The 181 Point Credit Score Challenge: Transform Your Finances. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

- The 181 Point Credit Score Challenge: Transform Your Finances. Find Out More In Our Latest Article!

- Are you looking for a challenge to improve your credit scores?

- Quick Guide to Boosting Your Credit Score

- Maximizing Credit Scores: The Power of Triple Report Checks

- Mastering Credit Score Enhancement

- Why Checking Your Credit Reports Regularly Matters

- Check Your Credit Reports Regularly

- Credit score types to consider

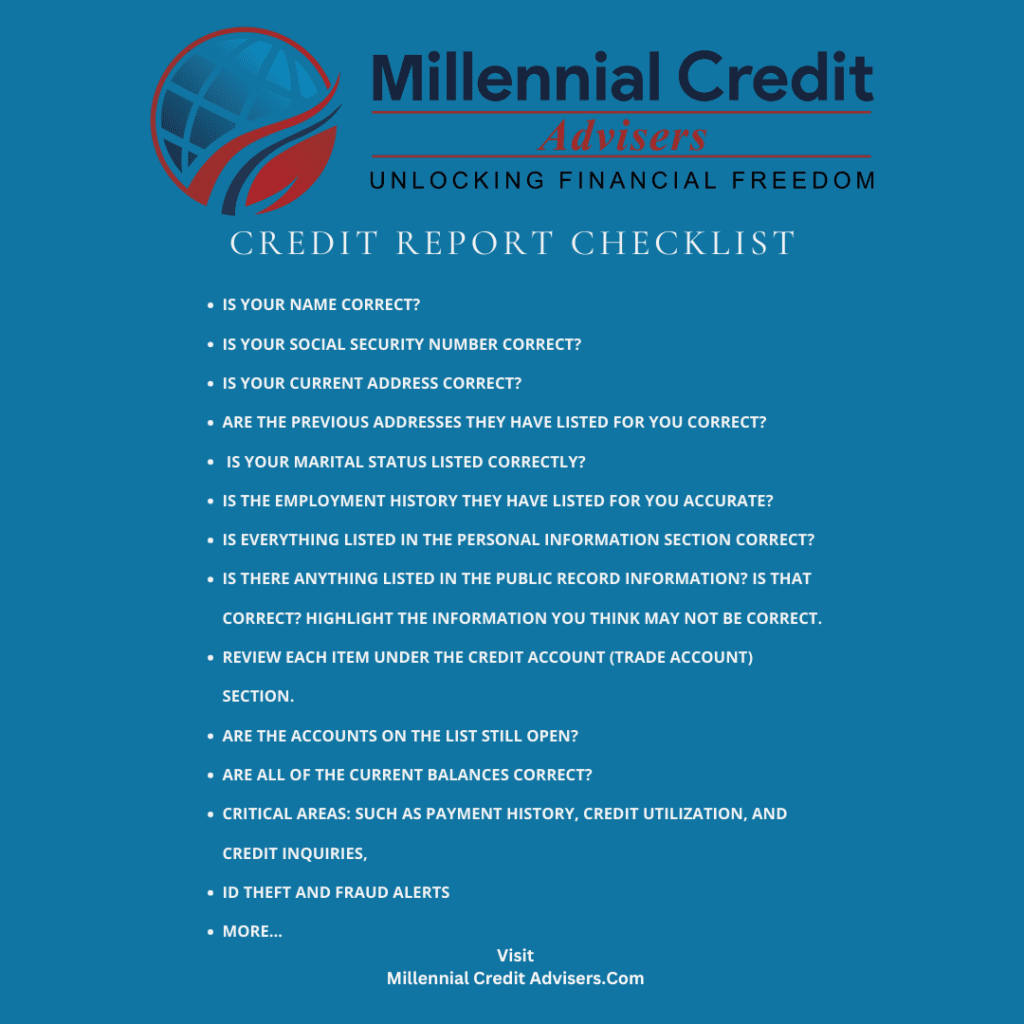

- Stay on top of your credit report with a review checklist

- Breaking Bad Credit Habits: Steps to Financial Health

- Poor credit practices impact your financial future

- Elevate Your Credit Score in These 5 Key Areas

- Recognizing and Correcting Poor Credit Practices

- Elevating Credit Scores: Small Steps Lead to Big Savings

- Wrapping Up Your Credit Journey

Are you looking for a challenge to improve your credit scores?

