How Can You Save Up to $5,787? Discover the Best Ways to Pay Your Credit Card Bill. Uncover the Advantages Today. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

Don’t Have Time To Read The Full Article. Here’s What You Are Missing.

- How Can You Save Up to $5,787? Discover the Best Ways to Pay Your Credit Card Bill. Uncover the Advantages Today. Find Out More In Our Latest Article!

- Understanding Credit Card Debt

- Did You Miss This Money Saving Information?

- Strategies for Reducing Credit Card Bills

- Negotiating with Creditors

- Benefits of Paying in Full

- Credit Score Improvement

- The Downside of Minimum Payments

- How A Minimum Payment Warning saved me over $5,787.

- Action Plan to Eliminate Debt

- Creating a Budget

- Setting Up Payment Reminders

- Make sure you pay at least the minimum payment each month.

- Tracking Your Progress

- Best Apps and Financial Tools

- Frequently Asked Questions

If you’re carrying credit card debt, you’re not alone. Credit card debt balances have increased to over $1.14 trillion, according to a recent Q2 2024 report from the Federal Reserve Bank of New York and the U.S. Census Bureau.

Carrying a balance from month to month can be costly. Interest charges can add up quickly, making it difficult to pay off your debt. That’s why it’s important to have a plan to pay off your credit card debt as soon as possible.

One strategy for paying off credit card debt is to pay your balance in full each month.

By using this powerful strategy, you avoid paying interest charges and reduce the time it takes to pay off your debt.

However, paying your balance in full can be challenging, especially if you have a large balance.

If you’re not able to pay off the balance in full. With the right strategy, you can make it happen.

In this article, I’ll share some tips for paying off your credit card debt in full and explain the benefits of doing so.

Understanding Credit Card Debt

Credit card debt is a common financial burden. It’s easy to fall into the trap of overspending and inability to pay off the balance each month, leading to long-term debt and economic mess and more stress.

When you carry a balance on your credit card, here’s what happens: You are charged interest on the unpaid amount. The interest rate can be high and quickly add up over time. If you only make the minimum monthly payment, you will pay more interest, which will take longer to pay off your balance.

Did You Miss This Money Saving Information?

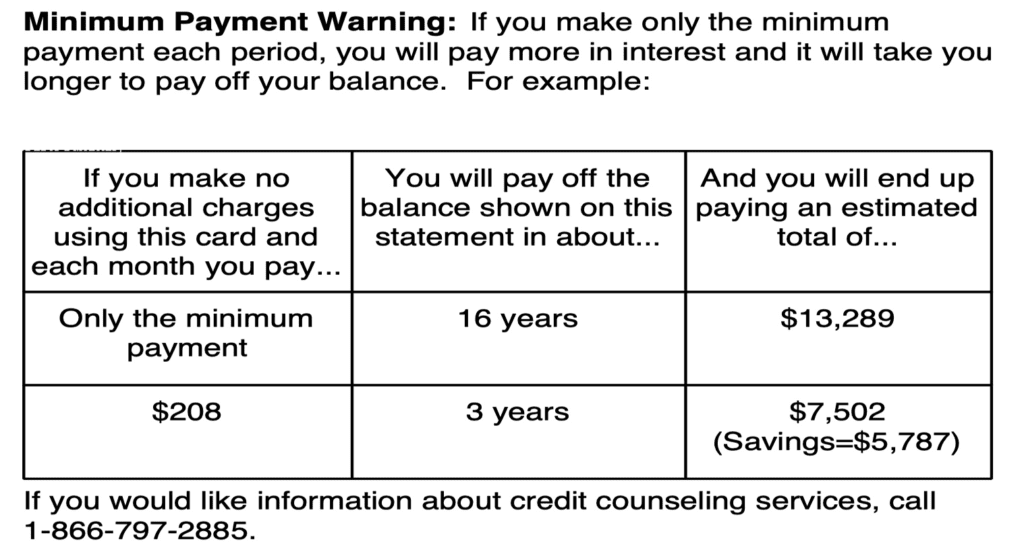

The minimum payment warning that credit card companies must provide is often over looked. This warning shows how long it will take to pay off the balance if you only make the monthly minimum payment.

This can be a wake-up call for many people who need to know how long it will take to pay off their debt and a tremendous money and time saver if the saving recommendations are followed.

If you want to avoid long-term debt and high-interest charges.

- The best way is to pay off your credit card balance in full each month.

- One benefit of paying off your credit card balance in full each month is improving your credit score.

- Another benefit of paying off your balance in full each month is that you can keep your credit utilization rate low, which could improve your credit score over time.

- A high credit utilization rate, the amount of credit you use compared to your credit limit, can negatively impact your credit score.

