Blog

Hey there! Forget about the boring financial jargon!

This blog section is a fan favorite. It’s like having a personal finance best friend– down-to-earth, engaging, and here to keep you informed on debt, saving, credit, money, and more. It’s a treasure trove of fantastic Millennial Credit Advisers content designed to help you achieve your financial goals!

If you’re ready to free yourself from financial stress and start making progress on your money goals, this section is your one-stop shop for financial success! We have fresh articles, inspiring stories, and practical tips to help you level your financial game like a pro. Imagine hearing real-life success stories, getting clear-cut solutions to everyday money issues, and receiving expert advice to make you feel confident about your finances.

So, don’t wait! Dive in and start your financial journey today! ✨

RECENT POSTS

Becoming Debt-Free – A Guide to Budgeting, Expense Management, and Debt Repayment Strategies.

Discover the essential steps to achieving financial freedom.

The Ultimate Guide to Using Your Credit Card’s Exclusive Benefits – Save Money with Companion Fares, Lounge Benefits, and More.

Credit cards offer various exclusive benefits and perks to help consumers save money.

Debt-Free in 180 Days – A Step-by-Step Guide to Financial Freedom.

Discover the ultimate roadmap to financial liberation. Embark on your journey to financial freedom today!

Debt Meltdown Plan: Proven Strategies to Pay Off Debt Quickly and Save Big.

Learn about the Debt Meltdown plan, a powerful tool for managing personal finances and achieving debt freedom.

How to Save 50 000 in a Year: A Strategic Guide to Boosting Your Savings.

Amassing $50,000 in one year may seem daunting, but it’s an achievable feat with the right strategy.

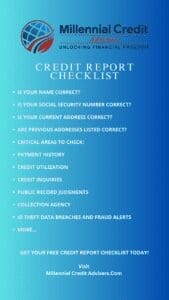

Credit Review Checklist.

USE A CREDIT REVIEW CHECKLIST TO TRACK YOUR PROGRESS AND STAY ON TARGET.

Are you looking for ideas for starting an online business? A blog may just be what you’re looking for.

Unsurprisingly, these four niches are booming markets for information and guidance. Making blogging one of many top-paying online businesses.

What Every Freelancer Knows About Lucrative Side Hustle Niches Answered.

Many excellent niches are easily monetizable and could align with your interests, including:

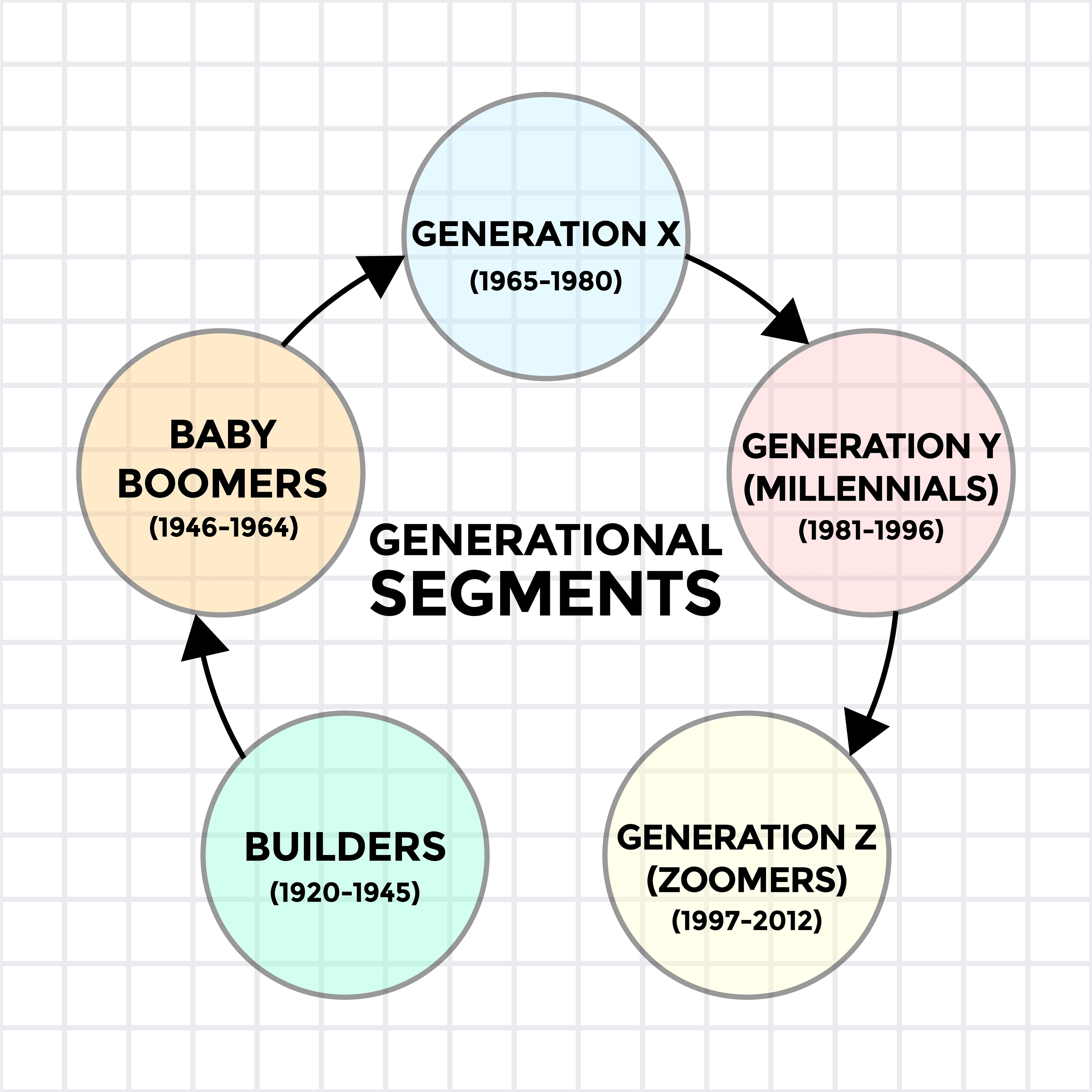

Understanding Credit Across Generations: Challenges and Victories. Silent Generation: Financial Responsibility.

Silent Generation's key traits include their preference for saving and overtaking financial risks. This generation learned to be thrifty and…

Understanding Credit Across Generations: Challenges and Victories. Baby Boomers: Established Credit.

Baby Boomers are known for their established credit profiles. Their experiences include navigating different financial climates, including economic growth and…

Understanding Credit Across Generations: Challenges and Victories. Generation X: Striking A Financial Balance.

Generation X's generous saving habits and cautious spending are crucial for their financial well-being.

Understanding Credit Across Generations: Challenges and Victories. Millennials: Managing Debt Smartly.

Despite challenges, millennials are developing intelligent strategies to manage their debt.

Related posts

Related posts

Free Email Course

Gain invaluable insights on launching your blog, from niche selection to audience expansion and monetization strategies. Access your FREE course today and embark on your journey to blogging success!

We respect your privacy. We will not send you spam emails.

RECENT POSTS

Becoming Debt-Free – A Guide to Budgeting, Expense Management, and Debt Repayment Strategies.

Discover the essential steps to achieving financial freedom.

The Ultimate Guide to Using Your Credit Card’s Exclusive Benefits – Save Money with Companion Fares, Lounge Benefits, and More.

Credit cards offer various exclusive benefits and perks to help consumers save money.

Debt-Free in 180 Days – A Step-by-Step Guide to Financial Freedom.

Discover the ultimate roadmap to financial liberation. Embark on your journey to financial freedom today!

Debt Meltdown Plan: Proven Strategies to Pay Off Debt Quickly and Save Big.

Learn about the Debt Meltdown plan, a powerful tool for managing personal finances and achieving debt freedom.

How to Save 50 000 in a Year: A Strategic Guide to Boosting Your Savings.

Amassing $50,000 in one year may seem daunting, but it’s an achievable feat with the right strategy.

Credit Review Checklist.

USE A CREDIT REVIEW CHECKLIST TO TRACK YOUR PROGRESS AND STAY ON TARGET.

Are you looking for ideas for starting an online business? A blog may just be what you’re looking for.

Unsurprisingly, these four niches are booming markets for information and guidance. Making blogging one of many top-paying online businesses.

What Every Freelancer Knows About Lucrative Side Hustle Niches Answered.

Many excellent niches are easily monetizable and could align with your interests, including:

Understanding Credit Across Generations: Challenges and Victories. Silent Generation: Financial Responsibility.

Silent Generation's key traits include their preference for saving and overtaking financial risks. This generation learned to be thrifty and…

Understanding Credit Across Generations: Challenges and Victories. Baby Boomers: Established Credit.