This article explores a remarkable case of an 181-point credit score increase, shedding light on the strategies and steps that can lead to such impressive results.

Credit scores play a crucial role in financial well-being. Many people wonder if they can significantly boost their credit scores quickly.

Improving one’s credit score often requires patience and consistent effort. Yet, some individuals have managed to achieve substantial gains more rapidly than expected.

By examining this specific instance of a major credit score jump, readers can gain valuable insights into effective credit-building techniques and potential pitfalls to avoid.

Quick Guide to Boosting Your Credit Score

Regular credit report checks are crucial for maintaining a healthy financial life. Many people overlook this important task, but it’s key to spotting errors and improving your score. Here’s what you need to know:

- Check all three major credit bureaus

- Look for mistakes or suspicious activity

- Use a checklist to stay organized

Good credit habits make a big difference. Focus on these areas:

- Payment history

- Credit utilization

- Length of credit history

- Credit mix

- New credit inquiries

Even small improvements can have a big impact. A single point increase can move you into a better credit category. This can lead to:

- Lower interest rates

- Better loan terms

- More financial opportunities

By regularly reviewing your credit reports, you’ll be on the path to stronger credit and a brighter financial future.

Maximizing Credit Scores: The Power of Triple Report Checks

Credit scores play a crucial role in financial health. Many people don’t realize how important these three-digit numbers can be. Credit scores can range from poor to excellent, typically spanning 300 to 900 points depending on the scoring system.

Checking credit reports from all three major agencies is key. This practice helps catch errors and understand what factors are affecting scores. It’s a common misconception that all credit reports and scores are the same. In reality, they can vary significantly.

Here are some benefits of improving credit scores:

- Lower interest rates on loans

- Better rewards and perks from credit cards

- Increased savings opportunities

- More favorable terms from lenders

Improving credit takes time and effort, but even small gains matter. A single point increase can be motivating and signal the start of positive change. With consistent effort, scores can move from poor to good, then to very good, and eventually reach excellent.

To boost credit scores:

- Review reports regularly

- Address any errors promptly

- Pay bills on time

- Keep credit utilization low

- Avoid applying for new credit too often

It’s important to avoid negative items on credit reports. These can significantly impact scores. Taking proactive steps to improve credit can lead to noticeable changes, sometimes more quickly than expected.

Credit improvement opens doors to better financial opportunities. It allows for more favorable loan terms, access to premium credit cards, and increased negotiating power with lenders. The journey from poor to excellent credit is achievable with dedication and the right strategies.

Remember, credit scores are not fixed. They change based on financial behaviors and reported information. Regular monitoring and positive financial habits are key to maintaining and improving scores over time.

Mastering Credit Score Enhancement

Want to boost your credit score? Start with simple steps. Order your credit reports and scores. Take a close look at your debts and credit situation. Use a basic budget to track spending and pay down debts. Review your credit reports carefully.

Remember, credit can always get better with time and effort. Here are some key points:

- Use legitimate methods that fit your situation

- Positive changes to your credit history have lasting effects

- Begin by ordering and reviewing your reports and scores

These steps will set you on the right path. Credit improvement takes time, but it’s worth it. Regular reviews of your credit reports are crucial. They help you spot errors and track progress.

Here’s a simple checklist to get started:

- Get your credit reports

- Check for errors

- Set up a budget

- Pay bills on time

- Reduce credit card balances

Stay focused on your goals. With patience and effort, you can improve your credit score.

Why Checking Your Credit Reports Regularly Matters

Keeping an eye on your credit reports is a smart financial habit. It gives you a clear picture of your credit health and helps you take control of your finances.

