Busting the Myths: Effective Long-Term Savings Strategies Explained. Find Out More In Our Latest Article!

THIS ARTICLE MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS AT NO COST TO YOU. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFO.

DON’T HAVE TIME TO READ THE FULL ARTICLE. HERE’S WHAT YOU ARE MISSING.

Saving money for the long term can seem challenging, especially with so many myths about what works and what doesn’t. While some believe it’s only for the wealthy, everyone can benefit from smart savings strategies.

The key to success is a consistent plan that fits your life and financial goals.

Many myths suggest it’s impossible to save without sacrificing daily comforts. In truth, small adjustments can lead to big savings without noticeable cuts in spending.

For instance, setting up automatic transfers to a savings account can make growing your nest egg feel effortless.

There are also misconceptions about needing to understand complex financial markets or having a big income to save significantly. With easy-to-use tools and resources, anyone can start saving effectively.

Consistency, smart use of available tools, and knowing your financial goals are crucial to building long-term savings that matter.

Understanding the Basics of Personal Finance

Mastering personal finance involves managing money wisely to meet goals effectively. This requires careful planning and smart decisions, focusing on essentials like budgeting, handling debt, and setting aside emergency funds.

The Role of Budgeting

Budgeting is a crucial aspect of personal finance. It helps individuals track their income and expenses, ensuring they live within their means.

Creating a budget involves listing all sources of income and regularly monitoring spending. This ensures that necessary expenses are covered while also allowing for savings and discretionary spending.

A good budget helps prioritize spending on essential needs while leaving room for savings.

Adjustments can be made monthly to reflect life changes. With proper budgeting, financial goals become more achievable, laying the foundation for long-term fiscal health.

Debt Management

Managing debt is vital to maintaining financial stability. High-interest debts, like credit cards, should be a priority to pay off first, as they can quickly spiral out of control.

Consolidating debts might simplify payments and reduce interest rates, making it easier to manage monthly obligations.

Keeping track of debt balances and due dates is important to avoid penalties or additional charges.

Exploring strategies like the avalanche or snowball method can be beneficial. These approaches offer structured ways to tackle debt efficiently and help eliminate financial stress, promoting better financial control.

Emergency Funds

An emergency fund acts as a financial safety net. It ensures funds are available during unforeseen situations like job loss, medical emergencies, or urgent repairs.

Ideally, an emergency fund should cover at least three to six months’ worth of living expenses.

Building this fund takes discipline. Regularly setting aside small amounts can accumulate over time, providing peace of mind.

It is crucial to keep this fund separate from checking accounts to avoid unnecessary spending.

Setting Realistic Savings Goals

Achieving financial goals requires clear planning. Short-term and long-term strategies differ, and being SMARThelps define and reach these goals effectively.

Short-Term vs Long-Term

Short-term goals usually cover one month to a few years. These might include saving for a vacation, holiday spending, or building an emergency fund. They require setting aside smaller amounts regularly.

Long-term goals often extend five years or more. These may involve saving for retirement, buying a house, or funding a child’s education.

Long-term saving typically needs more commitment and larger contributions over time.

Understanding the time frame of each goal helps monitor progress. It also helps decide whether to use more conservative or aggressive savings approaches.