Baby Boomers are known for their established credit profiles. Their experiences include navigating different financial climates, including economic growth and…

Understanding Credit Across Generations: Challenges and Victories. Generation X: Striking A Financial Balance.

Generation X's generous saving habits and cautious spending are crucial for their financial well-being.

Understanding Credit Across Generations: Challenges and Victories. Millennials: Managing Debt Smartly.

Despite challenges, millennials are developing intelligent strategies to manage their debt.

Related posts

RECENT POSTS

Becoming Debt-Free – A Guide to Budgeting, Expense Management, and Debt Repayment Strategies.

Discover the essential steps to achieving financial freedom.

The Ultimate Guide to Using Your Credit Card’s Exclusive Benefits – Save Money with Companion Fares, Lounge Benefits, and More.

Credit cards offer various exclusive benefits and perks to help consumers save money.

Debt-Free in 180 Days – A Step-by-Step Guide to Financial Freedom.

Discover the ultimate roadmap to financial liberation. Embark on your journey to financial freedom today!

Debt Meltdown Plan: Proven Strategies to Pay Off Debt Quickly and Save Big.

Learn about the Debt Meltdown plan, a powerful tool for managing personal finances and achieving debt freedom.

How to Save 50 000 in a Year: A Strategic Guide to Boosting Your Savings.

Amassing $50,000 in one year may seem daunting, but it’s an achievable feat with the right strategy.

Credit Review Checklist.

USE A CREDIT REVIEW CHECKLIST TO TRACK YOUR PROGRESS AND STAY ON TARGET.

Are you looking for ideas for starting an online business? A blog may just be what you’re looking for.

Unsurprisingly, these four niches are booming markets for information and guidance. Making blogging one of many top-paying online businesses.

What Every Freelancer Knows About Lucrative Side Hustle Niches Answered.

Many excellent niches are easily monetizable and could align with your interests, including:

Understanding Credit Across Generations: Challenges and Victories. Silent Generation: Financial Responsibility.

Silent Generation's key traits include their preference for saving and overtaking financial risks. This generation learned to be thrifty and…

Understanding Credit Across Generations: Challenges and Victories. Baby Boomers: Established Credit.

Baby Boomers are known for their established credit profiles. Their experiences include navigating different financial climates, including economic growth and…

Understanding Credit Across Generations: Challenges and Victories. Generation X: Striking A Financial Balance.

Generation X's generous saving habits and cautious spending are crucial for their financial well-being.

Understanding Credit Across Generations: Challenges and Victories. Millennials: Managing Debt Smartly.

Despite challenges, millennials are developing intelligent strategies to manage their debt.

Related posts

Blog

✨ Hey there! This blog section is a fan favorite. Let’s say goodbye to dull financial jargon and explore the exciting and fun world of finance!

This blog provides personalized strategies for managing debt, saving, improving your credit, and exploring income options, suitable for individuals of all ages.

Your support team is always available, engaging, and dedicated to keeping you informed about debt, savings, credit, income, and more.

It’s a treasure chest of helpful Millennial Credit Adviser content aimed at helping you reach your financial goals!

If you’re ready to eliminate financial stress and begin making progress on your money goals, this section is your one-stop shop for financial success!

We have new articles, inspiring stories, and practical tips to help you improve your financial skills like a pro.

Imagine reading real-life success stories, getting straightforward solutions to everyday money problems, and receiving expert advice to help you feel comfortable and confident about your finances.

So, don’t wait! Jump in and begin your financial journey today! ✨

RECENT POSTS

Boost Your Credit Score: A Fun 5-Step Guide to Financial Freedom! Visit Our Blog for Tips!

A credit score plays a key role in financial decisions. This three-digit number tells lenders how trustworthy someone is when…

Top Proven Strategies to Reduce Expenses and Boost Income – Your Complete Financial Success Guide.

Making smart financial decisions is essential for building long-term wealth and creating a secure future.

Boost Your Credit Score: Top Proven Strategies for Better Credit Reports.

Building a strong credit score takes time and dedication, but the rewards are worth the effort. A good credit score…

Unlock Your Financial Freedom: A Game-Changing 7-Figure Blueprint for Creating Wealth Without Debt!

Building a seven-figure income without depending on debt demands tried-and-true strategies and steady effort.

Conquering Debt – 5 Proven Strategies to Become Financially Free.

Managing debt requires a clear plan and dedicated effort, but the results can be life-changing.

Smart Choices – Mastering the Art of Enjoyable and Responsible Spending.