Regular reviews let you:

• Track your credit scores • Spot areas for improvement • Prepare for loan applications • Compare different credit reports • Manage debts effectively

Credit reports show how you use credit. By looking at them often, you can learn to use credit better. This can lead to higher scores over time.

Checking your reports also helps catch mistakes. You might find:

- Wrong personal details

- Accounts you didn’t open

- Incorrect balances

It’s important to fix these errors quickly. They can hurt your credit score if left alone.

Looking at your reports regularly also shows who’s checking your credit. This can help you spot possible identity theft early.

Here’s a quick breakdown of what to look for:

| Item to Check | Why It’s Important |

|---|---|

| Personal Info | Ensure accuracy |

| Account List | Verify all accounts are yours |

| Payment History | Check for late payments |

| Credit Inquiries | See who’s viewed your credit |

By staying on top of your credit reports, you’re taking a big step towards better financial health. It’s a simple task that can have a big impact on your future money choices.

Check Your Credit Reports Regularly

Keeping tabs on your credit reports is vital for your financial health. You can now get free weekly online credit reports from the major bureaus at annualcreditreport.com. This allows you to stay on top of your credit situation.

There are many good reasons to review your credit reports often:

- Many businesses can see your credit info

- Your personal data could be at risk from identity theft or data breaches

- It’s important to compare reports from different bureaus

- Getting credit scores with your reports is helpful

When you order your reports, be sure to:

- Look for any errors or suspicious activity

- Note both positive and negative information

- Identify areas for easy improvement

Checking your reports regularly helps you track your progress over time. You can spot potential issues early and take steps to boost your credit. Making this a habit is key for building and maintaining strong credit.

Credit score types to consider

Many companies provide credit scores, but some are more widely used than others. FICO scores stand out as the most important. Banks and other lenders use FICO scores in 90% of lending decisions. This makes FICO scores very useful for consumers to track.

Knowing your FICO score can help you make smarter choices about credit. It may also save you money over time. But don’t stop there. It’s smart to look at scores from other major companies too, like Equifax, Experian, and TransUnion.

When you check your credit reports:

- Compare scores from different companies

- Look for differences between reports

- Check for correct and incorrect information

- Watch for unknown activity

This thorough approach gives you a full picture of your credit health. It helps you spot issues and take action to improve your scores.

Stay on top of your credit report with a review checklist

A credit report review checklist can be a helpful tool for tracking key details. It lets you record important information and note any changes since your last review.

Use this checklist along with your financial records to keep tabs on both positive and negative items. This can help you spot any issues quickly and see your progress over time.

Make sure to update your checklist each time you check your reports to maintain an accurate picture of your credit history.

Breaking Bad Credit Habits: Steps to Financial Health

Poor credit habits can lead to significant financial challenges. A low credit score can limit options and result in unfavorable terms when seeking loans or making major purchases.

Consider a car-buying experience with subpar credit:

- Limited to high-risk dealerships

- Extremely high interest rates (over 29%)

- Poor quality vehicles with mechanical issues

- Extra charges for basic features

To avoid these pitfalls, focus on developing positive credit behaviors:

- Pay bills on time

- Keep credit utilization low

- Maintain a mix of credit types

- Limit new credit applications

- Regularly check credit reports for errors

Building good credit takes time and effort. It involves making consistent, responsible financial decisions. By practicing effective credit habits, individuals can improve their credit scores and access better financial opportunities.

Key areas to address:

| Area | Action |

|---|---|

| Payment History | Set up automatic payments |

| Credit Utilization | Keep balances below 30% of limits |

| Length of Credit | Keep old accounts open |

| Credit Mix | Maintain different types of credit |

| New Credit | Apply for new credit sparingly |

By focusing on these areas, people can gradually improve their credit standing and avoid the pitfalls associated with poor credit.

Poor credit practices impact your financial future

Bad credit habits can have long-lasting effects on your financial health. Late payments are a prime example of a harmful practice that needs to be addressed.

Payment history is a key factor in credit reports and can significantly impact your credit standing.