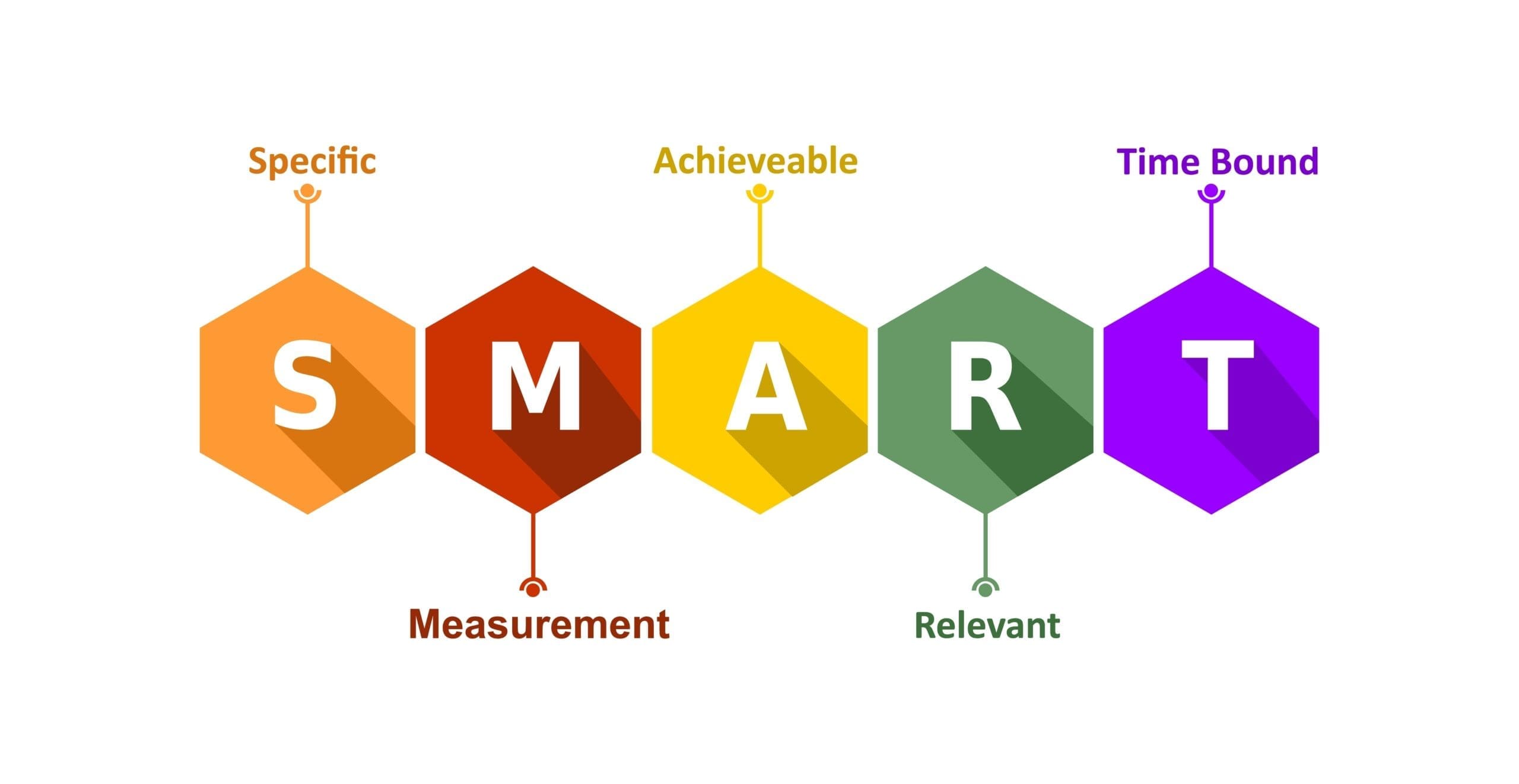

SMART Goals

To make savings goals more effective, many follow the SMART method. This stands for Specific, Measurable, Achievable, Relevant, and Time-bound.

- Specific: Be clear about what the goal is, like saving $5,000 for a used car.

- Measurable: Track progress easily, ensuring amounts saved match the target.

- Achievable: Set doable goals based on income and expenses.

- Relevant: Make sure the goal aligns with personal values and needs.

- Time-bound: Set a clear deadline, such as reaching the goal in two years.

Using SMART goals clarifies what is needed and encourages focused effort toward financial success.

Effective Long-Term Investment Strategies

Long-term investing requires careful planning and the use of strategies that effectively manage risk and return. By following smart principles, investors can grow their wealth steadily over time.

Diversification Principles

Diversification involves spreading investments across different asset classes and sectors. This reduces risk by avoiding reliance on a single investment.

Mutual funds and exchange-traded funds (ETFs) are popular ways to diversify.

By investing in a mix of stocks, bonds, and real estate, people can protect against market downturns.

Diversification can help smooth out returns, leading to more stable growth. Regularly reviewing and adjusting portfolios keeps them aligned with investment goals.

