The Hottest Debt Repayment Plan – Strategy for Rapid Debt Meltdown. FIND OUT MORE IN OUR LATEST ARTICLE!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO. Discover a treasure trove of over $2,900 worth of free link resources designed to propel you toward success! Dive in and unlock the tools you need to thrive.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

- Overview of the Debt Meltdown Method

- Impact of Debt on Millennials

- Principle 1: Pay the Minimum Payment

- Principle 2: Pay Half of the Minimum Payment

- Principle 3: Pay an Interest Payment Each Month

- Chart 1: Debt Repayment Timeline Comparison

- Chart 2: Interest Savings Breakdown

- Chart 3: Payment Allocation Example

- Calculating Benefits of the Debt Meltdown Plan

Overview of the Debt Meltdown Method

The Debt Meltdown Method is a strategic approach to eliminating debt quickly and efficiently. It combines three key principles to accelerate debt repayment and reduce interest costs.

The first principle involves making the minimum required payment on all debts. This ensures obligations are met, and penalties are avoided.

Secondly, individuals pay an additional half of the minimum payment. This extra amount reduces the principal balance directly.

The third principle requires making an interest payment each month. This helps decrease the total interest accrued over time.

Debtors can significantly shorten their repayment timeline by implementing these three principles together. The method often leads to substantial interest savings compared to traditional repayment strategies.

The Debt Meltdown Method benefits people with high-interest debts like credit cards. It allows for faster progress towards debt freedom and can also be helpful for other debts!

Consistency is key when using this method. Regular application of all three principles yields the best results. Over time, debtors may see their balances decrease more rapidly than expected.

This approach requires discipline and commitment. However, the potential for accelerated debt repayment makes it an attractive option for many.

Impact of Debt on Millennials

Millennials are one of many groups facing a significant debt burden. This generation, now in their 30s, has accumulated a historic $3.8 trillion in debt, which affects various aspects of their lives.

Credit card debt is a significant concern for millennials. High interest rates make it challenging to pay off balances, leading to a cycle of growing debt.

Student loans also play a significant role. Many millennials entered the workforce with substantial educational debt, impacting their ability to save or invest.

Housing costs contribute to the debt problem. Rising home prices and mortgages add to the financial pressure on this generation.

The debt burden affects millennials’ financial decisions:

- Delayed homeownership

- Postponed marriage and family planning

- Reduced retirement savings

- Limited entrepreneurial ventures

Financial stress can impact mental health and overall well-being. Many millennials report anxiety and depression related to their debt situation.

Despite these challenges, millennials are seeking solutions. Some are exploring debt repayment strategies to improve their financial outlook, and others are advocating for policy changes to address the root causes of debt accumulation.

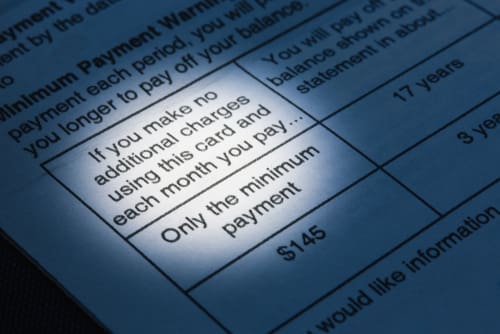

Principle 1: Pay the Minimum Payment

Making minimum payments on debts is the first step in managing financial obligations. This approach ensures individuals meet basic requirements while laying the groundwork for more aggressive repayment strategies.

Importance of Meeting Minimum Obligations

Paying the minimum amount due each month is crucial for maintaining a good credit score. It shows lenders that you’re responsible and can be trusted with credit. Missing payments can lead to costly fees and damage your credit history.

Minimum payments help avoid:

- Late fees

- Penalty interest rates

- Negative credit report entries

While this method doesn’t rapidly reduce debt, it keeps accounts in good standing. This preserves future borrowing options and prevents debt from spiraling out of control.

Long-Term Debt Repayment

Relying solely on minimum payments extends the time needed to clear debts. Interest continues to accrue, increasing the total amount paid over time. For example, a $910 emergency purchase could end up costing $2,029.47 after 154 minimum payments.

