Cracking the Code: What Your Credit Approval Officer Knows About Your Credit. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

- Cracking the Code: What Your Credit Approval Officer Knows About Your Credit. Find Out More In Our Latest Article!

- Understanding the Five C’s of Credit

- Character: Assessing Reliability

- Capacity: Evaluating Financial Strength

- Capital: Considering Assets

- Collateral: Securing the Loan

- Conditions: Reviewing Economic Factors

- Quick Look At The Five C’s of Credit In Action

- How To Enjoy The Benefits of the Five C’s of Credit

- Enhanced Creditworthiness

- Better Loan Terms

- Increased Financial Awareness

- Limitations of the Five C’s of Credit

- Potential for Misinterpretation

- Overemphasis on Quantitative Measures

- Practical Application of the Five C’s

- Building Excellent Credit

- Achieving Credit Approval

- Frequently Asked Questions

Wouldn’t you like to have a clear understanding of what lenders, banks, and non-lenders know about your credit?

Their approval or disapproval can greatly impact your ability to secure a loan. It is important to take control of your financial situation by being aware of what they know about your creditworthiness.

When securing a loan or credit, your credit reports and scores are two of the most important factors lenders consider. But how do they determine your creditworthiness?

This is where the Five C’s of Credit come into play. These five factors help lenders assess the risk of lending money to a borrower. By understanding the Five C’s of Credit, you can take steps to build excellent credit and achieve creditworthiness.

The Five C’s of Credit are Character, Capacity, Capital, Collateral, and Conditions. These are factors used by lenders to evaluate your creditworthiness and determine the likelihood of you repaying the loan. Character reflects your credit history. Capacity is your ability to repay based on income and debts. Capital is your available assets. Collateral is assets used as security. Conditions are loan terms.

Focusing on these factors can help improve your credit score and increase your chances of being approved for a loan or credit. However, it is essential to note that the Five C’s of Credit have limitations.

They do not consider other factors impacting your ability to repay the loan, such as economic changes or unexpected life events. It is also essential to consider these factors when applying for credit and to have a plan in place in case of unforeseen circumstances or emergencies.

Understanding the Five C’s of Credit

When applying for credit, lenders use criteria to evaluate the borrower’s creditworthiness. These criteria are commonly called “The Five C’s of Credit.”

Understanding these criteria can help borrowers improve their credit scores and increase their chances of credit approval.

Character: Assessing Reliability

The first “C” is character. This refers to a borrower’s reputation for paying debts on time and in full.

Lenders evaluate a borrower’s character by looking at their credit history, including past payment behavior, outstanding debts, and bankruptcies. A borrower with a good track record of paying debts on time and in full is seen as more reliable and, therefore, more likely to be approved for credit.

Capacity: Evaluating Financial Strength

The second “C” is capacity. This refers to a borrower’s ability to repay the loan.

Lenders evaluate borrowers’ capacity by examining their income, expenses, and debt-to-income ratio. A borrower with a high income and low costs is seen as having a strong capacity to repay the loan and is, therefore, more likely to be approved for credit.

Capital: Considering Assets

The third “C” is capital. This refers to a borrower’s assets, such as savings, investments, and property.

Lenders evaluate a borrower’s capital to determine their ability to repay the loan in case of a financial setback. A borrower with a high net worth and liquid assets is seen as having a strong capital position and is, therefore, more likely to be approved for credit.

Collateral: Securing the Loan

The fourth “C” is collateral. This refers to assets that a borrower pledges as security for the loan.

Lenders evaluate a borrower’s collateral to determine the risk of the loan. A borrower with valuable collateral is seen as less risky and more likely to be approved for credit.

Conditions: Reviewing Economic Factors

The fifth and final “C” is conditions. This refers to economic factors affecting a borrower’s ability to repay the loan, such as interest rates, inflation, and economic trends. Lenders evaluate these conditions to determine the risk of the loan.

A borrower applying for credit during a period of financial stability is seen as less risky and is, therefore, more likely to be approved for credit.

Quick Look At The Five C’s of Credit In Action

While “The Five C’s of Credit” can help borrowers establish credit and achieve creditworthiness, relying solely on these criteria has downsides.

For example, borrowers with no credit history or a poor credit score may be denied credit even if they have a solid capacity to repay the loan.

Additionally, borrowers with valuable collateral may be approved for credit even if they have a poor track record of paying debts on time and in full.

Understanding “The Five C’s of Credit” can help borrowers improve their credit scores and increase their chances of credit approval. However, it is essential to remember that these criteria are not the only factors lenders consider when evaluating creditworthiness.