Credit card debt can be a financial burden, leading to long-term debt and stress. But it shouldn’t have to be.

Avoiding long-term debt and high-interest charges may require applying a few changes to your current budgeting practices. Beneficial changes you make now to your savings plan can be a wise financial decision in the short and long term.

Understanding the minimum payment warning and the impact of high interest rates can help you make informed decisions about your finances and save you money.

- Paying off your credit card balance in full each month can be a smart financial decision. It can help you improve your credit score and avoid long-term debt.

Strategies for Reducing Credit Card Bills

Assessing Your Debt

Before reducing your credit card bills, you must clearly understand your debt. Start by reviewing your credit card statements and listing all your debts. Include each account’s interest rate, minimum payment, and outstanding balance. This will help you prioritize which debts to pay off first.

Consolidation Options

Consolidating your credit card debt can be a smart way to reduce your monthly payments and interest rates. One option is to transfer your balances to a lower-interest credit card.

Many credit card companies offer balance transfer promotions with low or 0% interest rates for a limited time. Be sure to read the fine print and understand any fees associated with balance transfers.

Another option for consolidation is a personal loan. With a personal loan, you can pay off your credit card debt and have a fixed monthly payment with a lower interest rate. This can help you pay off your debt faster and save money in interest charges.

Negotiating with Creditors

If you’re struggling to make your monthly payments, consider negotiating with your creditors. Many credit card companies will work with you to create a payment plan that fits your budget.

You can negotiate a lower interest rate or waive late fees. It’s important to be proactive and contact your creditors before you fall behind on your payments.

Remember, paying off your credit card debt in full is the best way to save money and improve your credit. Avoid making only the minimum monthly payment, leading to long-term debt and higher interest charges.

By assessing your debt, exploring consolidation options, and negotiating with your creditors, you can take control of your credit card bills and improve your financial situation.

Benefits of Paying in Full

Interest Savings

Paying off your credit card debt in full can help you save significant money in interest charges. When you only make the minimum payment, you’re mostly paying the interest charges and not making much progress in reducing the principal balance.

This means it will take you much longer to pay off your debt, and you’ll pay much more interest charges over time.

For example, let’s say you have a credit card balance of $5,000 with an interest rate of 18%. If you only make the minimum payment of 2% of the balance each month, it will take you over 22 years to pay off your debt, and you’ll end up paying over $9,000 in interest charges alone.

However, if you pay off your debt in full, you’ll save yourself from paying all that extra interest and reduce your debt to zero.

Credit Score Improvement

Paying off your credit card debt fully can also improve your credit score. Your credit utilization ratio, the amount of credit you use compared to your credit limit, is an essential factor in determining your credit score.

When you carry a high balance on your credit card, your credit utilization ratio increases, which can negatively impact your credit score.

However, when you pay off your credit card debt in full, your credit utilization ratio decreases, which can improve your credit score.

In addition, paying off your credit card debt in full shows lenders that you’re responsible with your credit and can manage your debt effectively. This can help you qualify for better interest rates and other loans in the future, such as mortgages and car loans.

Paying off your credit card debt in full is a smart financial move that can help you save money and improve your credit score.

If you’re struggling to pay off your debt, consider creating a budget, reducing your expenses, and finding ways to increase your income to pay off your debt faster.

The Downside of Minimum Payments

As tempting as it may be to make only the minimum payment on your credit card bill each month, it’s essential to understand the long-term consequences of this approach.

Long-Term Debt Accumulation

Making only the minimum payment on your credit card will result in a balance that accumulates month after month, accumulating interest charges.

Over time, this can lead to significant debt, making it difficult to pay off your balance and damaging your credit score.

For example, let’s say you have a credit card balance of $10,000 with an interest rate of 21%. If you only make the minimum payment each month, it will take you over 20 years to pay off your balance, and you’ll end up paying over $22,000 in interest alone. That’s more than double your original debt!

Credit card companies must disclose a minimum payment warning on their monthly statements.

How A Minimum Payment Warning saved me over $5,787.

This warning outlines how long it will take to pay off your balance and how much interest you’ll pay if you only make the minimum monthly payment.

It is designed to help you understand the consequences of making only the minimum payment.

Ignoring this warning and making only the minimum payment can have serious consequences.

You will pay more interest, and your credit score may also suffer.

This is because credit utilization, the amount of credit you’re using compared to your total credit limit, is an important factor in determining your credit score.

By carrying a balance and making only the minimum payment, you’re likely using a high percentage of your available credit, which can lower your credit score.

While it may be tempting to make only the minimum payment on your credit card bill each month, it’s essential to understand the long-term consequences of this approach.

