Debt-Free: Tips for Achieving Financial Freedom. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

Don’t Have Time To Read The Full Article. Here’s What You Are Missing.

- Debt-Free: Tips for Achieving Financial Freedom. Find Out More In Our Latest Article!

- Understanding Debt

- Types of Debt

- The Impact of Debt on Financial Health

- Strategies for Becoming Debt-Free

- Budgeting and Expense Management

- Debt Snowball Method

- Debt Avalanche Method

- Debt Meltdown Method

- Building an Emergency Fund

- Increasing Income

- Negotiating Salary

- Side Hustles and Passive Income

- Credit Score Improvement

- Reviewing Credit Reports

- Responsible Credit Use

- Long-Term Financial Planning

- Investment Strategies

- Retirement Savings

- Psychological Aspects of Debt

- Debt-Free Lifestyle

- Minimalism and Frugality

- Maintaining Financial Discipline

Debt is an all-too-common issue that many people face in their lives. It can be overwhelming and stressful, causing anxiety and worry. However, it is possible to become debt-free with proper planning and discipline.

In this article, we will explore the concept of debt-free, including what it means, why it is essential, and how it’s now easier to achieve.

Being debt-free means having no outstanding debts, such as credit card balances, loans, or mortgages.

You don’t have to completely change your lifestyle to become debt-free, as many types of debt are essential to building financial security.

Being debt-free feels better, it can be a significant accomplishment, which puts you in elite company providing financial freedom and peace of mind.

It allows individuals to focus on their goals and aspirations rather than being weighed down by the debt burden.

There are many reasons why becoming debt-free is essential. For one, it allows individuals to save for emergencies, retirement, and other worthwhile goals.

It also provides a sense of security, as there is no need to worry about making monthly payments or falling behind on bills.

Additionally, being debt-free can improve credit scores, making it easier to obtain loans or credit in the future.

It’s helpful to have a understanding of debt, how it impacts your financial health, how debt freedom should be part of your short and long-term planning.

If you’re in debt, read further about how a debt-free lifestyle can significantly impact your expenses, savings, and financial freedom.

Understanding Debt

Debt is an amount borrowed by an individual or an organization that needs to be repaid with interest. It is a standard financial tool to fund various expenses, such as education, housing, and business investments. However, debt can also become a burden if not managed properly.

Types of Debt

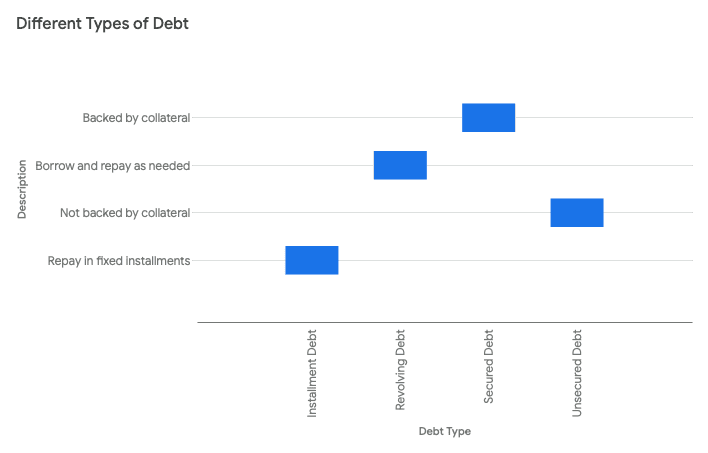

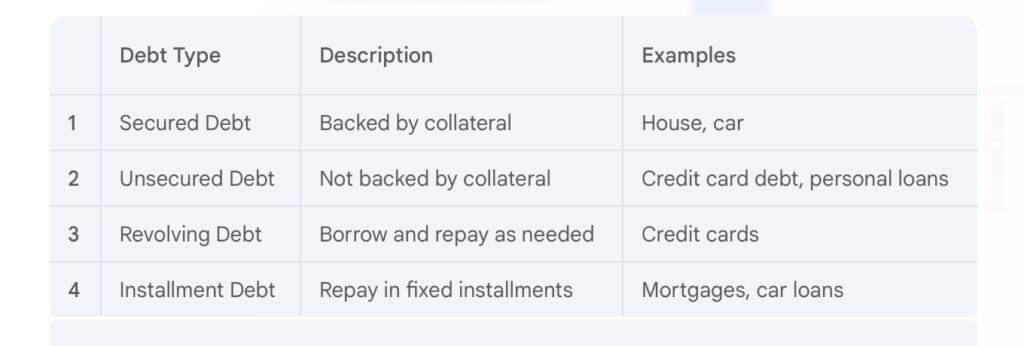

There are several types of debt, including:

- Secured Debt: This type of debt is secured by collateral, such as a house or a car. If the borrower fails to repay the debt, the lender can seize the collateral to recover the amount owed.

