Debt Demolition – Unleashing the Potential of the Debt Meltdown Method. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

Don’t Have Time To Read The Full Article. Here’s What You Are Missing.

Managing debt while achieving financial freedom can be challenging for millennials and perhaps everyone. But what if there was a powerful strategy that could help them pay off their debts rapidly?

The Debt Meltdown Method is a game-changing approach that can help you achieve financial liberation.

By combining three practical principles, individuals can significantly reduce the time it takes to become debt-free, save a substantial amount on interest, and ultimately achieve financial freedom.

By diligently adhering to these principles, individuals can significantly accelerate their debt repayment and reduce the overall interest paid over time.

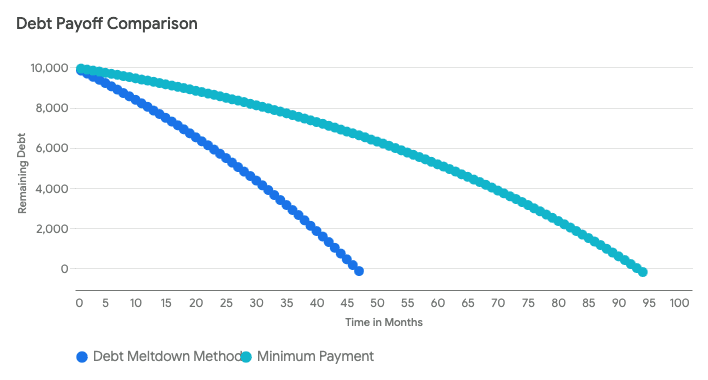

In this example, the individual with a $10,000 credit card debt at 18% interest can save over $4,600 in interest and become debt-free 47 months earlier by following the Debt Meltdown Method and adding an extra $100 to their monthly payments. This demonstrates how the Debt Meltdown Method can help individuals accelerate their debt payoff and achieve financial freedom significantly faster.

Understanding the Debt Meltdown Method

Debt can significantly burden you, causing stress and impacting your financial well-being. Fortunately, there are effective strategies to help you become debt-free and achieve financial liberation. One such strategy is the Debt Meltdown Method, which combines three core principles to help individuals rapidly pay off their debts.

The Foundation of the Debt Meltdown Method

The Debt Meltdown Method is a strategy that starts with making the minimum payment on your debts. This approach helps you meet your financial obligations and avoid penalties. While it may take longer to become debt-free with this method, it is the first step towards achieving your goal. The minimum payment principle is the foundation of all debt payment methods.

The Three Core Principles

The Debt Meltdown Method combines three core principles to help you accelerate your debt repayment and reduce the overall interest paid over time.

- Pay the Minimum Payment: As mentioned earlier, paying the minimum payment is the foundation of the Debt Meltdown Method. It ensures that you meet your obligations and avoid penalties.

- Pay Half of the Minimum Payment: Under this principle, you pay half of the minimum payment in addition to the minimum required payment. This approach can significantly accelerate your debt repayment and reduce the overall interest paid over time.

- Pay an Interest Payment Each Month: In this principle, you make an additional payment toward the interest on your debts. Doing so can diminish the overall interest accrued and become debt-free much faster.

By diligently adhering to the Debt Meltdown Method and consistently applying all three principles, you can significantly reduce the time it takes to become debt-free, save a substantial amount on interest, and ultimately achieve financial liberation.

The Debt Meltdown Method is a powerful strategy for helping individuals rapidly pay off their debts. By combining the three core principles of paying the minimum payment, half of the minimum payment, and making an interest payment each month, you can accelerate your debt repayment, save on interest, and achieve financial liberation.

Executing the Debt Meltdown Strategy

Debt is a significant burden that affects many individuals, particularly millennials. Fortune shows millennials in their 30s have racked up a historic $3.8 trillion debt. Fortunately, the Debt Meltdown Method is a powerful strategy designed to help individuals rapidly pay off their debts by combining three practical principles:

- Paying the minimum payment

- Paying half of the minimum payment

- Making an interest payment each month

Principle 1: Pay the Minimum Payment

When utilizing this principle, individuals make the minimum required payment on their monthly debts, ensuring that they meet their obligations and avoid penalties. While this approach may take longer to become debt-free, it forms the foundation for the subsequent principles.

