Unlock Your Financial Future: Essential Steps to Boost Your Savings and Achieve Your Dreams! Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

Increasing savings is a vital step toward building a secure financial future. By creating and sticking to a savings plan, individuals can achieve their long-term goals.

Anyone with an income and expenses can benefit from prioritizing savings. Whether they are starting their careers or planning for their children’s future, setting aside money brings stability and peace of mind.

Starting to save as soon as possible is advisable. Even small amounts can make a significant difference over time.

Making saving a habit, whether through bonus windfalls or spare change, helps build a strong financial base.

With a variety of options like traditional or high-yield savings accounts, choosing the right place to save is crucial.

Separating accounts can also aid in minimizing temptation.

Utilizing effective strategies ensures savings grow steadily. Creating a personalized budget can highlight areas to reduce expenses.

Automatic transfers into savings accounts simplify the process and eliminate excuses.

Setting specific goals, such as buying a home or retiring comfortably, provides motivation and direction.

Breaking spending habits, like excessive online shopping, also frees up funds to allocate toward savings.

Importance of Savings

Saving money is essential for creating a stable financial future and building resilience against unexpected challenges. Understanding the significance of savings can lead to smarter financial decisions and long-term benefits.

Securing Future Stability

Stability in the future relies heavily on saving money today.

By putting funds aside, individuals can prepare for significant life events such as buying a home, starting a family, or pursuing higher education.

Savings help individuals avoid borrowing at high interest rates, thus maintaining financial health.

Another key aspect is retirement planning. By saving consistently, people ensure they will have resources to support themselves when they are no longer working.

This forward-thinking approach reduces financial stress later in life and allows for a comfortable retirement.

Moreover, accumulated savings can fund dreams like travel or starting a business. This not only improves personal satisfaction but also enhances quality of life.

Essentially, savings are a tool to ensure one’s future goals are achievable without financial strain.

Building Financial Resilience

Unpredictable events like medical emergencies or job loss can significantly impact finances. Having a robust savings account acts as a safety net, allowing individuals to handle these situations without resorting to high-interest debt. Being prepared with savings provides peace of mind.

Creating an emergency fund specifically for unforeseen expenses is crucial.

A good rule is to save three to six months’ worth of living expenses. This amount can vary based on individual needs, but it serves as a solid buffer against the unexpected.

Additionally, savings contribute to financial independence.

With adequate savings, individuals have more control over their financial choices and can make decisions that align with their values and priorities without external pressures. This strengthens their ability to recover from setbacks and maintain a stable financial path.

Determining Your Savings Needs

Determining how much to save involves understanding your income, expenses, and setting clear savings targets. By assessing these factors, individuals can ensure they are putting aside the right amount to meet their financial goals.

Assessing Income and Expenses

To determine savings needs, start by reviewing monthly income and expenses.

Knowing both is key to identifying how much can be saved each month.

First, list all sources of income, such as salaries, bonuses, or any other regular earnings.

Next, make a list of all expenses. This includes everything from housing, utilities, and groceries to smaller costs like subscriptions and entertainment.

Categorize expenses to see where most of the money goes. Look for patterns in spending that can be adjusted to increase the savings rate.

Having a clear view of finances helps spot areas where expenses can be cut.

For some, this may mean dining out less or limiting impulse purchases. Others might find opportunities in cutting back on recurring subscriptions.

This approach offers a realistic view of how much can be saved.

Setting Personal Savings Targets

Setting personal savings targets is crucial for financial stability.

Begin by identifying short-term and long-term savings goals.

Short-term goals might include saving for a vacation or an emergency fund, while long-term goals often encompass retirement or buying a home.

For instance, saving for retirement early, as advised by Peoples Bank of Alabama, can be beneficial.

Decide how much is needed for each goal and work backward to determine how much to save each month.

Establishing timelines for goals helps stay on track.

Monitoring progress regularly against these targets ensures adjustments can be made if needed.

Automated savings can aid in reaching targets consistently. This method makes sure savings happen consistently, even in months with unexpected expenses.

Timeliness and Savings

Understanding the importance of when to start saving can have a major impact on your financial success. Beginning early offers growth advantages, while starting late can still be managed smartly.

Starting Early Advantages

Starting to save early in life can lead to significant financial benefits.

Compound interest plays a major role in this, allowing small amounts saved regularly to grow substantially over time.

Individuals who begin saving in their 20s have more time to let their investments mature, leading to potentially larger returns as they approach retirement age.

Planning early also helps build a strong foundation for financial independence.

Early savers may face less financial stress during economic downturns because they have a cushion to fall back on.

Regular saving habits, developed early, can lead to a more secure financial future and enable them to take advantage of opportunities like homeownership or starting a business with confidence.

Managing Late Savings Start

Starting to save later in life isn’t ideal but it can be managed with strategic planning.