- Unsecured Debt: This type of debt is not secured by collateral, and the lender cannot seize any assets if the borrower fails to repay the debt. Examples of unsecured debt include credit card debt and personal loans.

- Revolving Debt: This type of debt allows the borrower to borrow up to a certain amount, and the borrower can borrow and repay the debt as needed. Credit cards are a typical example of revolving debt.

- Installment Debt: This type of debt requires the borrower to repay the debt in fixed installments over time. Mortgages and car loans are examples of installment debt.

The Impact of Debt on Financial Health

Debt can impact an individual’s financial health in both positive and negative ways. On the one hand, debt can fund investments that increase an individual’s income and net worth. On the other hand, if the debt is not managed correctly, it can lead to financial stress and even bankruptcy.

Understanding the terms and conditions of any debt before borrowing and creating a plan to repay the debt promptly is essential. By managing debt effectively, individuals can avoid financial stress and achieve long-term financial stability.

Strategies for Becoming Debt-Free

Becoming debt-free requires discipline, commitment, and a solid plan. Here are some effective strategies for achieving financial freedom.

Budgeting and Expense Management

The first step towards debt-free is creating and sticking to a budget. Here’s how to make your budget work for you. Budgeting involves tracking your income and expenses and identifying areas to reduce unnecessary spending. Some practical ways to manage your costs include:

- Creating a monthly budget and sticking to it.

- Tracking your expenses using a budgeting app or spreadsheet.

- Prioritizing your spending and cutting back on non-essential items.

- Negotiating bills and costs to get the best deals.

- Finding ways to earn extra income to supplement your budget.

By managing your costs effectively, you can free up more money to pay off your debts.

Debt Snowball Method

The debt snowball method is a popular debt repayment strategy that involves paying off your debts from smallest to largest. This consists of making the required minimum payments on all your debts while putting extra money towards paying off your smallest debt first. Once the smallest debt is paid off, you move on to the next smallest debt, and so on, until all your debts are paid off.

This method is effective because it helps you build momentum and motivation as you see your debts disappear individually. It also frees up more money to pay off more enormous debts as you go.

Debt Avalanche Method

The debt avalanche method is another popular debt repayment strategy that involves paying off debts from the highest to the lowest interest rates. This strategy consists of making minimum payments on all your debts while putting extra money towards paying off the debt with the highest interest rate first. Once the highest interest rate debt is paid off, you move on to the next highest interest rate debt, and so on, until all your debts are paid off.

This method is effective because it helps you save money on interest charges in the long run. By paying off high-interest debts first, you can reduce the interest you pay overall, which can help you become debt-free faster.

Becoming debt-free requires a combination of budgeting, expense management, and debt repayment strategies. The key to success is creating a solid plan and sticking to it, to help you achieve financial freedom and live a more stress-free life.

Debt Meltdown Method

The Debt Meltdown plan is a powerful strategy designed to help individuals rapidly pay off their debts. By combining the three core principles of paying the minimum balance, paying half of the minimum balance, and making an interest payment each month, you can accelerate your debt repayment, save on interest, and achieve financial liberation.

Building an Emergency Fund

One of the most essential and best ways to achieving financial stability and becoming debt-free is with an emergency fund. It is a pool of money that covers unexpected expenses, such as medical bills, car repairs, or a sudden job loss.

To build an emergency fund, one should start by determining how much money they need to set aside. A good rule is to aim for three to six months’ living expenses. This amount may vary depending on individual circumstances, such as job security, health, and family responsibilities.

Once the target amount is established, the next step is to create a plan to reach that goal. One effective strategy is automating savings by setting up a direct deposit into a separate account. This way, the money is automatically transferred from the individual’s paycheck, making it easier to save consistently.

Another way to build an emergency fund is to reduce unnecessary expenses and redirect that money toward savings. This could mean more meal planning, cutting down on eating out, canceling subscriptions, or reducing utility bills. Every little bit helps; over time, these small savings can add up to a significant amount. A great way to help savings add up quickly, put that extra savings into a higher yielding savings accounts.

It’s important to remember that building an emergency fund takes time and discipline. While it may be tempting to dip into the fund for non-emergency expenses, it is crucial to resist that urge and keep the money reserved for true emergencies. Following these steps, anyone can build an emergency fund and achieve financial stability.

Increasing Income

Negotiating Salary

One of the most effective ways to increase income is by negotiating a higher salary. Before entering a negotiation, it is essential to research industry standards and the company’s financial situation. It is also important to highlight one’s achievements and contributions to the company. During the negotiation, one should remain confident, professional, and willing to compromise.

Side Hustles and Passive Income

Another way to increase income is by starting a side hustle or generating passive income. This can include freelance work, selling products online, or investing in stocks or real estate. It is essential to choose a side hustle that aligns with one’s skills and interests and to be willing to put in the time and effort required to make it successful. Generating passive income can provide a steady stream of additional income without requiring ongoing effort, but it often requires an initial investment of time and money.