Once a payment is reported as late, it’s too late to fix the damage. The consequences of poor credit habits include:

- Higher interest rates

- Extra fees and penalties

- Negative marks on credit reports

- Lower credit scores

- Accounts sent to collections

These negative impacts can last for years on your credit report. They can also affect major financial decisions, like buying a car.

To maintain good credit, it’s crucial to:

- Pay bills on time

- Keep credit utilization low

- Avoid applying for too much credit at once

- Regularly check your credit report

By avoiding these pitfalls, you can build a strong credit history and improve your financial options.

Elevate Your Credit Score in These 5 Key Areas

Take charge of your financial future by focusing on these important aspects of credit management:

- Pay attention to credit reports: Review your reports regularly to spot errors and track progress.

- Create a financial roadmap: Develop a long-term plan and budget to guide spending and credit use.

- Set and update credit goals: Establish clear objectives and adjust them as needed.

- Lower debt-to-income ratio: Work on reducing debts while increasing income.

- Build emergency savings: Use credit wisely to increase your emergency fund.

By focusing on these areas, you can improve your credit score and potentially save thousands in interest over time. Good credit habits extend beyond just your score – they can positively impact many areas of your financial life.

Recognizing and Correcting Poor Credit Practices

Credit improvement starts with identifying problematic habits. Many people find success by focusing on five key areas.

Regular credit report monitoring helps spot issues and track progress. Paying down debt, especially credit card balances, is crucial.

Better budgeting and income tracking lead to smarter financial decisions. Automating bill payments prevents late fees and missed payments.

Building an emergency fund provides a safety net and reduces reliance on credit.

These habits form the foundation of a solid credit strategy:

- Monitor credit reports

- Reduce debt

- Budget and track income

- Automate bill payments

- Save for emergencies

By adopting these practices, individuals can steadily improve their credit scores over time.

The journey to better credit begins with obtaining current credit reports to assess the starting point. From there, consistent application of good habits yields positive results.

Elevating Credit Scores: Small Steps Lead to Big Savings

Improving a credit score can bring significant financial benefits. Even a small increase can make a big difference. As credit scores rise, people often see savings in many areas of their financial lives.

Lower interest rates are a key advantage of better credit. This can mean smaller monthly payments on loans and credit cards.

Many fees may also be reduced or eliminated entirely.

Better credit can lead to lower or no down payments on purchases. This frees up cash for other needs. Secured deposits may no longer be required, keeping more money in your pocket.

Credit line increases are another perk of improved scores. This can provide more financial flexibility and potentially boost credit further if used wisely.

Some of the best rewards come with better credit:

- Travel perks like companion fares

- Access to airport lounges

- Exclusive credit card benefits

These rewards can add up to substantial savings over time. While the journey to better credit takes effort, the payoff in financial advantages makes it worthwhile.

Wrapping Up Your Credit Journey

Ready to take on your credit challenge?

Improving credit requires dedication along with proven and innovative strategies. Focus on paying down debts and ordering credit reports regularly. Also, look for bad habits that may hurt your credit reports and scores.

Take time to review your reports for any errors carefully.

Building an emergency fund is crucial. Even small savings can help cover unexpected costs and boost financial stability.

Set long-term goals to steadily enhance your finances and credit standing.

Some key steps to consider:

• Pay off debts systematically

• Check credit reports from all bureaus

• Watch for and correct harmful credit behaviors

• Save for emergencies, even in small amounts

• Work towards long-term financial improvement

With consistent effort, you can make major credit score gains. Many have achieved triple-digit increases by following sound practices.

Remember that credit improvement is a journey. Track progress over time to stay motivated.

Celebrate milestones along the way, whether big or small.

For personalized guidance, consider speaking with a qualified financial advisor. They can provide tailored advice for your specific situation.

Ultimately, better credit opens doors to improved financial health. Lower interest rates, better loan terms, and more opportunities become available as scores rise.

Stay focused on positive habits, and your credit score will likely follow suit.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content – “Please view our full AI Use Disclosure.”

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.