

Improving your credit score starts with ensuring that your credit report is accurate. Review your credit report regularly and dispute any errors immediately. Pay your bills on time, keep your credit utilization low, and avoid opening too many new accounts simultaneously. These steps can help enhance your credit score and protect your credit rating.

Guarding Against Data Breaches

Data breaches can significantly threaten your credit rating. To guard against data breaches, be cautious with your personal information and monitor your credit report regularly. Consider placing a fraud alert or free credit freeze on your credit report to prevent unauthorized access. Taking these steps can help protect your credit rating and prevent identity theft.

Frequently Asked Questions

Why is it crucial to verify personal details such as name and Social Security number on your credit report?

Verifying your personal information, such as your name and Social Security number, is essential to ensure the accuracy of your credit report. Any errors in this information can lead to issues with the accounts listed on your report, which can ultimately impact your credit score.

How can checking your address and phone number on a credit report prevent potential issues?

Checking your address and phone number on your credit report is crucial to ensure that any potential issues can be addressed promptly. If your address or phone number is incorrect, you may not receive important notifications from creditors or credit reporting agencies.

What steps should you take if your marital status or employment history is inaccurately reported?

If your marital status or employment history needs to be updated on your credit report, you should contact the credit reporting agency and the creditor or institution providing the information. They will investigate the issue and make any necessary corrections.

Why is it important to review public record information on your credit report?

Reviewing public record information on your credit report is important to ensure that any information is accurate and up-to-date. This information includes bankruptcies, tax liens, and civil judgments.

How can inaccuracies in your credit account balances or payment history affect your credit score?

Inaccuracies in your credit account balances or payment history can negatively impact your credit score. If you notice any discrepancies, you should contact the creditor or institution providing the information and the credit reporting agency to resolve the issue.

What actions should you take if you suspect identity theft or find unauthorized accounts on your credit report?

If you suspect identity theft or find unauthorized accounts on your credit report, you should immediately contact the credit reporting agency and the creditor or institution providing the information. You can also place a fraud alert on your credit report to prevent further unauthorized activity.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content: Please view our full AI Use Disclosure.

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.