Increasing income requires hard work, research, and strategic planning. By negotiating a higher salary and exploring side hustles and passive income opportunities, individuals can take control of their financial future and work towards being debt-free.

Credit Score Improvement

Improving credit score is a crucial step towards achieving debt-free status. A good credit score helps get loans and credit cards approved, resulting in lower interest rates and better terms. Here are some tips to improve your credit score:

Reviewing Credit Reports

The first step towards improving credit scores is to review credit reports from all three credit agencies—Equifax, Experian, and TransUnion. Reviewing credit reports allows individuals to check for errors, fraudulent activity, and incorrect information. Any errors or discrepancies should be disputed with the respective credit agency.

Responsible Credit Use

Responsible credit use is the key to improving credit scores. This involves making timely payments, keeping credit utilization low, and only opening a few new accounts. Individuals should aim to keep their credit utilization below 30% and avoid closing old credit accounts, as this can negatively impact credit scores.

Improving credit score takes time and effort, but it is essential to achieving debt-free status. Individuals can enhance their credit scores and reach their financial goals by reviewing credit reports and practicing responsible credit use.

Long-Term Financial Planning

When it comes to achieving financial freedom, long-term planning is critical. It involves creating a roadmap to help individuals reach their financial goals over an extended period.

Investment Strategies

Investing in stocks, bonds, mutual funds, and other securities is one of the most effective ways to achieve long-term financial stability. Thorough research and analysis are essential before investing in any security. Diversification is also crucial to minimize risk and maximize returns. Individuals should consider investing in different sectors, industries, and asset classes. Before investing, be sure to contact a professional financial advisor for the best investment strategies.

Retirement Savings

Retirement savings are another critical aspect of long-term financial planning. To maximize compounding interest, it is essential to start saving for retirement early. An individual should consider opening a retirement account such as a 401(k) or an IRA and contributing the maximum amount yearly.

Long-term financial planning is crucial for anyone looking to achieve financial freedom. By investing in securities and saving for retirement, an individual can secure their financial future and reach their long-term goals. Before investing, be sure to contact a professional financial advisor for the best retirement saving strategies

Psychological Aspects of Debt

Debt can have a significant impact on a person’s mental health. It can cause stress, anxiety, and depression. The psychological effects of debt can be overwhelming, and they can lead to other problems, such as relationship issues and substance abuse.

One of the main psychological effects of debt is stress. People in debt may constantly worry about paying their bills and making ends meet. This stress can lead to physical symptoms, such as headaches and insomnia, and it can also affect a person’s ability to concentrate and make decisions.

Another psychological effect of debt is anxiety. People in debt may feel anxious about their financial situation and worry about how they will get out of debt. This anxiety can be debilitating and can prevent a person from taking action to improve their economic situation.

Debt can also lead to depression. People in debt may feel hopeless and helpless and lose interest in activities they once enjoyed. They may also experience feelings of shame and guilt, which can further contribute to their depression.

It is essential to address the psychological aspects of debt when working towards becoming debt-free. Seeking support from loved ones or a mental health professional can help alleviate some of the stress, anxiety, and depression associated with debt.

Debt-Free Lifestyle

Living a debt-free life can be difficult, but the benefits are significant. It requires a major shift in mindset and lifestyle habits. This section will explore two essential components of a debt-free lifestyle: minimalism, frugality, and maintaining financial discipline.

Minimalism and Frugality

Should you embrace minimalism and frugality? They can be integral aspects of a debt-free lifestyle. Through minimalism, individuals can cut down on expenses and concentrate on what holds genuine value. This may involve downsizing living spaces, decluttering possessions, and placing greater importance on experiences over material goods.

Frugality entails being mindful of spending habits and seeking opportunities to save money. This may involve purchasing or buying items in bulk and meal planning to minimize food waste. By adopting frugality, individuals can lower expenses and bolster their savings.

You don’t have to deprive yourself of all your hard work and effort. The secret to combining minimalism and frugality is establishing an easy financial game plan for your spending and monitoring expenses using a budget that crafts a framework that can lead to financial stability.

Maintaining Financial Discipline

Maintaining financial discipline is essential for leading a debt-free life. This involves establishing a budget, keeping track of expenses, and refraining from impulsive purchases.

It is also necessary to prioritize saving for emergencies and retirement and paying off outstanding debts.

To maintain financial discipline, individuals must avoid lifestyle inflation. This means resisting the temptation to increase spending as income rises. Instead, the focus should be enhancing the savings rate and investing in the future.

Adopting a debt-free lifestyle necessitates a change in mindset and habits. By embracing minimalism and frugality and adhering to financial discipline, individuals can decrease expenses, boost their savings, and attain financial freedom.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content – “Please view our full AI Use Disclosure.”

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.