Principle 2: Pay Half of the Minimum Payment

Under this principle, individuals pay half the minimum and minimum required payments. Doing so can significantly accelerate their debt repayment and reduce the overall interest paid over time. For example, if an individual has a credit card debt of $10,000, an interest rate of 18%, and a minimum monthly payment of $200, they would pay $300 monthly ($200 minimum payment + $100 half of the minimum payment). By following this approach, they could save over $3,000 in interest and become debt-free approximately 18 months earlier than making only the minimum payments.

Principle 3: Pay an Interest Payment Each Month

In this principle, individuals make an additional payment toward the interest on their debts. This proactive approach helps diminish the overall interest accrued, enabling them to become debt-free much faster. For instance, if an individual has a credit card debt of $10,000, an interest rate of 18%, and a minimum monthly payment of $200, they would allocate an extra $50 per month toward the interest payment.

By diligently adhering to the Debt Meltdown Method and consistently applying all three principles, individuals can significantly reduce the time it takes to become debt-free, save a substantial amount on interest, and ultimately achieve financial liberation.

The Financial Impact of the Debt Meltdown Method

Interest Savings Explained

One of the most significant benefits of the Debt Meltdown Method is the amount of interest saved over time. By paying half of the minimum payment and an additional interest payment each month, individuals can reduce the overall amount of interest accrued on their debts. This proactive approach can save thousands of dollars in interest expenses and significantly decrease the time it takes to become debt-free.

For instance, consider an individual with a credit card debt of $10,000, an interest rate of 18%, and a minimum monthly payment of $200. If they follow the Debt Meltdown Method by paying half the minimum payment and allocating an extra $50 per month towards the interest payment, they could save over $3,000 in interest and become debt-free approximately 18 months earlier than making only the minimum payments.

Accelerated Debt Repayment

Another significant advantage of the Debt Meltdown Method is accelerated debt repayment. By paying more than the minimum payment, individuals can significantly reduce the time it takes to become debt-free. This approach can help them gain financial freedom much faster and avoid the stress and anxiety associated with long-term debt.

For example, suppose an individual has a credit card debt of $20,000, an interest rate of 20%, and a minimum monthly payment of $400. By following the Debt Meltdown Method and paying more than the minimum payment, they could become debt-free in approximately five years, saving over $17,000 in interest expenses. In contrast, if they only made the minimum payments, it would take them over 14 years to become debt-free, and they would pay over $37,000 in interest.

The Debt Meltdown Method is a powerful strategy to help individuals become debt-free faster and save thousands of dollars in interest expenses. By consistently applying the three principles of the plan, individuals can achieve financial liberation and enjoy a stress-free life without the burden of debt.

Real-World Application

The Debt Meltdown Method is a powerful strategy to help individuals get out of debt faster and more efficiently than traditional methods. By combining the three principles of paying the minimum payment, paying half of the minimum payment, and making an interest payment each month, individuals can significantly reduce the time it takes to become debt-free and save a substantial amount on interest.

Example Calculation

Let’s consider an individual with a credit card debt of $10,000, an interest rate of 18%, and a minimum monthly payment of $200. If they follow the Debt Meltdown Method by paying the minimum payment, half the minimum payment, they will pay $300 monthly ($200 minimum payment + $100 half of the minimum payment). Additionally, they would allocate an extra $50 per month towards the interest payment. By following this approach, they could save over $3,000 in interest and become debt-free approximately 18 months earlier than making only the minimum payments.

Using the Debt Meltdown Method can save individuals significant money and time. By diligently adhering to your debt reduction plan and consistently applying all three principles, individuals can achieve financial liberation and become debt-free much faster.

The Debt Meltdown Method is a powerful tool that can help individuals get out of debt faster and more efficiently than traditional methods. Its three-principle approach of paying the minimum payment, half of the minimum payment, and an interest payment each month makes it easy. This method can significantly reduce the time it takes to become debt-free and save a substantial amount on interest.

Achieving Financial Liberation

Why use the Debt Meltdown Method? It’s a fast and efficient way to achieve financial liberation and debt-free.