How To Enjoy The Benefits of the Five C’s of Credit

Enhanced Creditworthiness

By understanding the criteria lenders use to evaluate a borrower’s creditworthiness and taking steps to improve them, borrowers can enhance their creditworthiness and increase their chances of getting approved for loans and credit products.

Enhance your character and reputation by paying debts on time and in full.

By consistently making timely payments on existing debts, borrowers can demonstrate good character and improve this aspect of their credit profile.

Enhance your capacity! Borrowers can improve their capacity by increasing their income, reducing expenses, or paying off debts. Your capacity is used to access a borrower’s ability to repay debts.

Lenders evaluate capacity by examining a borrower’s income, expenses, and other debts.

Enhance your capital and improve and increase your financial resources and assets. Lenders may assess a borrower’s capital by examining their savings, investments, and other assets.

Borrowers can improve their credit profile by building up their savings, investments, and assets.

Enhance your collateral; increase your collateral, which refers to assets that a borrower pledges as security for a loan. Collateral can include real estate, vehicles, or other valuable assets.

By offering collateral, borrowers can qualify for larger loans or lower interest rates.

Enhance your conditions; there is little you can control here. Economic and market conditions may affect a borrower’s loan repayment ability.

Lenders may consider factors such as the borrower’s industry, the state of the economy, and other external factors.

Borrowers cannot directly improve this aspect of their credit profile but can mitigate risk by choosing appropriate loans for their financial situation.

Better Loan Terms

By improving their credit profile and meeting the Five Cs of Credit, borrowers can qualify for better loan terms.

This can include lower interest rates, extended repayment periods, or significant loan amounts. Better loan terms can help borrowers save money over the life of the loan and make it easier to manage their debt.

Increased Financial Awareness

Understanding the Five Cs of Credit can help borrowers become more financially aware and responsible.

By knowing what lenders look for and how their credit profile is evaluated, borrowers can improve their credit and build a solid financial foundation.

This can include paying bills on time, reducing debt, and building up savings and investments.

The Five Cs of Credit are an essential set of criteria lenders use to evaluate a borrower’s creditworthiness.

By meeting these criteria and improving their credit profile, borrowers can enhance their creditworthiness, qualify for better loan terms, and become more financially aware.

Limitations of the Five C’s of Credit

While the Five C’s of Credit are a helpful framework for lenders to evaluate a borrower’s creditworthiness, borrowers should be aware of some limitations to this approach.

Potential for Misinterpretation

One limitation of the Five C’s of Credit is that they are open to interpretation by lenders.

For example, the “character” component of the Five C’s of Credit is based on a borrower’s reputation, but this can be difficult to assess objectively.

Lenders may also have different criteria for evaluating the other components of the Five C’s of Credit, such as “capacity” and “collateral.”

This can lead to inconsistent lending decisions and make it difficult for borrowers to understand what they need to do to improve their creditworthiness.

Overemphasis on Quantitative Measures

Another limitation of the Five C’s of credit is that they can place too much emphasis on quantitative measures, such as credit scores and debt-to-income ratios, and not enough on qualitative factors, such as a borrower’s character and reputation.

This can be problematic because borrowers with low credit scores or high debt-to-income ratios may be unfairly penalized, even if they have a strong history of paying their bills on time and are otherwise financially responsible.

To overcome these limitations, borrowers should build a strong credit history demonstrating their financial responsibility and creditworthiness. This can include paying bills on time, keeping credit card balances low, and avoiding opening too many new credit accounts simultaneously.

Borrowers should also be prepared to provide additional documentation or explanations to lenders if they have extenuating circumstances that may affect their creditworthiness, such as a job loss or medical emergency. By taking these steps, borrowers can improve their chances of being approved for credit and achieving their financial goals.

Practical Application of the Five C’s

Building Excellent Credit

The Five Cs of Credit, namely Character, Capacity, Capital, Collateral, and Conditions, are essential aspects that lenders consider when evaluating a borrower’s creditworthiness.

These factors can help individuals build excellent credit. For instance, maintaining a good credit history can demonstrate a borrower’s character and reliability in repaying debts when applying for credit. Making timely payments, keeping credit utilization low, and avoiding late payments can help establish good credit scores.

Capacity, which refers to a borrower’s ability to repay a loan, is another crucial factor that lenders consider. To build excellent credit, borrowers should ensure they can comfortably afford their debts and not take on more than they can handle. This can be achieved by creating a budget, keeping track of expenses, and avoiding unnecessary debts.

Capital, or a borrower’s assets, can also help build excellent credit. Lenders prefer borrowers with substantial assets because they show a financial cushion and are less likely to default on their loans. Building up savings, investments, and other assets can help improve creditworthiness.