Understanding Risk and Return

Risk and return are fundamental concepts in investing. High-risk investments, like stocks, offer the potential for higher returns but come with greater volatility.

Conversely, low-risk investments, such as bonds, generally provide steadier, lower returns.

Investors must balance their desire for high returns with their ability to withstand market swings.

This balance, known as risk tolerance, varies by individual.

Diversifying investments helps manage risk while aiming for desired returns.

Asset Allocation

Asset allocation is the practice of deciding how to distribute investments among different asset classes. It plays a crucial role in investment success.

Stocks, bonds, and cash each serve unique purposes in a portfolio. Stocks provide growth potential, bonds offer income, and cash maintains liquidity.

Setting an allocation strategy depends on factors like age, financial goals, and risk tolerance.

Younger investors might favor stocks, while those nearing retirement may shift toward bonds. Adjusting the mix over time ensures alignment with changing goals and circumstances. Proper asset allocation helps balance risk and reward.

Retirement Planning Essentials

Planning for retirement involves understanding different savings options and future benefits. Two key areas to focus on are retirement accounts such as 401(k) and IRA, and understanding Social Security benefits.

401(k) and IRA Options

A 401(k) is a retirement savings plan offered by many employers. Employees contribute a portion of their paycheck to the account.

Some employers match these contributions, which increases the savings. Contributing at least enough to get the full match is recommended since it’s free money towards retirement.

IRAs (Individual Retirement Accounts) provide another way to save for retirement. Two main types are Traditional IRA and Roth IRA.

Traditional IRAs offer tax deductions on contributions, but taxes are paid upon withdrawal after retirement.

Roth IRAs reverse this tax process, where contributions are made with after-tax dollars, but withdrawals are tax-free. Understanding the differences helps individuals choose the best option for their financial situation.

Social Security Benefits

Social Security is a government program providing financial support during retirement. Benefit amounts are based on earnings history and the age one starts receiving them.

Delaying benefits past full retirement age increases the monthly benefit.

Full Retirement Age is generally around 67, but benefits can start as early as age 62.

Early benefits reduce the monthly amount, while delaying past full retirement age increases it.

It’s crucial to plan the timing based on financial needs and life expectancy to maximize the benefits received. Understanding Social Security helps individuals better incorporate it into their overall retirement strategy.

Common Savings Myths Debunked

Many people believe saving is difficult or unnecessary. Myths can prevent them from taking smart financial steps. Here are a few common misconceptions that can be addressed to improve financial well-being.

Myth: Save Whatever Is Left Over

Some people think they should save what remains after spending. This is not the best approach to saving. Often, spending everything first leaves little to save.

Instead, experts suggest paying yourself first by setting aside money for savings before paying for other expenses.

Creating a budget can help.

List your income and expenses to see where you can cut back.

Automate savings with a direct deposit to your savings account. This strategy makes saving easier and helps build a habit of saving consistently.

Myth: Young People Don’t Need to Save for Retirement

Another myth is that young people can wait to start saving for retirement. Time is actually a young person’s greatest ally in building wealth.

Starting early allows savings to grow over the years through interest and investments.

Consider this example: saving just $100 a month starting at age 25 could grow significantly by age 65 due to compound interest. Waiting until 35 can drastically reduce potential savings.

It’s clear that saving early can give a head start on a secure retirement.

Myth: Only High-Income Individuals Can Build Wealth

It’s common to think only those with high incomes can accumulate wealth. However, wealth building is possible for everyone, regardless of income. The key is consistency and smart money management.

Even small amounts saved regularly can add up over time. Investing wisely and living within your means can increase wealth even on a modest income. By understanding and avoiding this myth, individuals can take manageable steps to improve their financial future.

Short-term sacrifices, such as eating out less frequently or buying fewer new clothes, can contribute significantly to savings. This practice helps in creating a financial cushion that grows over time.

Advanced Saving Techniques

Long-term success in saving can come from using smart strategies like knowing tax rules, using health accounts, and planning education savings. These methods help save money and gain extra benefits.

Tax-Efficient Savings

Using tax-efficient savings is smart. People can benefit by choosing accounts like Roth IRAs or traditional IRAs.

