Boost Your Credit Score: A Fun 5-Step Guide to Financial Freedom! | Visit Our Blog for Tips! Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

A credit score plays a key role in financial decisions. This three-digit number tells lenders how trustworthy someone is when borrowing money. It affects everything from credit card approvals to mortgage rates.

People who want to take control of their financial future need to master the basics of credit scores. The good news is that improving your credit score involves straightforward steps. Anyone can follow them with dedication and smart financial habits.

What is a credit score?

A credit score is a three-digit number between 300 and 850 that shows how well you handle money and pay bills. This number helps banks and other companies decide if they want to give you loans or credit cards.

Good credit scores open up many opportunities. They make it easier to:

- Rent homes or apartments

- Get better loan interest rates

- Lower insurance costs

- Apply for credit cards

Your credit score changes based on your financial choices and bill payment history. Higher scores mean you have shown good money management skills over time.

Ways to Check Your Credit Score

You can find your credit score in several ways. Most credit card companies, credit unions, banks, and loan providers show credit scores on monthly statements. Many other services also let you check your score:

Free Options:

- Credit counseling agencies

- Non-profit housing counselors

- Credit monitoring websites

Paid Options:

- Equifax

- Experian

- TransUnion

Getting your credit score helps track your financial health and spot potential issues early. The three major credit bureaus offer direct score purchases through their websites and on a central online portal.

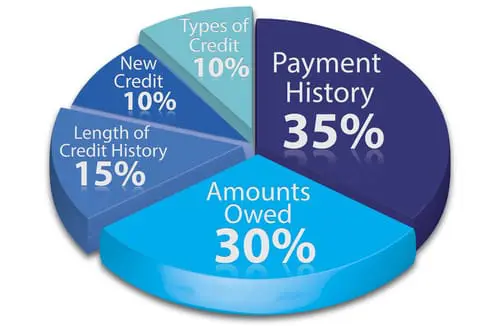

Credit Score Calculation Factors

Five key elements shape your credit score from credit bureau reports. Payment history makes up 35% of the total score. It tracks if bills are paid on time. Meanwhile, credit utilization takes 30%, measuring how much available credit is being used.

The remaining factors include:

- Credit history length (15%)

- Credit mix (10%) – variety of account types

- New credit applications (10%)

Checking your own credit score does not affect the calculation. This is called a “soft inquiry.”

Ways to Boost Your Credit Rating

Making on-time payments is vital for a strong credit score. Keep credit card balances low and aim to use less than 30% of your available credit.

Time matters with credit. Longer credit histories often lead to better scores, so keep old accounts open, even if you rarely use them.

Check your credit reports regularly for mistakes. Look for:

- Wrong account balances

- Accounts that aren’t yours

- Payment errors

- Incorrect personal information

Have a Question?

When you need answers, free information is available. Visit the Millennial Credit Advisers blog. The blog could point you to the right resources or provide direct guidance.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We do not offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized guidance. Track your progress for an improved credit journey.

Written content – “Please view our complete AI Use Disclosure.”

We enhance our products and advertising by using Microsoft Clarity to understand how you interact with our website. Using our site, you agree that we and Microsoft can collect and utilize this data. Our privacy policy provides further details.