Minimum payment strategies work best when combined with other debt reduction methods. They provide a stable foundation while allowing flexibility to apply extra funds to high-interest debts.

Key considerations:

- Interest continues to compound

- Total repayment time is extended

- More money is paid in interest over time

Principle 2: Pay Half of the Minimum Payment

Paying half of the minimum and full payments can speed up debt repayment and cut interest costs. This approach helps borrowers tackle their debts more aggressively.

Accelerating Debt Repayment

Borrowers can reduce their debt faster by paying half the minimum extra payment. For a $10,000 credit card balance with an 18% interest rate and a $200 minimum payment, adding $100 more each month makes a big difference.

This strategy shortens the repayment period by about 18 months. The debt gets paid off in 3.5 years instead of 5 years with just minimum payments.

A payment calculator can show how extra payments affect the loan term. Even small additional amounts can lead to significant time savings.

Reducing Interest Over Time

Extra payments decrease the principal balance faster, which means less interest accrues over time. In the $10,000 credit card debt example, paying an additional $100 monthly saves over $3,000 in interest charges.

This method works well for high-interest debts like credit cards. The sooner the principal is paid off, the less interest increases each month.

Borrowers can track their progress by checking their monthly statements. Over time, they’ll see the principal balance drop more quickly and the portion of each payment to interest shrink.

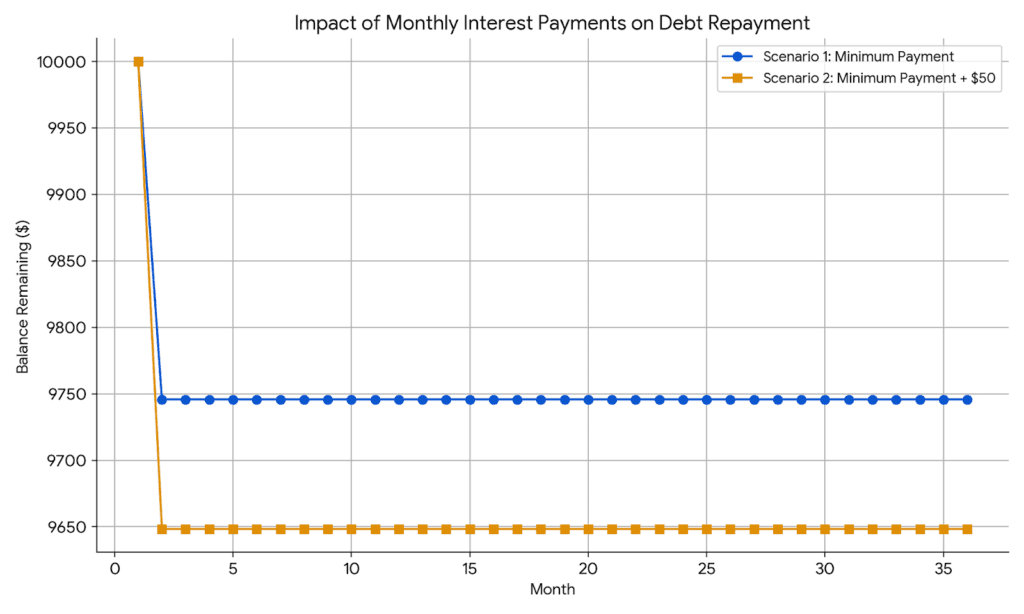

Principle 3: Pay an Interest Payment Each Month

Monthly interest payments can significantly reduce overall debt and accelerate the payoff timeline. This approach targets the interest directly, preventing it from compounding and slowing down debt repayment.

Minimizing Interest Accrual

Paying extra towards interest helps minimize the amount of interest that accrues over time. Borrowers can chip away at the total interest owed more quickly by allocating additional funds specifically to interest.

For example, on a $10,000 credit card balance with an 18% interest rate, an extra $50 monthly interest payment could save over $1,500 in interest charges over the life of the debt. This strategy reduces the total interest paid and shortens the repayment period.