Roth IRAs allow after-tax contributions, and growth is tax-free. Withdrawals in retirement aren’t taxed. On the other hand, Traditional IRAs offer tax-deductible contributions but taxes apply on withdrawal.

Another way is by using 401(k) plans at work. Contributions are pre-tax, lowering taxable income. This means paying less tax now while saving for the future. It’s crucial to stay informed about contribution limits and withdrawal rules to maximize benefits.

Health Savings Accounts (HSAs)

HSAs provide a way to save for medical expenses. They are available for those with high-deductible health plans.

Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also not taxed.

These accounts offer a triple-tax advantage. Additionally, unused funds roll over each year, allowing savings to grow. After age 65, funds can be used for retirement expenses, but non-medical withdrawals are taxed. HSAs can be a strategic tool for healthcare and retirement.

Education Savings Accounts (ESAs)

Education Savings Accounts are ideal for saving for a child’s education. Accounts like 529 Plans offer tax advantages.

While contributions aren’t deductible, earnings grow tax-free. Withdrawals for qualified educational expenses are also not taxed.

There are two main types: Prepaid Tuition Plans and Education Savings Plans. Prepaid plans allow paying current tuition rates for future education. Savings plans offer more flexibility, letting you use funds at most colleges. ESAs can also benefit from state tax deductions. It’s important to research options to choose the best account for educational goals.

Maintaining and Adjusting Your Financial Plan

Regularly reviewing a financial plan is crucial. Life changes like a new job, marriage, or kids can affect finances. It’s important to make adjustments to keep the plan relevant and effective.

Setting a reminder to review the plan every six months is helpful. Look over bank statements, investment accounts, and monthly budgets. This habit ensures nothing slips through the cracks.

Tracking progress toward goals is important. They should note if they are on track or need to make changes. If saving for a house or retirement, small changes can have big impacts.

Using a simple list can help keep track:

- Check current income and expenses.

- Update savings goals.

- Adjust budget as needed.

They should also stay informed about economic changes. Markets can shift, affecting savings and investments. Keeping an eye on interest rates or inflation helps them tweak the plan as necessary.

Consulting with a financial advisor can provide guidance. Advisors can offer advice on investments or tax breaks. This help ensures that changes made are wise and beneficial.

Navigating Financial Advice and Experts

When planning long-term savings, finding the right guidance is key. This involves selecting a financial advisor or using digital tools like robo-advisors. Below, essential points are discussed to help you make informed choices.

Choosing a Financial Advisor

Finding a skilled financial advisor can make a big difference. Look for someone with proper certifications, like a Certified Financial Planner (CFP).

These professionals have passed rigorous exams and maintain ethical standards.

Check their experience and past success. Reviews and recommendations from friends or family can be helpful.

It’s important to meet with them to make sure your communication styles match. Feeling comfortable and confident in their guidance is crucial.

Understand the fee structure. Some advisors charge flat fees, while others take a percentage of your investments.

Choose what aligns best with your financial plans and needs. Be clear about services provided to avoid unexpected costs.

Robo-Advisors and Digital Platforms

Robo-advisors offer automated financial solutions. They use algorithms to manage investments. This makes them a popular choice for those who prefer technology-driven approaches. These platforms often have lower fees than human advisors.

Consider the specific features they offer. Some provide personalized advice or let you customize your portfolio. They typically require completing a detailed questionnaire to understand your risk tolerance and financial goals.

Check how they handle security and privacy. With increasing digital threats, ensuring that your data is protected is essential. Research their reputation and user reviews to gauge reliability and support quality.

Disclaimer: Millennial Credit Advisers is not a licensed credit service provider or financial advisor. We do not offer credit repair, debt management, or legal services. Educate yourself on saving, reducing debt, and managing credit for economic improvement. Understand credit reports, scores, and financial products. Consult a financial advisor for personalized guidance. Track your progress for an improved credit journey.

Written content – “Please view our complete AI Use Disclosure.”

We enhance our products and advertising by using Microsoft Clarity to understand how you interact with our website. Using our site, you agree that we and Microsoft can collect and utilize this data. Our privacy policy provides further details.