In today’s fast-paced world, it’s easy to slip into mindless spending habits that can jeopardize our financial health.

Ten Essential Questions and Answers: Smart Strategies for Boosting Your Credit Score.

Are you ready to take charge of your financial future? Improving your credit rating is a powerful step toward achieving…

How to Boost Your Credit Score: A Smart Saver’s Guide.

Boosting your credit score is an essential part of maintaining a healthy financial life.

Transform Your Savings Goals into Achievements with an Exciting Millennial Credit Advisers Savings Challenge That Ignites Success!

I have always been a saver at heart, but turning my savings goals into achievements has been challenging. I was…

Achieving Financial Freedom – Mastering the Art of Smart Saving for a Limitless Life.

Imagine a life where your dreams are within reach, unshackled by financial constraints. Welcome to the journey of unlocking financial…

Building Financial Resilience – Lessons Learned from Smart Savers Who Weathered Economic Challenges.

If you’re someone who has faced economic challenges, you know firsthand the importance of building financial resilience.

Breaking Down Barriers – How Smart Savers Overcame Doubt and Procrastination.

If you’ve struggled with procrastination and self-doubt, I know firsthand how challenging it can be to achieve your financial goals.

Related posts

RECENT POSTS

Becoming Debt-Free – A Guide to Budgeting, Expense Management, and Debt Repayment Strategies.

Discover the essential steps to achieving financial freedom.

The Ultimate Guide to Using Your Credit Card’s Exclusive Benefits – Save Money with Companion Fares, Lounge Benefits, and More.

Credit cards offer various exclusive benefits and perks to help consumers save money.

Debt-Free in 180 Days – A Step-by-Step Guide to Financial Freedom.

Discover the ultimate roadmap to financial liberation. Embark on your journey to financial freedom today!

Debt Meltdown Plan: Proven Strategies to Pay Off Debt Quickly and Save Big.

Learn about the Debt Meltdown plan, a powerful tool for managing personal finances and achieving debt freedom.

How to Save 50 000 in a Year: A Strategic Guide to Boosting Your Savings.

Amassing $50,000 in one year may seem daunting, but it’s an achievable feat with the right strategy.

Credit Review Checklist.

USE A CREDIT REVIEW CHECKLIST TO TRACK YOUR PROGRESS AND STAY ON TARGET.

Are you looking for ideas for starting an online business? A blog may just be what you’re looking for.

Unsurprisingly, these four niches are booming markets for information and guidance. Making blogging one of many top-paying online businesses.

What Every Freelancer Knows About Lucrative Side Hustle Niches Answered.

Many excellent niches are easily monetizable and could align with your interests, including:

Understanding Credit Across Generations: Challenges and Victories. Silent Generation: Financial Responsibility.

Silent Generation's key traits include their preference for saving and overtaking financial risks. This generation learned to be thrifty and…

Understanding Credit Across Generations: Challenges and Victories. Baby Boomers: Established Credit.

Baby Boomers are known for their established credit profiles. Their experiences include navigating different financial climates, including economic growth and…

Understanding Credit Across Generations: Challenges and Victories. Generation X: Striking A Financial Balance.

Generation X's generous saving habits and cautious spending are crucial for their financial well-being.

Understanding Credit Across Generations: Challenges and Victories. Millennials: Managing Debt Smartly.

Despite challenges, millennials are developing intelligent strategies to manage their debt.

RECENT POSTS

Becoming Debt-Free – A Guide to Budgeting, Expense Management, and Debt Repayment Strategies.

Discover the essential steps to achieving financial freedom.

The Ultimate Guide to Using Your Credit Card’s Exclusive Benefits – Save Money with Companion Fares, Lounge Benefits, and More.

Credit cards offer various exclusive benefits and perks to help consumers save money.

Debt-Free in 180 Days – A Step-by-Step Guide to Financial Freedom.

Discover the ultimate roadmap to financial liberation. Embark on your journey to financial freedom today!

Debt Meltdown Plan: Proven Strategies to Pay Off Debt Quickly and Save Big.

Learn about the Debt Meltdown plan, a powerful tool for managing personal finances and achieving debt freedom.

How to Save 50 000 in a Year: A Strategic Guide to Boosting Your Savings.

Amassing $50,000 in one year may seem daunting, but it’s an achievable feat with the right strategy.

Credit Review Checklist.

USE A CREDIT REVIEW CHECKLIST TO TRACK YOUR PROGRESS AND STAY ON TARGET.