• The plan is based on three winning principles.

• By following these principles, one can pay off debts quickly and efficiently.

The first principle is to pay the minimum payment. By paying the minimum required payment on my monthly debts, I can ensure that I meet my obligations and avoid penalties. While this approach may take longer to become debt-free, it forms the foundation for the subsequent principles.

The second principle is to pay half of the minimum payment. By paying half the minimum and required payments, you can significantly accelerate debt repayment and reduce the overall interest paid over time. This approach is efficient when dealing with high-interest debts like credit cards.

The third principle is to pay an interest payment along with your regular minimum payment and a half-minimum payment each month. By making an additional payment toward the interest on my debts, I can diminish the overall interest accrued, enabling me to become debt-free much faster. This proactive approach is beneficial when dealing with long-term debts like student loans.

Let’s consider an example to illustrate the effectiveness of the Debt Meltdown Method. Suppose I have a credit card debt of $10,000, an interest rate of 18%, and a minimum monthly payment of $200. If I follow the Debt Meltdown Method by paying half the minimum payment and allocating an extra $50 per month towards the interest payment, I could save over $3,000 in interest and become debt-free approximately 18 months earlier than making only the minimum payments.

Many of the examples are the same or similar, and are used only to let you know that paying off debt is the possible.

By diligently adhering to your plan or the Debt Meltdown Method and consistently applying all three principles, I can significantly reduce the time it takes to become debt-free, save a substantial amount on interest, and ultimately achieve financial liberation.

Debt Demolition: Unleashing the Potential of the Debt Meltdown Method

As millennials grapple with a staggering amount of debt, it is essential to explore effective strategies for managing and paying off these debts. One such strategy is the Debt Meltdown Method, which combines three principles to help individuals pay off debts quickly.

- Paying the minimum payment

- Paying half of the minimum payment

- Making an interest payment each month

Frequently Asked Questions

What strategies can millennials employ to manage and pay off their debts effectively?

Millennials can employ several strategies to manage and pay off their debts effectively. These strategies include creating a budget, negotiating with creditors, consolidating debts, and seeking professional financial advice.

How does the Debt Meltdown Method differ from other debt repayment methods?

The debt meltdown method differs from other debt repayment methods in combining three principles to help individuals pay off their debts quickly. By paying in addition to the minimum regular payment, half of the minimum payment, and making an interest payment every month, individuals can significantly reduce the time it takes to become debt-free and save a substantial amount on interest.

What are the long-term financial benefits for millennials using the Debt Meltdown Method?

The long-term financial benefits for millennials who utilize the Debt Meltdown Method include the following:

- Becoming debt-free much faster.

- Saving a significant amount on interest.

- Ultimately achieving financial liberation.

By diligently adhering to the Debt Meltdown Method and consistently applying all three principles, individuals can significantly reduce the time it takes to become debt-free and ultimately achieve their financial goals.

How can making additional interest payments each month impact millennials’ overall debt?

Making additional interest payments each month can significantly impact millennials’ overall debt. By proactively allocating extra funds towards interest payments, individuals can diminish the overall interest accrued, making them debt-free much faster.

What resources are available to address millennial debt issues?

NextGenMoneySkills inspires a brighter financial future by providing practical finance skills to the younger generation. NextGenMoneySkills easy-to-understand content is based on years of experience and helps establish a solid financial foundation early in life.

What are millennials’ common financial challenges, and how can they overcome them?

Young adults from the millennial generation frequently encounter financial challenges, including managing student loan debt, credit card debt, and a lack of knowledge about personal finance. To address these issues, millennials can adopt various financial tactics, such as establishing a budget, engaging in discussions with lenders, combining their debts, seeking guidance from financial experts, and employing efficient methods like the Debt Meltdown Method to repay their debts.

The Debt Meltdown Method is a powerful strategy to help millennials rapidly pay off their debts. By diligently adhering to the plan and consistently applying all three principles, individuals can significantly reduce the time it takes to become debt-free, save a substantial amount on interest, and ultimately achieve financial liberation.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content – “Please view our full AI Use Disclosure.”

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.