Strategic Additional Payments

Planning strategic additional payments can maximize the impact of this principle. Borrowers can time these extra payments to coincide with periods of increased cash flow, such as after receiving a bonus or tax refund.

A consistent approach, like adding $25 or $50 to each monthly payment, can yield significant long-term results. For a $20,000 loan at 6% interest over 5 years, an extra $50 monthly payment could save nearly $500 in interest and pay off the loan 4 months earlier.

Using an amortization calculator can help visualize the impact of these additional payments. It allows borrowers to see how even small extra payments can lead to substantial savings over the loan term.

Chart Demonstrations

Visual representations help illustrate the effectiveness of the Debt Meltdown Method. These charts showcase the method’s impact on debt repayment timelines, interest savings, and payment allocations.

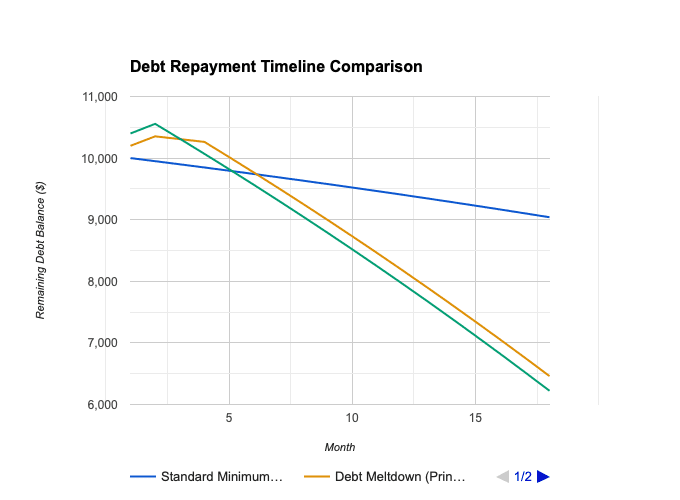

Chart 1: Debt Repayment Timeline Comparison

This chart compares debt repayment timelines using different strategies. It shows a $10,000 credit card debt with an 18% interest rate and a $200 minimum monthly payment.

The blue line represents the standard minimum payment approach, which takes 94 months to repay. The orange line shows the Debt Meltdown Method, which combines principles 1 and 2 and repays in 76 months. The green line demonstrates all three principles, resulting in full repayment in just 58 months.

This visual demonstrates helping individuals become debt-free faster.

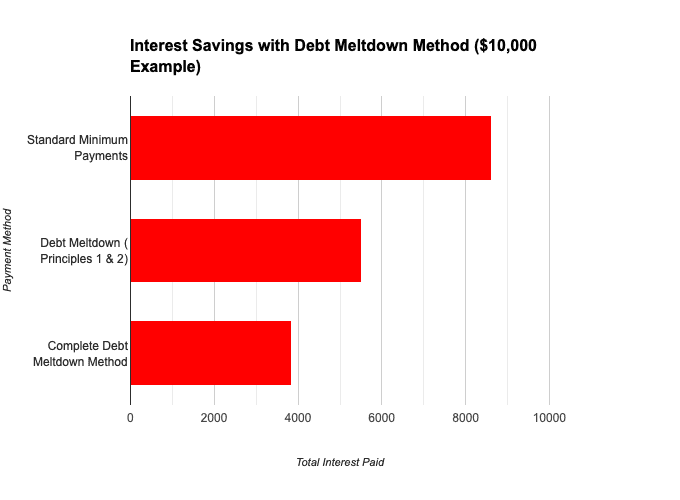

Chart 2: Interest Savings Breakdown

This chart breaks down the interest savings achieved through the Debt Meltdown Method. Using the same $10,000 debt example:

- Standard minimum payments: $8,622 total interest paid

- Debt Meltdown Method (Principles 1 & 2): $5,512 interest paid

- Complete Debt Meltdown Method: $3,845 interest paid

The bar graph visually represents these differences, highlighting the substantial savings. By implementing all three principles, individuals can save $4,777 in interest compared to making only minimum payments.