Achieving Credit Approval

The Five Cs of Credit can also help individuals achieve credit approval.

For instance, lenders may require collateral, such as property or assets, to secure a loan. Having collateral can increase the chances of approval, but borrowers should ensure they can repay the loan to avoid losing their collateral and assets.

Conditions, such as economic factors, can also affect credit approval. Borrowers should monitor economic trends and ensure they apply for credit during a stable financial period. This can increase the chances of approval and help borrowers avoid taking on debts during an economic downturn.

Understanding and applying the Five Cs of Credit can help individuals build excellent credit and achieve credit approval.

By demonstrating the “Five Cs of Credit” good character, ensuring capacity, building capital, providing collateral, and considering economic conditions, borrowers can improve their creditworthiness and secure favorable loan terms.

- Along with your creditworthiness. Both positive and negative information reported (by the listed subscribers) to the credit reporting agencies and on your credit reports are also looked at.

- Collection Accounts are another type of adverse information that can weigh heavily on your credit for a noteworthy period. Other types of adverse information include Public Record Accounts, bankruptcy, judgments, liens, repossessions, and Medical Debt (medical debt credit reporting laws are being updated).

Here’s a quick recap.

A credit approval officer views the Five C’s of credit, your personal identifying information, latest credit reporting and scoring factors, and any other required data. All in one neat package!

Your credit reports and credit scores. Which tells you, and everyone how well you’re handling the Five Cs of Credit.

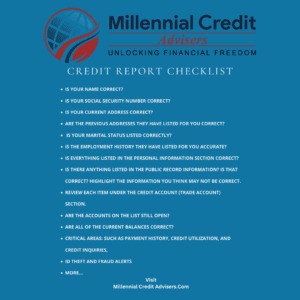

Don’t miss out on better credit! Not looking at your credit reports regularly could slow your chances of having and building excellent credit.

Frequently Asked Questions

What constitutes the Five C’s of Credit, and how do they influence an individual’s creditworthiness?

The Five C’s of Credit refer to five factors lenders use to evaluate a borrower’s creditworthiness. These factors are Character, Capacity, Capital, Collateral, and Conditions. Character refers to a borrower’s credit history and reputation for paying back debts on time. Capacity refers to a borrower’s ability to repay a loan based on income and existing obligations. Capital refers to the assets a borrower has available to cover loan payments in case of financial hardship. Collateral refers to assets that a borrower pledges as security for a loan. Finally, Conditions refer to the economic and market conditions that may impact a borrower’s loan repayment ability.

How does one’s capacity to repay debt affect their credit score and chances of obtaining new credit?

Capacity is a crucial aspect of creditworthiness because it indicates whether a borrower has the financial means to repay a loan. Lenders will evaluate borrowers’ capacity by examining their income, expenses, and debts. A borrower with a high income and few existing debts will have a higher capacity to repay debt and will be more likely to obtain new credit. Conversely, a borrower with a low income and high debt levels will have a lower capacity to repay debt and will be less likely to obtain new credit.

In the Five Cs of Credit context, what role does capital play in credit evaluation?

Capital refers to the assets a borrower has available to cover loan payments in case of financial hardship. Capital can include savings accounts, investments, and other easily liquidated assets. Lenders evaluate a borrower’s capital as an indicator of their ability to repay a loan in the event of a financial setback. A borrower with a high level of capital will be seen as less risky than a borrower with little capital.

How does the ‘Character’ aspect of the Five C’s of Credit impact a lender’s decision to extend credit to a borrower?

Character refers to a borrower’s credit history and reputation for paying back debts on time. Lenders will evaluate a borrower’s character by looking at their credit report, which includes information on past credit accounts, payment history, and outstanding debts. A borrower with a good credit history and a reputation for paying back debts on time will be seen as less risky than a borrower with a poor credit history.

What measures can individuals take to build a strong credit score in line with the Five C’s of Credit principles?

To build a strong credit score, individuals should maintain a good credit history, pay bills on time, and keep debt levels low. They should also regularly review their credit reports to ensure accuracy. Additionally, individuals can work to improve their capacity and capital by increasing their income and savings.

Which of the Five C’s of Credit is concerned with the collateral to secure a loan, and why is it significant?

Collateral refers to assets that a borrower pledges as security for a loan. Lenders will evaluate a borrower’s collateral as an indicator of their ability to repay a loan in case of default. Collateral can include real estate, vehicles, and other valuable assets. The significance of collateral is that it provides lenders a way to recover their losses if a borrower cannot repay a loan.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We don’t offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized advice. Track your progress for a better credit journey.

Written content – “Please view our full AI Use Disclosure.”

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy policy has more details.