Those who find themselves in this situation should focus on maximizing their contributions to retirement accounts.

Catch-up contributions are often available for older individuals, allowing them to put aside more money annually and recover some lost ground.

A late start also requires a closer look at budgeting and cutting unnecessary expenses.

Prioritizing savings over non-essential spending can significantly improve one’s financial health over time.

Investing in high-yield accounts or diversified portfolios can offer better growth potential, even with a shorter time horizon.

Although the road is steeper, taking deliberate steps can still lead to a stable financial future.

Choosing Savings Platforms

Choosing the right savings platform is essential for achieving financial goals. It involves understanding various account types and investment options, each having unique benefits and considerations.

Comparing Account Types

Different savings platforms offer varied account types, each designed to meet specific needs.

Standard savings accounts provide easy access to funds but usually offer lower interest rates. For higher returns, a high-yield savings account can be a better option, providing more interest for the money saved.

Cash savings platforms help users manage multiple accounts without individual applications, making it efficient to shop for competitive rates. These platforms allow easy switching between accounts, ensuring savers always get the best available returns.

Understanding the differences between these account types can help in choosing the most suitable option based on accessibility and financial goals.

Understanding Investment Options

Savings platforms also provide investment options for those looking to grow their money more aggressively.

Some platforms include features for investing in fixed-term bonds or other investment products, which typically offer higher returns than savings accounts.

This strategy involves committing funds for a set period, potentially yielding higher gains.

Investment options require understanding the risks involved.

While higher returns are possible, investing in such products does come with uncertainties.

It is important to assess personal risk tolerance before selecting these investment options.

For those willing to take calculated risks, these platforms can be a lucrative way to increase savings over time.

Strategies for Enhanced Savings

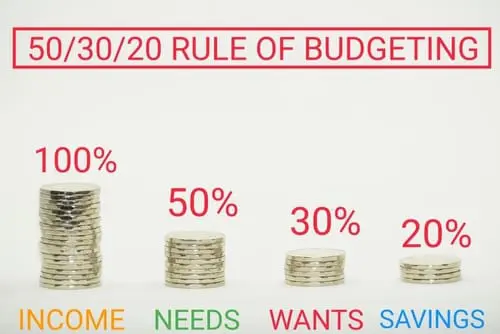

Elevating your savings requires clear strategies and actionable steps. Effective planning, understanding goals, automating processes, optimizing expenses, and building consistent habits are crucial components to grow your financial reserves significantly.

Budget Planning

A solid budget is the foundation of effective saving. It keeps track of income and expenses and helps identify potential savings areas.

By listing monthly expenditures and categorizing them, one can see exactly where money is going. This transparency is critical in discovering which expenses are necessary and which can be curtailed or eliminated.

Setting a realistic budget is important. It ensures funds are allocated correctly, covering essentials while prioritizing savings.

Utilizing budget apps or simple spreadsheets can greatly simplify the process, making it easier to adhere to the plan.

Goal-Oriented Saving

Setting clear savings goals provides motivation and direction. Whether saving for a new home, a family vacation, or retirement, knowing what you’re working towards can enhance commitment and focus.

This is especially important when the goal requires long-term dedication.

Breaking down large goals into smaller, manageable milestones is effective. It allows for progress tracking and provides a sense of achievement along the way.

Regularly reviewing these goals and adjusting them as needed can help maintain momentum.

Savings Automation

Automating savings ensures consistency without requiring constant attention.

Setting up automatic transfers from checking accounts to savings accounts allows individuals to save regularly without thinking about it. This method minimizes the temptation to spend money intended for savings.

Automated savings plans often lead to more consistent contributions. They can also be adjusted to align with financial changes.

It’s a straightforward way to commit to saving regularly and can be easily set up through most banking institutions.

Expense Optimization

Optimizing expenses involves critically evaluating and reducing unnecessary spending.

This may include switching from branded to generic products, canceling unused subscriptions, or cooking at home instead of dining out. Even small savings in everyday spending can add up over time.

Expense optimization requires regular reviews of spending habits.

By keeping an eye on inflow and outflow, adjustments can be made to ensure spending aligns with financial goals.

Employing this practice will likely yield more precious funds available for saving activities.

Building Consistency

Consistency in saving is crucial for long-term financial success. Developing a regular saving habit makes it a routine part of financial management rather than an occasional decision.

It requires discipline and commitment but is achievable with practice.

Creating reminders or setting goals for a fixed savings percentage from each paycheck can help. Recognize milestones to encourage continued saving.

Consistent saving ultimately leads to greater financial stability and builds a buffer for unforeseen expenses.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We do not offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized guidance. Track your progress for an improved credit journey.

Written content – “Please view our complete AI Use Disclosure.”

We enhance our products and advertising by using Microsoft Clarity to understand how you interact with our website. Using our site, you agree that we and Microsoft can collect and utilize this data. Our privacy policy provides further details.