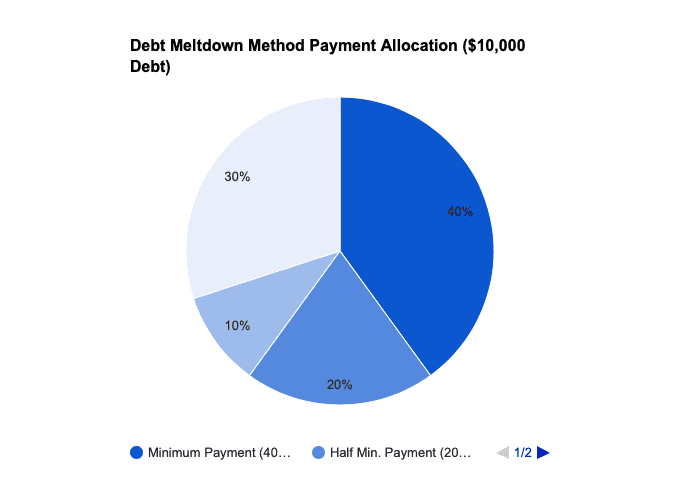

Chart 3: Payment Allocation Example

This pie chart illustrates how payments are allocated using the Debt Meltdown Method for a $10,000 debt with 18% interest and a $200 minimum fee.

- 40% – Minimum payment ($200)

- 20% – Half of minimum payment ($100)

- 10% – Additional interest payment ($50)

- 30% – Principal reduction ($150)

This breakdown shows how the method directs more funds toward principal reduction, accelerating debt repayment. The chart emphasizes the importance of making extra payments beyond the minimum to tackle debt effectively.

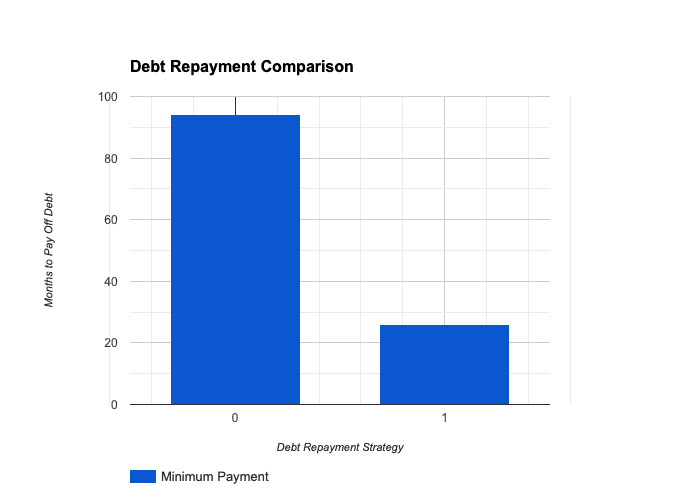

Calculating Benefits of the Debt Meltdown Plan

The Debt Meltdown Plan offers clear financial advantages for individuals looking to pay off debt quickly. Its three-pronged approach can lead to significant savings and faster debt elimination.

Scenario Analysis

Let’s examine a typical debt scenario using the Debt Meltdown Plan. Assume an individual has $20,000 in credit card debt, an 18% interest rate, and a $400 minimum monthly payment.

Using only the minimum payment, the debt would be paid off in 94 months, with $17,737 paid in interest.

Applying the Debt Meltdown Plan:

- Minimum payment: $400

- Half of the minimum: $200

- Interest payment: $300

Total monthly payment: $900

With this strategy, the debt would be paid off in just 26 months, with only $4,380 paid in interest.

A debt repayment comparison shows that the plan saves $13,357 in interest and eliminates debt 68 months faster.

This analysis demonstrates the Debt Meltdown Plan’s effectiveness in rapidly reducing debt and minimizing interest payments.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We do not offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized guidance. Track your progress for an improved credit journey.

Written content – “Please view our complete AI Use Disclosure.”

We enhance our products and advertising by using Microsoft Clarity to understand how you interact with our website. By using our site, you agree that we and Microsoft can collect and utilize this data. Our privacy policy provides further details.