Are you looking for ideas for starting an online business? A blog may just be what you’re looking for.

Unsurprisingly, these four niches are booming markets for information and guidance. Making blogging one of many top-paying online businesses.

What Every Freelancer Knows About Lucrative Side Hustle Niches Answered.

Many excellent niches are easily monetizable and could align with your interests, including:

Understanding Credit Across Generations: Challenges and Victories. Silent Generation: Financial Responsibility.

Silent Generation's key traits include their preference for saving and overtaking financial risks. This generation learned to be thrifty and…

Understanding Credit Across Generations: Challenges and Victories. Baby Boomers: Established Credit.

Baby Boomers are known for their established credit profiles. Their experiences include navigating different financial climates, including economic growth and…

Understanding Credit Across Generations: Challenges and Victories. Generation X: Striking A Financial Balance.

Generation X's generous saving habits and cautious spending are crucial for their financial well-being.

Understanding Credit Across Generations: Challenges and Victories. Millennials: Managing Debt Smartly.

Despite challenges, millennials are developing intelligent strategies to manage their debt.

RECENT POSTS

Becoming Debt-Free – A Guide to Budgeting, Expense Management, and Debt Repayment Strategies.

Discover the essential steps to achieving financial freedom.

The Ultimate Guide to Using Your Credit Card’s Exclusive Benefits – Save Money with Companion Fares, Lounge Benefits, and More.

Credit cards offer various exclusive benefits and perks to help consumers save money.

Debt-Free in 180 Days – A Step-by-Step Guide to Financial Freedom.

Discover the ultimate roadmap to financial liberation. Embark on your journey to financial freedom today!

Debt Meltdown Plan: Proven Strategies to Pay Off Debt Quickly and Save Big.

Learn about the Debt Meltdown plan, a powerful tool for managing personal finances and achieving debt freedom.

How to Save 50 000 in a Year: A Strategic Guide to Boosting Your Savings.

Amassing $50,000 in one year may seem daunting, but it’s an achievable feat with the right strategy.

Credit Review Checklist.

USE A CREDIT REVIEW CHECKLIST TO TRACK YOUR PROGRESS AND STAY ON TARGET.

Are you looking for ideas for starting an online business? A blog may just be what you’re looking for.

Unsurprisingly, these four niches are booming markets for information and guidance. Making blogging one of many top-paying online businesses.

What Every Freelancer Knows About Lucrative Side Hustle Niches Answered.

Many excellent niches are easily monetizable and could align with your interests, including:

Understanding Credit Across Generations: Challenges and Victories. Silent Generation: Financial Responsibility.

Silent Generation's key traits include their preference for saving and overtaking financial risks. This generation learned to be thrifty and…

Understanding Credit Across Generations: Challenges and Victories. Baby Boomers: Established Credit.

Baby Boomers are known for their established credit profiles. Their experiences include navigating different financial climates, including economic growth and…

Understanding Credit Across Generations: Challenges and Victories. Generation X: Striking A Financial Balance.

Generation X's generous saving habits and cautious spending are crucial for their financial well-being.

Understanding Credit Across Generations: Challenges and Victories. Millennials: Managing Debt Smartly.

Despite challenges, millennials are developing intelligent strategies to manage their debt.

Related posts

How To Win The Debt, Savings, and Credit Challenge With Proven Tactics for Success.

The DEBT, SAVINGS, AND CREDIT CHALLENGE is a three-step program designed to help you pay off your debt, increase your…

181-Point Credit Score Increase: More Details Inside!

Learn which credit habits to watch out for and avoid costly mistakes that could impact your financial well-being.

How You Can You Save Up to $5,787? Discover the Best Ways to Pay Your Credit Card Bill. Uncover the Advantages Today.

Carrying a balance from month to month can be costly. Discover the advantages of this strategy and start saving today.

Millennial Credit Advisers Debt, Savings, and Credit Challenge: A Winning Three-Step Plan For Paying Off Debt, Increasing Savings, And Improving Credit.

Millions are struggling with debt, savings, and credit and want to make a change. The DEBT, SAVINGS, AND CREDIT CHALLENGE…

Debt Demolition – Unleashing the Potential of the Debt Meltdown Method.

The Debt Meltdown Method is a game-changing approach that can help you achieve financial liberation.

Organize Your Finances: Let’s Declutter Those Financial Closets!

Individuals that successfully organized their finances. Adjusting Habits for Optimal Cash Flow.