Published September 2005. Credit Advisers of America Offers Over 100 Products for One-Stop Access

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO

Published September 2005

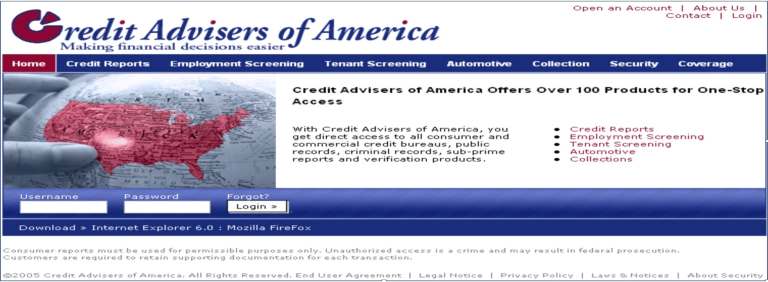

Credit Advisers of America Offers Over 100 Products for One-Stop Access

Newly updated website and services enable businesses, from Small to large, to Access Credit Reports Instantly from All Consumer and Commercial Credit Bureaus, and accelerate business with sub-prime products and decisioning tools. Credit Advisers of America, which offers automated decision-making, collection services, and data products, has announced major upgrades, including website updates for businesses.

In today’s rapidly evolving economy, timely information is crucial for success. They provide access to industry benchmarks, risk management tools, and decision-making data, enabling businesses to find answers efficiently.

The upgrades create a unified platform for managing debts. Over 100 products provide direct access to credit bureaus, records, reports, verification, and real-time screening.

The company emphasizes that updated information is vital for assessing businesses and customers, reducing ambiguity in lending and financial decisions. They also offer analytical tools, data collection, and web-based tools, as well as products to aid in informed financial decisions.

For more details, contact Credit Advisers of America or visit their website.

However, Credit Advisers of America, Inc. is now inactive and no longer actively offers reseller services and data reports.

Today, the Millennial Credit Advisers blog is giving back by empowering people of all ages with the knowledge they need to make practical, informed decisions easily.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We do not offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized guidance. Track your progress for an improved credit journey.

Written content – “Please view our complete AI Use Disclosure.”

We enhance our products and advertising by using Microsoft Clarity to understand how you interact with our website. Using our site, you agree that we and Microsoft can collect and utilize this data. Our privacy policy provides further details.