By paying off your debt in full, you can avoid this minimum payment warning, accumulating long-term debt and improve your credit score.

Action Plan to Eliminate Debt

Creating a Budget

To start paying off your credit card debt, you must create a game plan that works using a budget. A budget will help you to see where your money is going and where you can cut back.

List all your income and expenses, including your credit card payments. Then, look for areas where you can reduce your spending. For example, you could cut back on eating out, How to Budget Food: Your Guide to Smart Spending or managing a subscription service you don’t use with apps disign to optimize savings.

Setting Up Payment Reminders

Late payments can hurt your credit score and incur additional fees and interest charges. To avoid this, set up payment reminders. You can do this by setting up automatic payments using the best reminder apps or setting reminders on your phone or calendar.

Make sure you pay at least the minimum payment each month.

Tracking Your Progress

It is important to track your progress as you pay off your credit card debt. This will help you stay motivated and see how far you’ve come. You can do this by creating a spreadsheet or using a budgeting app.

Make sure to update it regularly and celebrate your progress along the way.

Remember, paying off your credit card debt in full is the best way to avoid long-term debt and improve your credit score.

By creating a budget, setting up payment reminders, and tracking your progress, you can eliminate your debt and start saving for your future. What to Do With Extra Money: Smart Strategies for Your Spare Cash.

Best Apps and Financial Tools

Best Budgeting And Savings App

Keeping track of your expenses and savings can take time and effort.

- Thankfully, many budgeting and savings apps are available to make things easier.

- Looking for the right financial management tool to help you achieve long-term financial stability or a comprehensive financial management approach? Quicken vs YNAB.

- Are you looking for the best money-saving app with an excellent suite of tools for managing finances effectively? Analyze your spending habits and suggest areas for savings.

Best Bill Organizer App

Organizing your bills can be a hassle, especially if multiple bills are due at different times throughout the month. Fortunately, many bill organizer apps can help simplify the process.

Be sure to use apps that allows you to keep track of all your bills in one place, set reminders for when bills are due, and track your payment history.

Have an iPhone stay on top of your finances without the headache by using the Best Free Bill Organizer App for iPhone – Stay on Top of Your Finances Effortlessly.

Best Bill Reminder App

Forgetting to pay a bill can be costly, resulting in late fees and damage to your credit score. To avoid this, having a reliable bill reminder app is important.

These apps allow you to track all your bills in one place, set reminders for when bills are due, and make payments directly through the app.

Best Financial App

Managing your finances can be overwhelming, but it can be much easier with the right app. Two of many budgeting apps available are YNAB vs Empower: Comparing Budgeting and Financial Planning Tools

Both powerful apps stand out for their specialized approaches. Whether you’re interested in zero-based budgeting or comprehensive financial management, find out how you can benefit from apps that offer personalized investment advice and financial planning services.

Using these tools, you can take control of your finances and work towards paying off your debt in full.

Remember, paying your debt in full is the best way to avoid long-term debt and improve your credit score. What to Do With Extra Money: Smart Strategies for Your Spare Cash.

Frequently Asked Questions

What are the disadvantages of paying off debt early?

There are generally no disadvantages to paying off debt early. It can save you money in interest charges and improve your credit score. The only potential disadvantage is that you may have less cash in the short term if you use your savings to pay off debt.

How does paying off a credit card in full affect my credit score?

Paying off a credit card in full can positively impact your credit score. This is because it shows that you can manage your credit responsibly and pay back what you owe. However, if you have a high balance on your credit card, paying it off in full could cause a temporary dip in your credit score due to changes in your credit utilization ratio.

Is paying off one credit card more beneficial or spreading payments across multiple cards?

Paying off one credit card at a time is generally more beneficial than spreading payments across multiple cards. This is because it lets you focus your efforts and pay off one debt before moving on to the next. Additionally, paying off a credit card in full can have a positive impact on your credit score.

Can paying off my entire credit card balance every month negatively impact my credit score?

No, paying off your entire credit card balance every month should not negatively impact your credit score. It can have a positive impact by showing that you can manage your credit responsibly and pay back what you owe.

Should I close my credit card account after paying it off?

Closing a credit card account after paying it off is generally not recommended. This is because it can have a negative impact on your credit score by reducing your available credit and increasing your credit utilization ratio. Instead, consider keeping the account open and using it responsibly to maintain a good credit score.

How can I effectively pay off credit card debt while also saving money?

One effective way to pay off credit card debt while saving money is to create a budget and stick to it. This can help you identify areas where you can reduce spending and redirect those funds toward paying off your debt. Additionally, consider using balance transfer cards, consolidating your debt, and negotiating with creditors to lower interest rates.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content – “Please view our full AI Use Disclosure.”

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.